Silver reached its highest daily levels since 2011 last Tuesday, before a minor correction took hold, which was deepened by the Federal Reserve's difficult-to-interpret policy decision. Today, Neel Kashkari, a Fed member, stated that he supported the recent rate cut and foresees two more moves this year. Although Kashkari is not a voting member this year, he will be in 2026. Miran also indicated that voting for a 50 basis point rate cut is appropriate to bring rates to a neutral level.

From a fundamental perspective, silver has been in a significant supply deficit for several years. In 2025, this deficit could exceed 200 million ounces, marking the eighth consecutive year of shortages. While silver recycling is high, growing investment demand could lead to a lack of supply for industrial applications. Currently, silver is primarily used in the photovoltaic sector, electric vehicles, electronics, and 5G technology.

The rise in gold prices is also driven by demand. Gold is being purchased by large investors as well as official bodies like central banks. Silver, being a more affordable option, is favored by smaller investors.

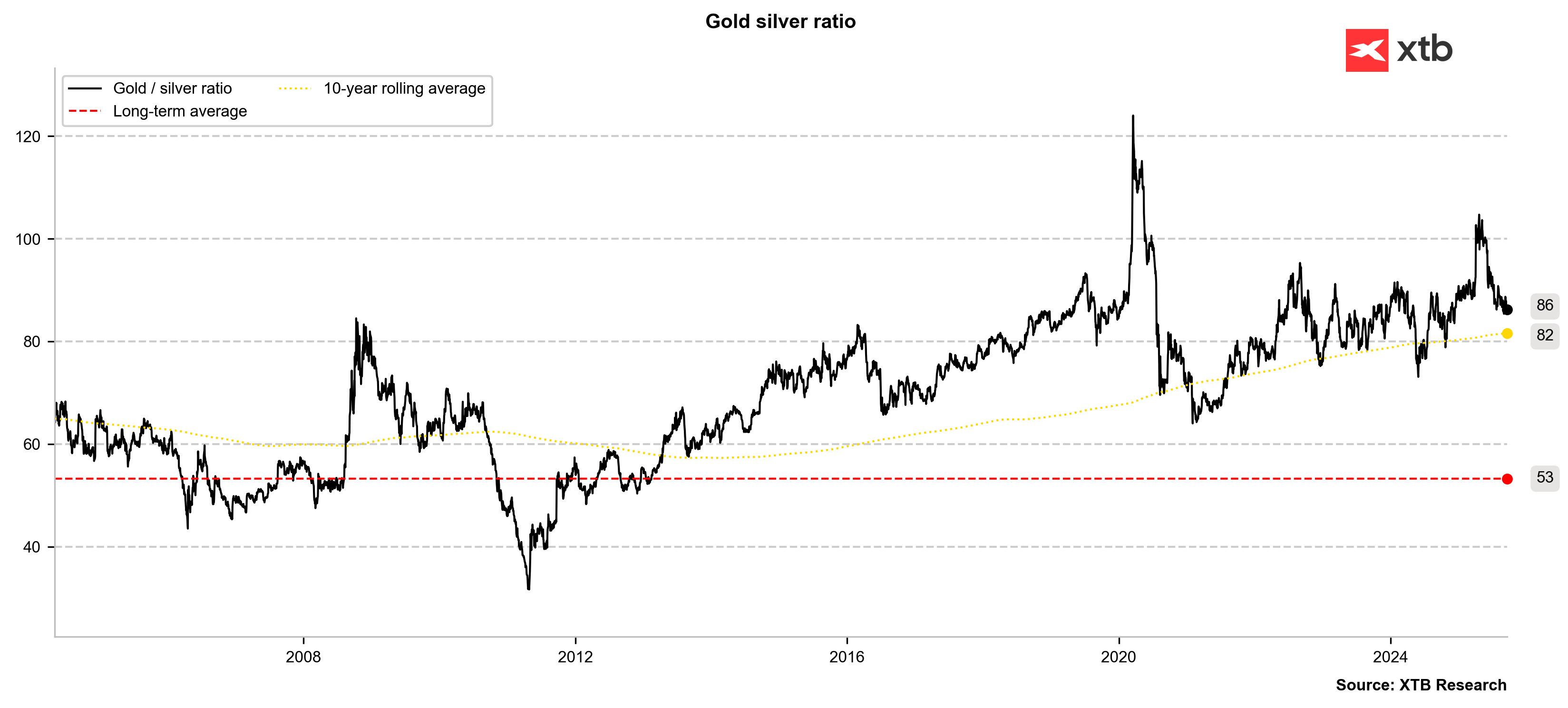

The gold-to-silver ratio is currently dropping to 86, while the 10-year moving average sits at 82. If gold were to return to $3700 or even reach $3800 per ounce, a drop in the price ratio to 82 would value silver at $45-$46 per ounce. While this would not be a record high for silver, it would be very close.

Today, there is a potential for silver to post its highest close since 2011. Today's gains are the largest in nominal terms since September 1. If silver were to reverse and correct, key support levels would be around $41.5 and $40 per ounce. Potential targets for silver are $43 and subsequently $45 per ounce. Source: xStation5

Today, there is a potential for silver to post its highest close since 2011. Today's gains are the largest in nominal terms since September 1. If silver were to reverse and correct, key support levels would be around $41.5 and $40 per ounce. Potential targets for silver are $43 and subsequently $45 per ounce. Source: xStation5

Chart of the day: JP225 jumps on unexpected upward GDP revision 🇯🇵 📈 Japan is back in the game❓

Economic Calendar: Quiet Tuesday Highlights Geopolitics and Weekly Oil Stocks (10.03.2026)

EURUSD gains 0.2% on unexpectedly bigger trade surplus in Germany 🇩🇪 📈

Morning wrap (10.03.2026)