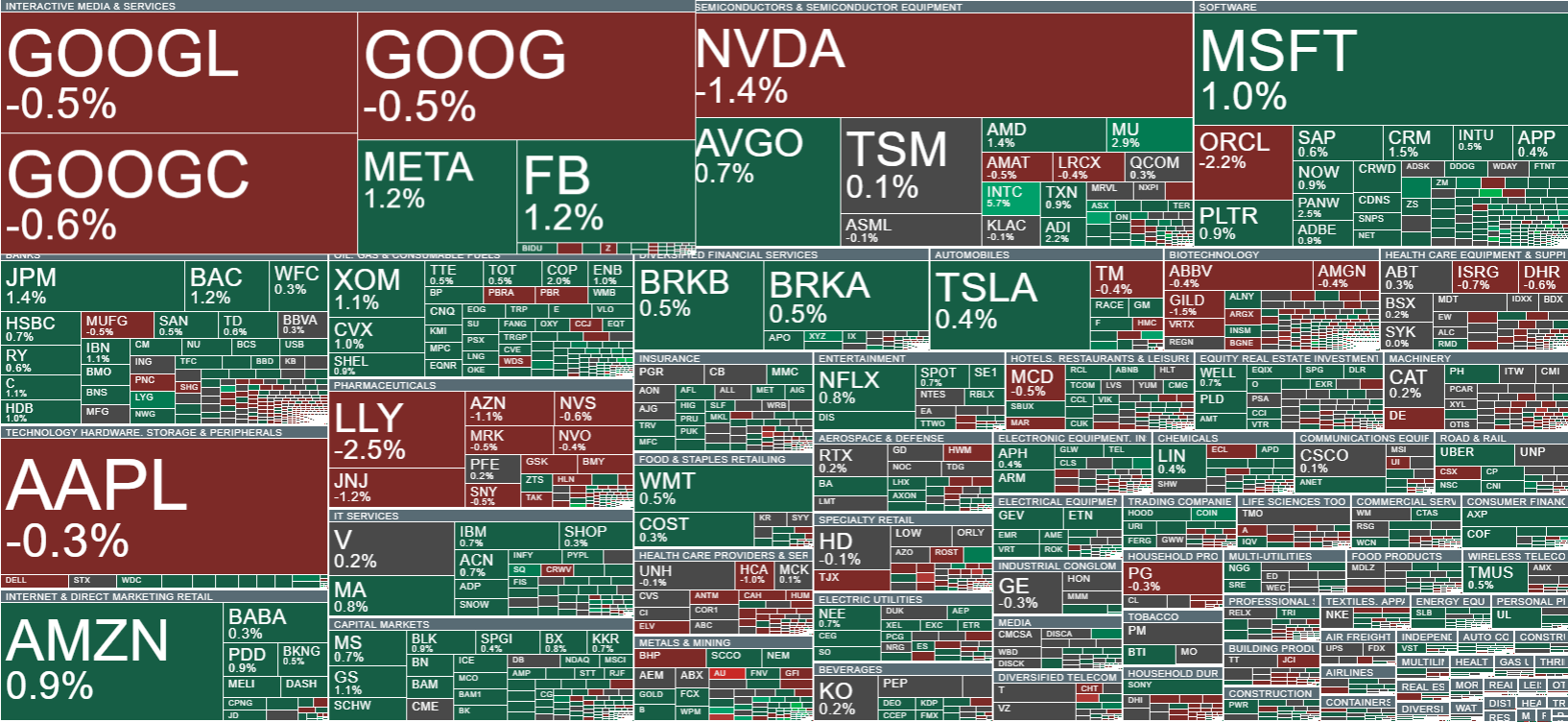

Wall Street is showing clear optimism today, with major indexes rising during the session. The S&P 500 is up 0.2%, while the Nasdaq gains 0.3%. The Dow Jones maintains a positive trend, supported primarily by the technology and industrial sectors.

Today’s gains are largely driven by expectations of potential interest rate cuts by the Federal Reserve (Fed) in December. Markets currently assign over an 80% probability that the December meeting will result in a 25-basis-point rate cut, further supporting bullish sentiment and sustaining stock market gains. Positive momentum is also fueled by speculation about a potentially more dovish successor to the Fed Chair, whose policy stance would favor maintaining an accommodative monetary course, implying lower financing costs and continued support for the economy and capital markets.

The technology sector remains the main beneficiary of today’s market optimism, driven by the high probability of a December rate cut. A more accommodative monetary policy encourages greater risk appetite, naturally boosting demand for technology stocks.

An element of uncertainty remains in the background: key economic data, including the Fed’s preferred PCE price index, will not be released until next week. Delays caused by the recent U.S. government shutdown mean the Fed will have limited information for the December meeting. Nevertheless, today’s session shows that the market is using thin, holiday-season liquidity to close the month on a positive note.

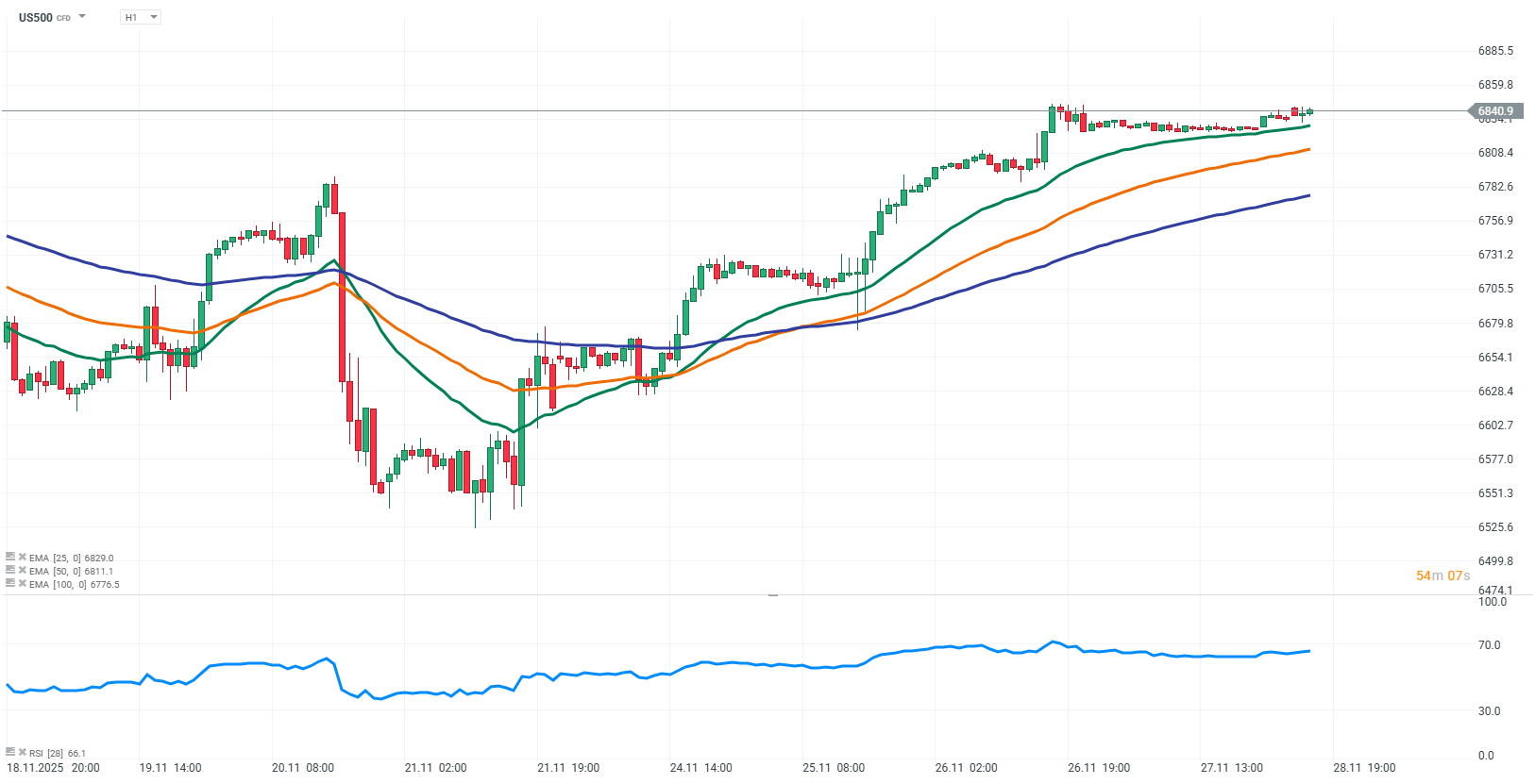

S&P 500 Futures (H1 Interval)

S&P 500 futures are rising today, with buyers clearly regaining control after the recent pullback, indicating a return of market optimism. Positive news regarding a potential December rate cut further supports the demand side, encouraging increased activity. Gains are also fueled by expectations that lower rates will support economic recovery and corporate earnings, providing prospects for continued upward momentum in the coming sessions.

Source: xStation5

Company News:

-

Alphabet (GOOGL.US) has withdrawn its antitrust complaint in the EU against Microsoft’s (MSFT.US) cloud practices, a week after regulators launched their own investigation. Google had previously accused Microsoft of anti-competitive behavior, restricting clients on the Azure platform. The withdrawal comes after the European Commission initiated an independent review of cloud practices. Despite this, the EU investigation continues, keeping Microsoft under regulatory scrutiny, while Google can focus on developing its own cloud services.

-

Nvidia (NVDA.US) shares are falling following reports that Chinese tech firms, including Alibaba and ByteDance, are training their AI models in overseas data centers to bypass U.S. export restrictions on chips. These companies rely on data centers owned by non-Chinese entities, allowing them continued access to advanced Nvidia chips despite the restrictions. The situation highlights geopolitical tensions in the semiconductor sector and adds temporary uncertainty to Nvidia’s stock valuation, even as long-term demand for AI chips remains strong.

-

Intel (INTC.US) shares are up 4% during the session, despite a raid on the home of engineer Wei-Jen Lo in Taiwan over concerns that he may have transferred national security-related technology from his previous employer. Lo previously worked at Taiwan Semiconductor and was brought to Intel, which has launched its own investigation into potential misappropriation of trade secrets.

-

Oracle (ORCL.US) shares are down nearly 2% in today’s session. The market remains skeptical about the company’s projections for massive revenues and expresses concerns over the scale of its debt.

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Crypto news: Bitcoin gains almost 2% despite the war in the Middle East 📈