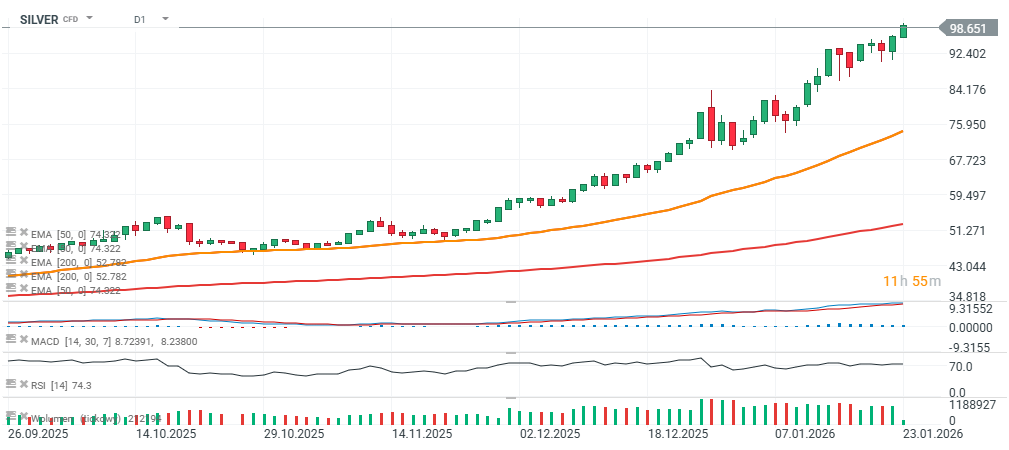

Silver has posted a gain of more than 40% in January and is pushing above $98.5 per ounce today, supported by a weaker US dollar and rising gold prices. In a special note, Bank of America said that $170 per ounce over a two-year horizon remains possible if retail investors start joining the rally - which is precisely what we appear to be seeing. The trend is particularly strong in China, where spot prices are reportedly nearly a dozen dollars higher per ounce than in the US.

Last weekend, the US Mint nearly doubled the sale prices of its silver coins to above $170 per ounce. While Bank of America estimates that the fundamentally justified level for silver today would be closer to $60 per ounce, gradual debasement of fiat currencies (including the dollar), persistent fiscal deficits, and rising frustration among individual investors suggest that increasing allocations to silver and other “hard assets” could be durable and strategic in nature.

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street