The IBEX 35 (SPA35) index is the biggest gainer among the major Western European stock market benchmarks in March, outperforming Italy's FTSE MIB (ITA40).

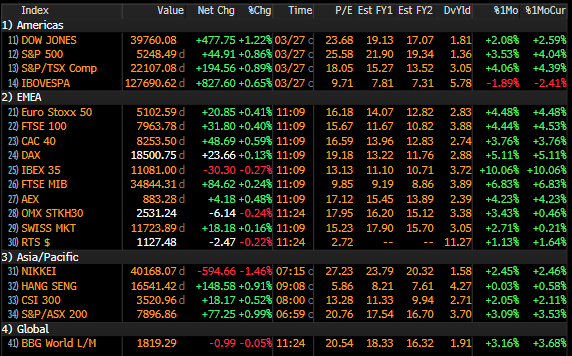

Rate of return for individual stock market indexes. Source: Bloomberg Financial LP

Banks, the IBEX's largest industry group, led the rise with more than 30%.

Return on shares of individual representatives of the European banking sector for March. We saw the largest increases in the stocks of Santander (SAN1.ES) and ING (INGA.NL). Source: xStation

Banks benefited from higher interest rates, which, however, may be leaning towards a change. On the other hand, however, increased shareholder returns may provide some support for the sector. Last week, Santander said it was considering making more than €6 billion worth of dividend payments and share buybacks after an "excellent" start to 2024.

The index is trading at a 20% discount to the Stoxx 600 index, well below its 10-year average. Source: Bloomberg Financial LP

However, looking at the momentum of recent moves, the window for sizable rallies may now be shrinking. The RSI indicator for the weekly interval has broken out above the textbook overbought zone. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers