There are companies that grow because the market favors them. And there are those that grow because they sit right at the heart of a new technological wave. Datadog increasingly belongs to the latter category.

The Q4 2025 results once again showed that the company is capable of delivering more than the market expects. Revenues rose 29% year-over-year to USD 953.2 million, significantly exceeding consensus. Adjusted earnings per share came in at USD 0.59 versus the expected USD 0.56. Free cash flow reached USD 291 million, up 21% y/y, while operating cash flow totaled USD 327 million, growing 23% y/y.

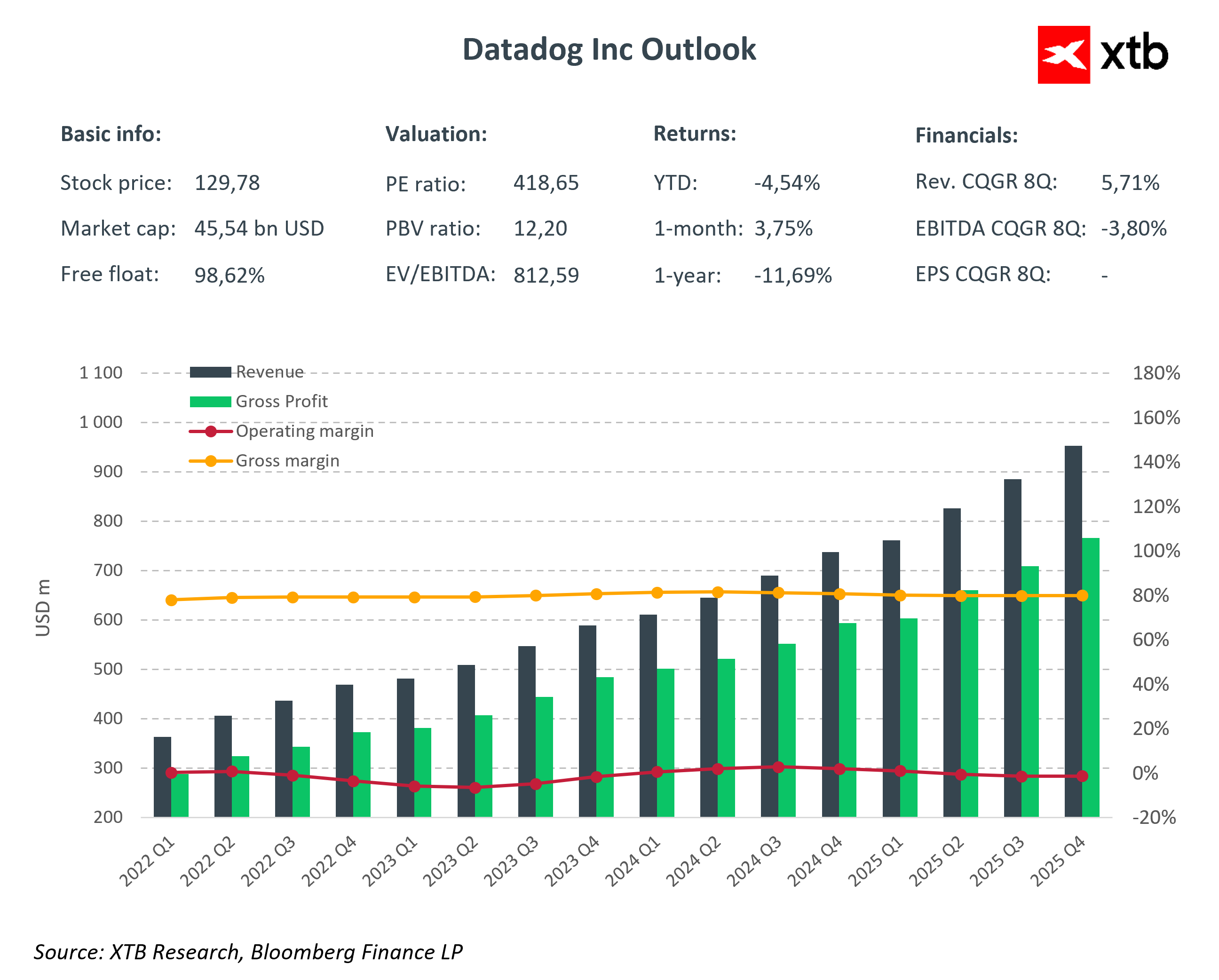

This combination of nearly 30% growth with a high gross margin of 76% demonstrates that Datadog is not just a story of rapid revenue expansion. It is a model beginning to generate increasing operating leverage, even amid intensive investments in product development.

At the same time, the company presented a more cautious outlook for 2026. Expected revenues in the range of USD 4.06–4.10 billion are slightly below consensus, while the forecast for adjusted operating income reflects increased investment spending. Management signals a readiness to continue strengthening its competitive position in AI and security, even at the cost of short-term margin pressure.

Key Q4 2025 Financials

-

Revenues: USD 953 million (+29% y/y, consensus 917 million USD)

-

Adjusted EPS: USD 0.59 (consensus 0.55 USD)

-

Net income: USD 46.6 million

-

Contracted sales: USD 1.2 billion

-

Gross margin: 76%

Q1 2026 Forecast

-

Revenues Q1: USD 951–961 million (consensus 940 million USD)

-

Adjusted EPS Q1: USD 0.49–0.51 (consensus 0.54 USD)

-

FY2026 revenues: USD 4.06–4.10 billion

-

FY2026 adjusted EPS: USD 2.08–2.16

And this combination is what makes Datadog an interesting story right now. On one hand, consistent outperformance and strong cash flows. On the other, a deliberate decision to reinvest in growth at a time when AI infrastructure and language-model-based applications are moving from experimental to production deployment.

It is no longer a question of whether observability is needed. The question is which platforms will become the standard in increasingly complex cloud and AI-driven environments. Datadog aims to be one of them.

What Observability Is and Why It’s a Critical Layer Today

In simple terms, observability is the ability to fully understand what is happening inside an IT system based on the data it generates. It is not just about detecting failures, but quickly identifying the cause, impact on users, and business cost.

Modern applications operate in cloud environments, consist of dozens of microservices, and often integrate AI models. In such an architecture, traditional monitoring is no longer sufficient. Companies need insights from metrics, logs, and traces in a unified system.

This is precisely the layer Datadog provides.

The platform combines infrastructure, application, and security monitoring into one environment. The greater the cloud complexity and the larger the AI deployment, the higher the value of such a solution. In a world where applications run 24/7, observability is no longer a nice-to-have, but a critical component for business continuity.

Revenue Structure and Geographic Dynamics

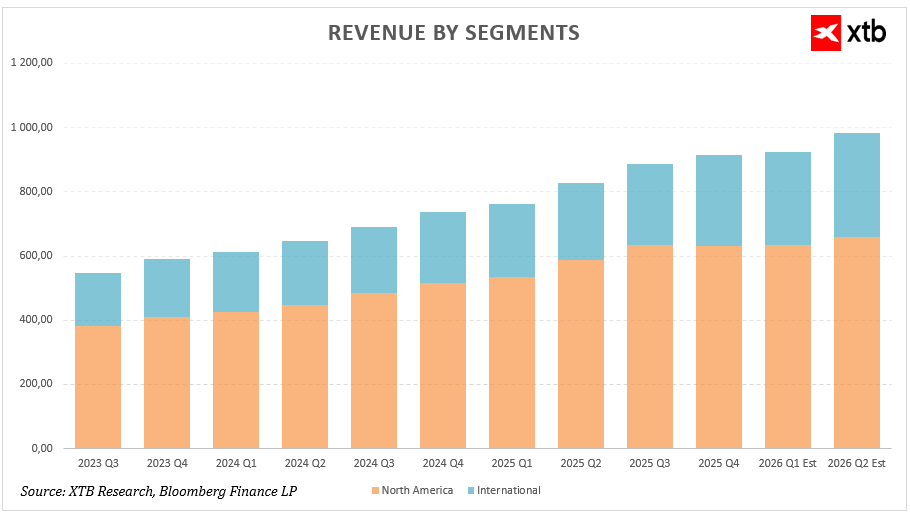

When analyzing Datadog’s revenue growth, it is worth looking not only at total expansion but also its geographic composition.

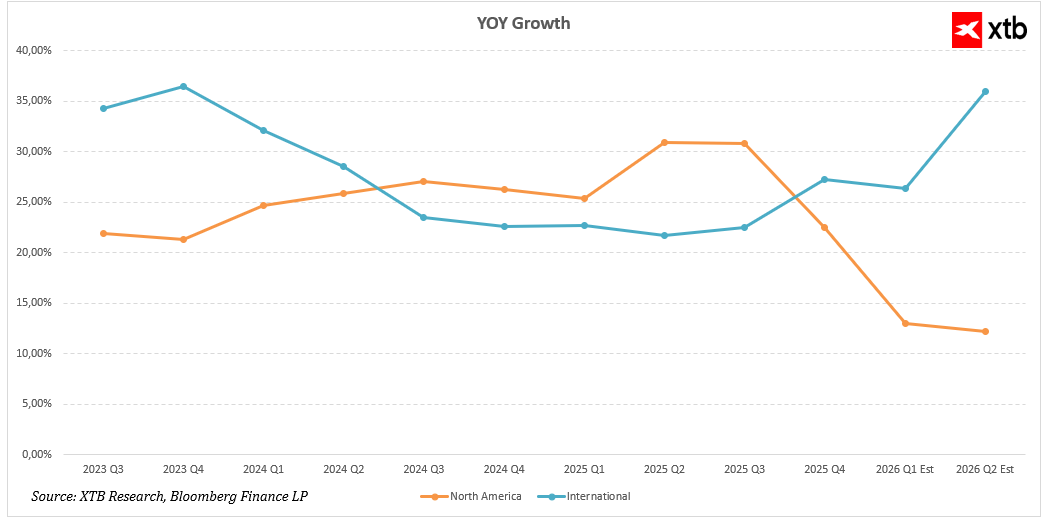

North America remains the largest revenue source. In 2025, quarterly revenues in this region rose from USD 533.82 million in Q1 to USD 632.59 million in Q4. Year-over-year growth remained above 25% for most of the year, reaching 30.96% in Q2 and 30.83% in Q3. In Q4, growth slowed to 22.55%, with consensus for the first half of 2026 pointing to a further slowdown to around 12–13%.

This indicates that the U.S. market is entering a more mature growth phase. The business scale is already significant, and year-over-year comparisons are becoming more challenging. Maintaining double-digit growth at such a high revenue base should still be considered a solid outcome.

The international segment looks even more promising. Revenues outside North America grew from USD 227.74 million in Q1 2025 to USD 281.97 million in Q4. Year-over-year growth, which had gradually slowed to 22–23% in 2024, accelerated to 27.28% in Q4 2025. Estimates for Q1 and Q2 2026 indicate growth of 26.38% and 35.97%, respectively.

If these forecasts materialize, the international segment could become a key revenue engine in the coming quarters. Growth outside the U.S. reflects increasing platform adoption in Europe and the Asia-Pacific region, where digital transformation in many industries is still in earlier stages.

From an investment perspective, two conclusions are important. First, growth is geographically diversified, limiting concentration risk. Second, acceleration in international markets may partially offset the natural slowdown in North America.

Financial Analysis

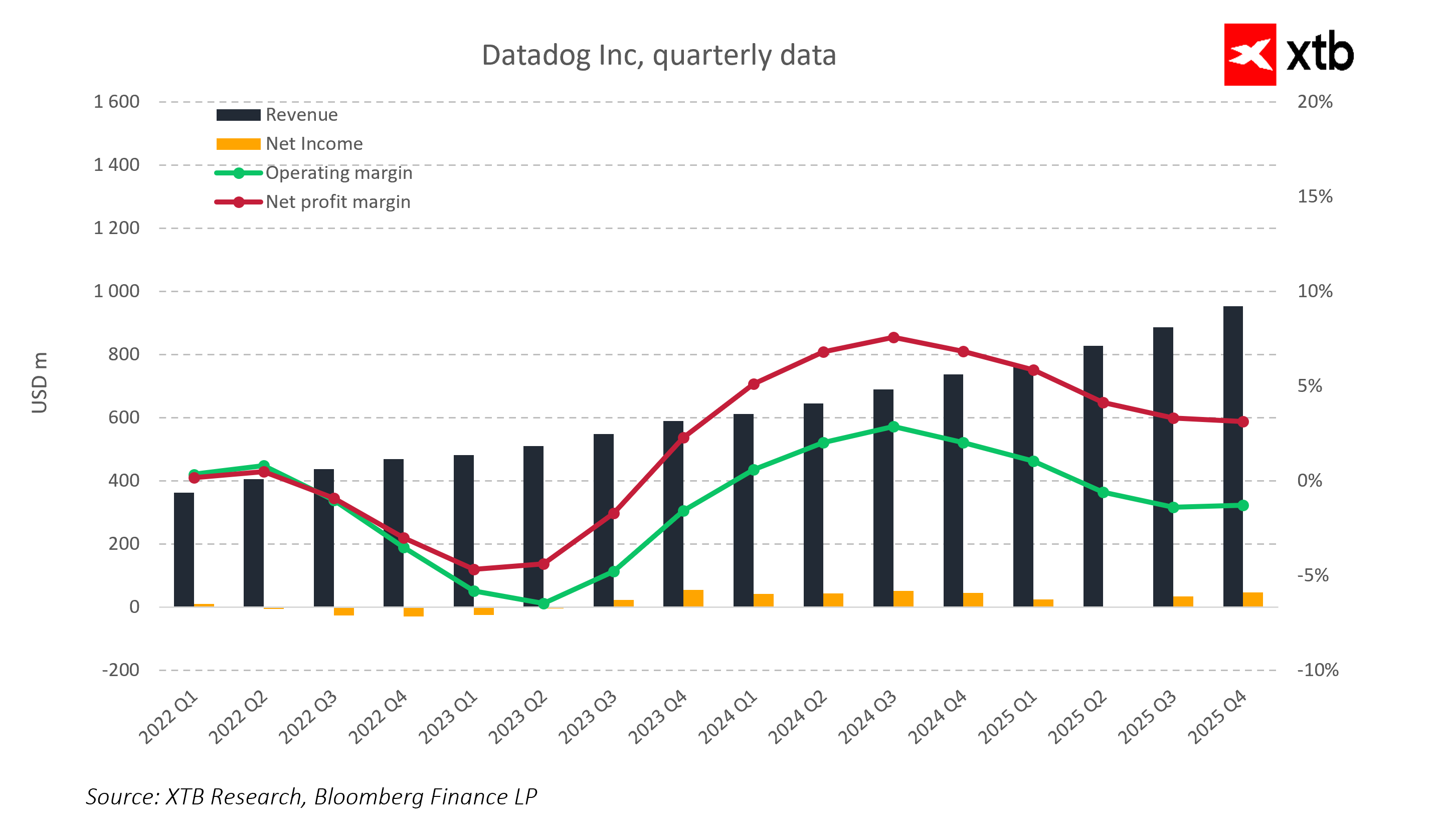

On a quarterly basis, Datadog has maintained a clear upward revenue trend since 2022. Quarterly revenue grew from around USD 360 million in Q1 2022 to nearly USD 950 million in Q4 2025—almost tripling in three years while maintaining high growth momentum.

At the same time, profitability evolved significantly. In 2022 and the first half of 2023, the company reported negative operating and net margins due to heavy investments in product development and sales scaling. From the second half of 2023, operational efficiency improved markedly.

Operating margin peaked above 15% in 2024, and net margin approached 8–9%. In 2025, margins partially normalized due to increased investments and competitive pressure. A decline to single-digit operating margins does not indicate a weaker business model but a deliberate reinvestment decision.

Gross margin remains high at around 75–80%, confirming the scalability of the SaaS model and leaving room for long-term profitability expansion.

Despite margin volatility, the company consistently generates positive operating and free cash flows. In recent quarters, free cash flow has remained solid, reflecting high revenue-to-cash conversion.

This is a key differentiator compared to many growth companies that only report positive accounting profits after cutting investments. For Datadog, cash generation coexists with dynamic revenue growth.

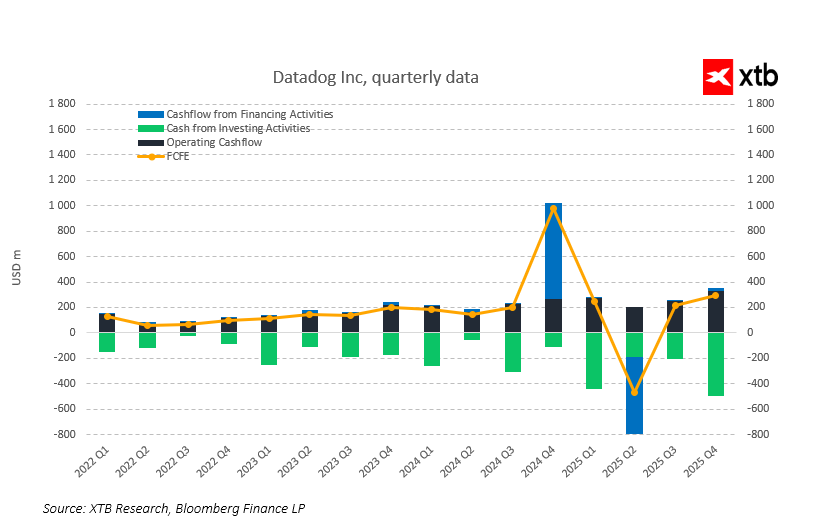

Quarterly data confirm that profitability improvement is not merely accounting-driven. Since 2022, operating cash flows have systematically increased alongside business scale. Free cash flow remains consistently positive, and its growth confirms strong revenue-to-cash conversion.

Periodic fluctuations in financing cash flows, including a notable increase in H2 2024 and a sharp negative reading in 2025, reflect capital structure management rather than deterioration in operational fundamentals. The core business continues to generate stable cash even amid intensive investment.

This cash profile is characteristic of a mature SaaS model capable of funding growth organically without significantly increasing debt.

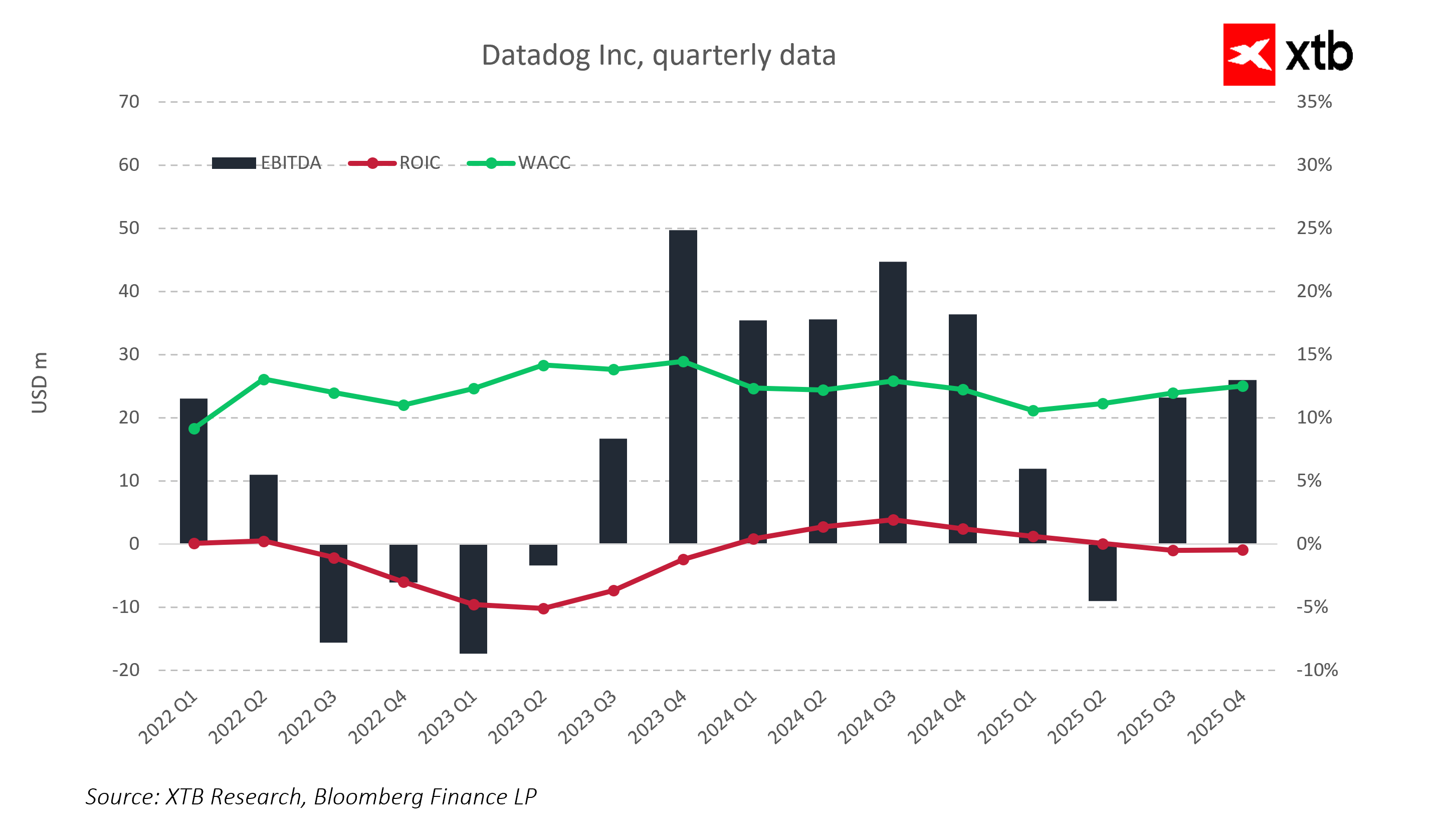

Profitability metrics show a clear transition from a scaling phase to business model stabilization. In 2022–2023, return on invested capital (ROIC) was below the cost of capital due to aggressive product and sales investments. From 2024 onward, EBITDA returned to stable positive levels, and ROIC approached the cost of capital. The company is gradually moving from capital consumption to more efficient utilization.

The relationship between ROIC and WACC will be a key metric to watch in 2026. Maintaining a profitability advantage over the cost of capital would signal a sustainable value creation phase while preserving strong revenue growth.

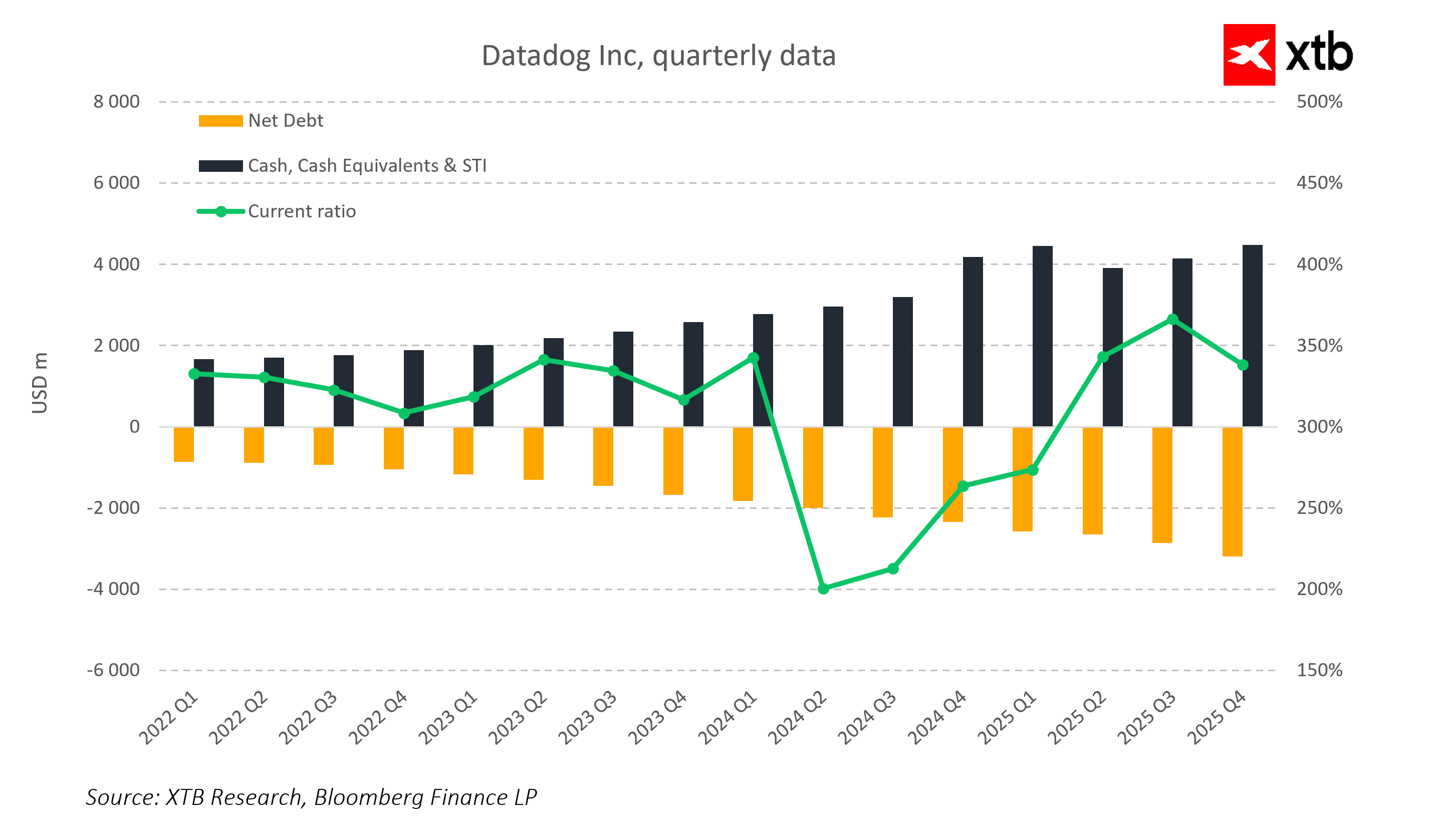

The balance sheet remains very conservative. Cash and short-term investments have steadily increased, exceeding USD 4 billion in recent quarters. Net debt is negative, giving the company a cash surplus relative to financial obligations.

The current ratio has consistently been very high. Temporary fluctuations do not change the overall picture of strong financial positioning. This balance sheet profile provides flexibility for organic growth and potential acquisitions.

Valuation Outlook

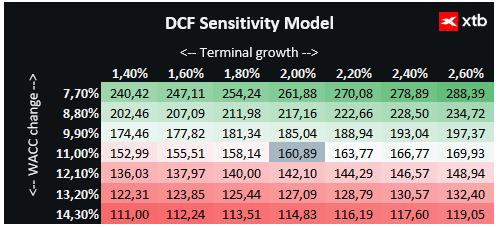

We present a DCF-based valuation of Datadog Inc. This is for informational purposes only and should not be considered investment advice or a precise valuation.

Datadog is a key player in cloud technology and AI infrastructure, offering advanced solutions for application monitoring, security, and real-time analytics. The company benefits from growing demand for cloud observability and AI-based applications. Strategic investments in platform development, international expansion, and AI integration create a solid foundation for continued growth.

Datadog maintains a high gross margin of around 80%, positive operating and free cash flows, providing flexibility for organic growth and potential acquisitions. Financial stability and a scalable SaaS model reduce market risks and allow safe planning for expansion in cloud and AI segments.

Based on our DCF analysis, Datadog’s fair value per share is estimated at around USD 160, compared to the current price of USD 129.78, implying an upside potential of about 24%. This indicates that the company not only has strong financial fundamentals but also offers an attractive opportunity for investors betting on continued growth in cloud, observability, and AI applications.

Share Price

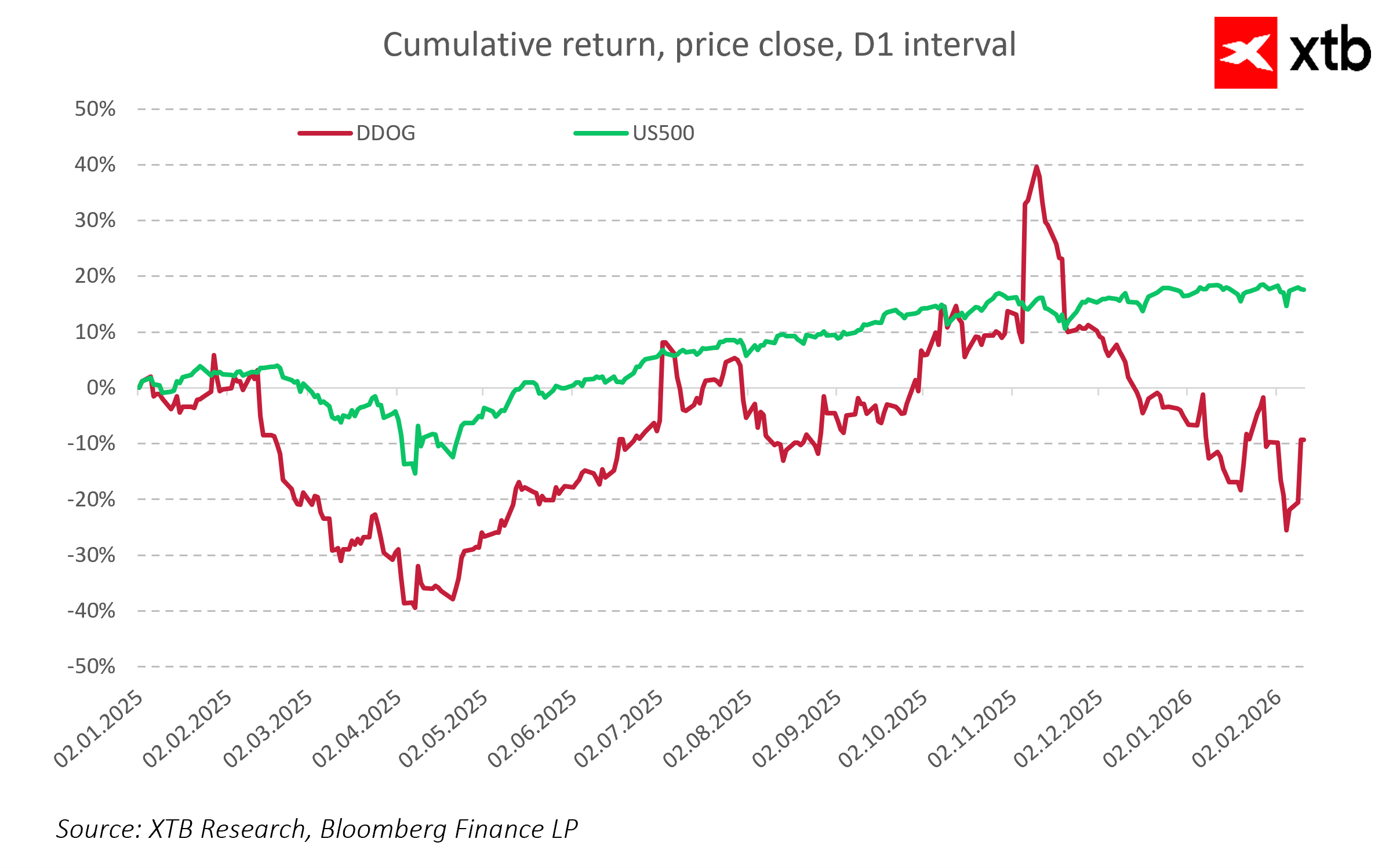

Despite clear operational improvement, Datadog’s stock remains more volatile than the broader market. In Q4 2025, shares clearly outperformed the S&P 500, but subsequent months saw a correction, giving back some earlier gains.

In early 2026, the market expressed pronounced concerns about SaaS companies, with narratives suggesting AI could soon replace traditional platforms. It is important to remember, however, that AI is most effective at replacing poorly written, repetitive, or suboptimal code. Well-written, scalable SaaS code has strategic value, and its quality, coupled with integration into cloud infrastructure and AI-driven applications, is not easily replaced in the short term.

In the short term, market sentiment may dominate fundamentals. Over the long term, share performance will depend on the company’s ability to maintain technological advantage, continue improving cash flow quality, and develop the platform so that AI acts as a tool supporting, rather than replacing, its functionality.

History shows that companies that consistently invest in solid code and scalable architecture maintain an edge even during technological transformations. Thanks to its mature platform and extensive ecosystem, Datadog is among the firms likely to benefit from AI rather than fear it as a competitor.

Key Takeaways

-

Strong revenue growth: Datadog nearly tripled revenues in three years, maintaining stable year-over-year growth of 20–30% depending on the region.

-

Profitability and margins: High gross margin (~75%) confirms SaaS scalability. Operating and net margins normalize in the context of reinvestment.

-

Robust cash flows: Positive operating and free cash flows enable organic growth financing without increasing debt.

-

Stable balance sheet and liquidity: Cash surplus over liabilities and a high current ratio provide flexibility for expansion and potential acquisitions.

-

AI and observability: Datadog is central to digital transformation; observability is a critical layer in cloud and AI environments.

-

Geographic diversification: International segment grows faster than North America, reducing concentration risk and potentially driving future revenues.

-

AI and code quality: Market fears of AI replacing SaaS are overblown. Well-designed, scalable code is hard to replace, and AI practically supports platform development rather than eliminating it.

-

Sentiment vs fundamentals: Short-term share swings may reflect market sentiment, but long-term performance depends on maintaining tech advantage and cash flow quality.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment