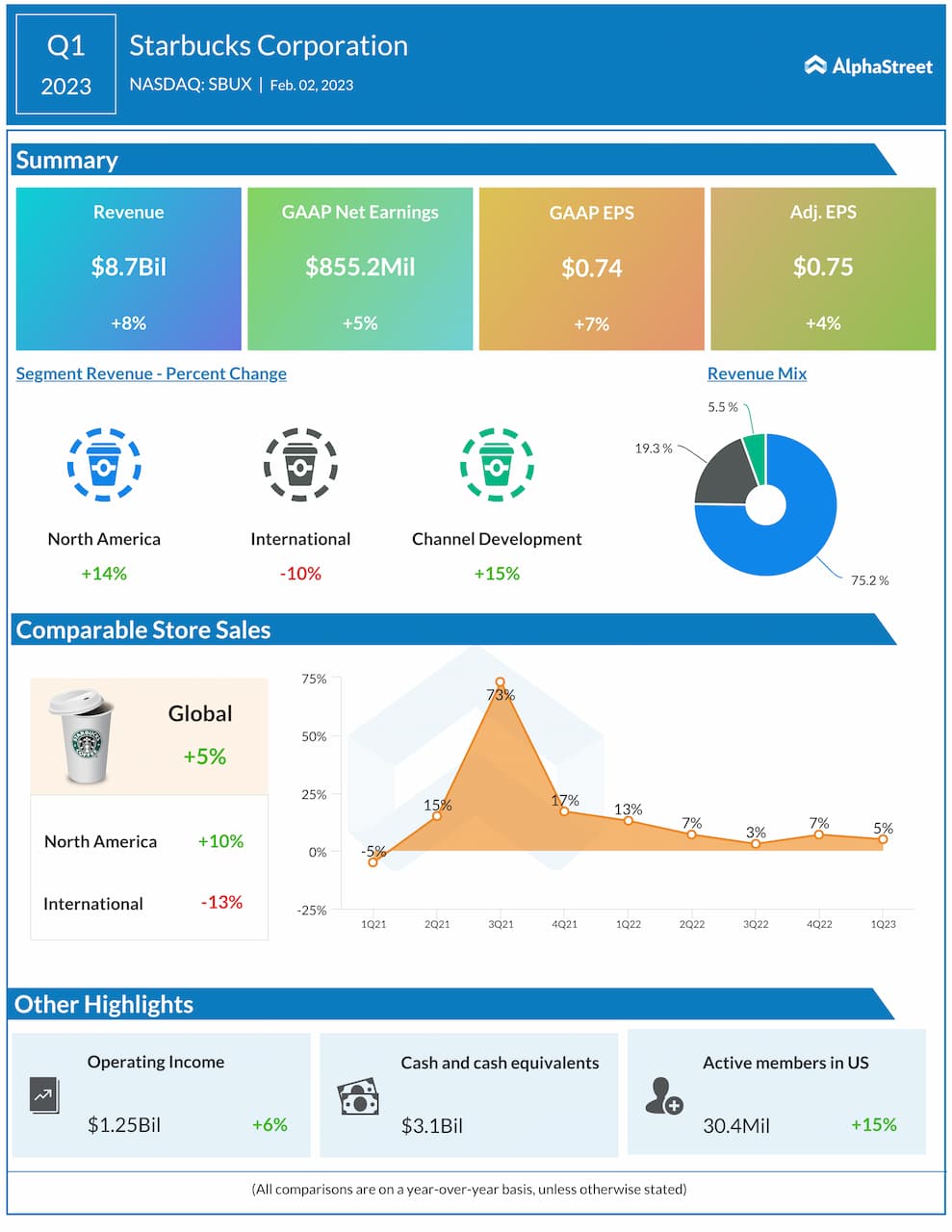

Starbucks (SBUX.US) shares lost over 3.5% on Friday after the coffee chain reported weak financial figures for Q1 2023. Company earned 75 cents per share slightly below analysts’ estimates of 77 cents. Revenue rose 8.0% to $8.71 billion, however came in below Refinitiv projections of $8.78 billion due to dwindling demand especially in China, which is the second-largest market.

-

U.S. same-store sales: 10% versus 9.26% expected

-

International sales: -13% versus -3.87% expected

-

China sales: -29% versus -13.31% expected

-

Global comparable store sales rose by 5% YoY

-

The company opened 459 net new stores in the previous quarter, ending the period with 36,170 stores worldwide.

Highlights of Starbucks Q1 2023 earnings report. Source: Alpha Street

Highlights of Starbucks Q1 2023 earnings report. Source: Alpha Street

According to interim CEO Howard Schultz recent figures reflect "challenging global consumer and inflationary environments, a soft quarter for retail overall and the unprecedented, COVID-related headwinds that unfolded in China in Q1."

Chief Financial Officer Rachel Ruggeri said "excluding China, we had tremendous growth across markets." She also said the company's fiscal 2023 outlook remains unchanged.

Starbucks (SBUX.US) stock launched today's session sharply lower, however sellers struggle to break below 50 SMA (green line). As long as price sits above, resumption of upward move is possible. On the other hand, should break lower occur, next support to watch can be found around $100.85, which is marked with lower limit of the 1:1 structure and 23.6% Fibonacci retracement of the last upward wave. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment