Taiwan Semiconductor Manufacturing Company is a firm that almost single-handedly drives global chip production. When we talk about artificial intelligence, high-performance computing, or supercomputers, TSMC is almost always in the background, supplying the heart of the most advanced chips. In the fourth quarter of 2025, the company demonstrated that its significance is not just theoretical. Financial results and strong demand from technology giants confirm that TSMC not only keeps up with trends but helps shape them. In this article, we will examine how record revenues and profits for the past quarter reflect the company’s industry dominance and explore its future prospects and real value.

TSMC at the center of global technology

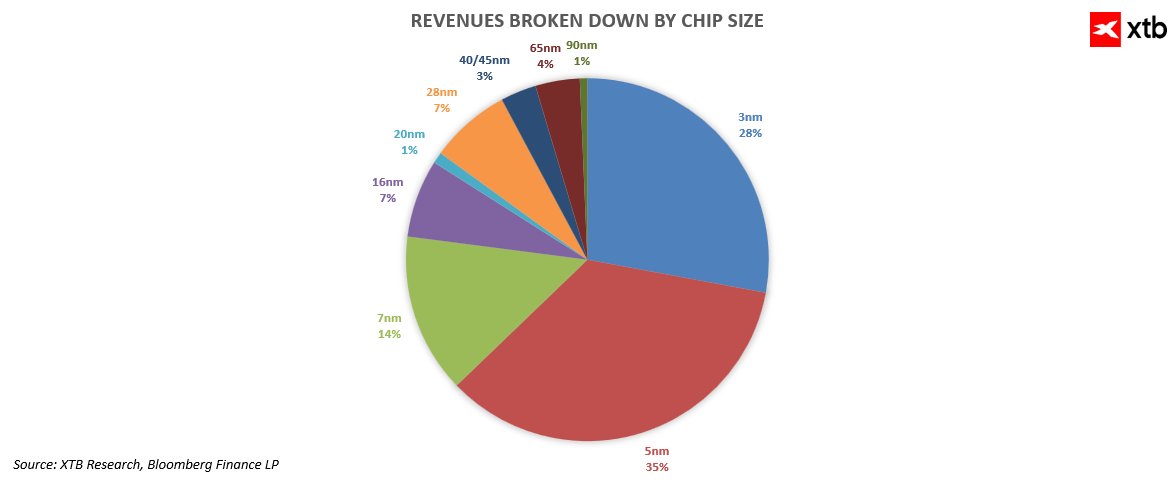

TSMC is not an ordinary chip manufacturer. It is a company that determines which technologies reach servers, supercomputers, and data centers powering artificial intelligence worldwide. Leading market players such as Nvidia, AMD, and Apple, as well as major hyperscalers, entrust TSMC with their most critical production orders. This allows the company not only to benefit from rising demand but also to shape the direction of the entire industry. Advanced technology nodes, including 3-nanometer, 5-nanometer, and 7-nanometer processes, together accounted for 77% of wafer revenue in Q4 2025. Moreover, the recently launched mass production of 2-nanometer chips is already establishing a solid foundation for future revenue. This technology has the potential to significantly increase TSMC’s share in the most advanced chip market segments in the coming years, particularly in artificial intelligence and high-performance computing.

Record results in Q4 2025

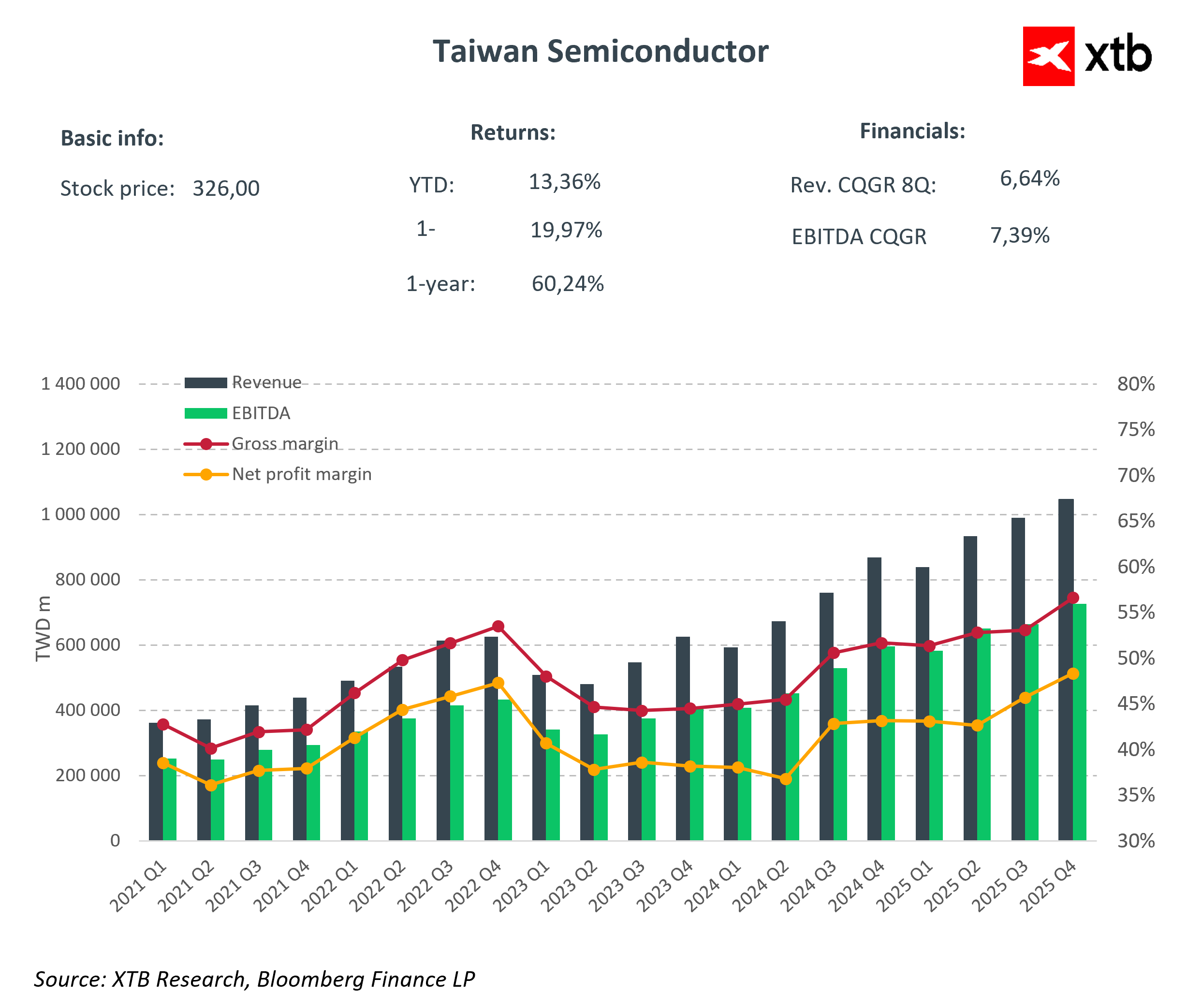

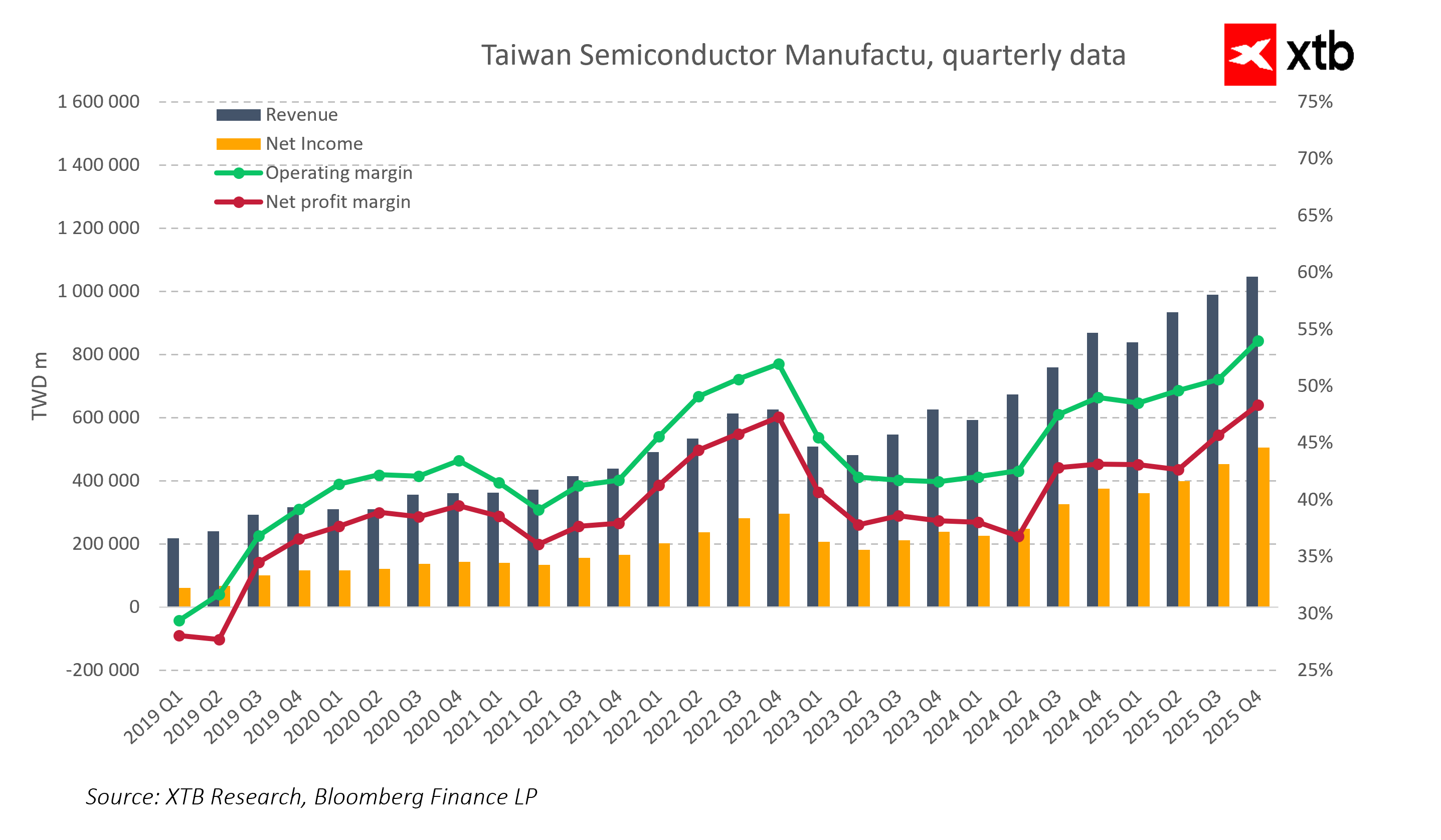

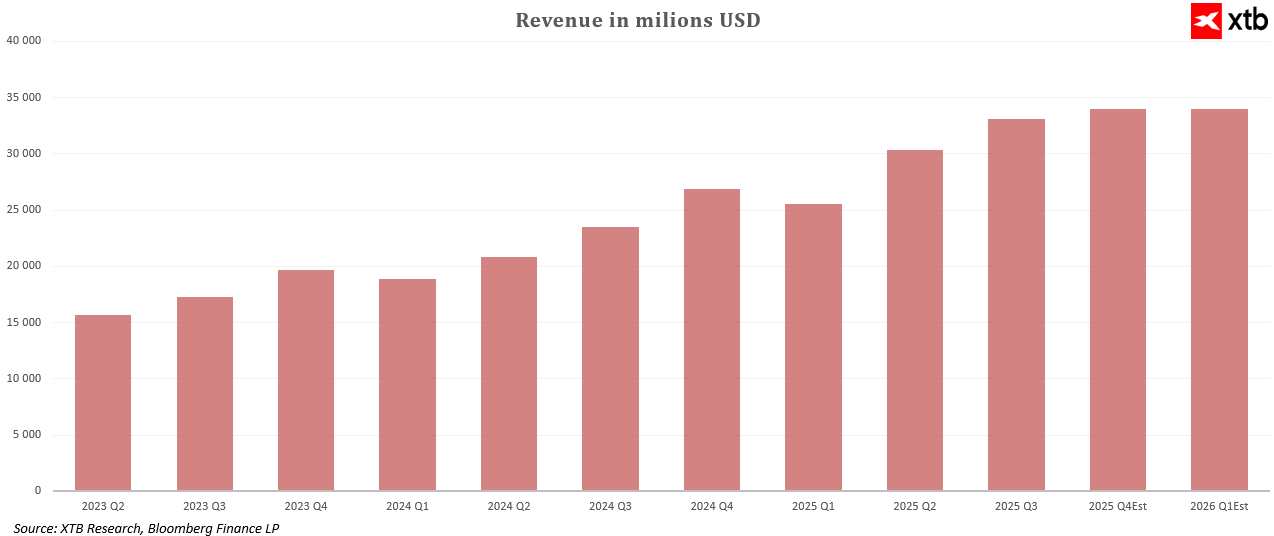

TSMC closed Q4 2025 with impressive results that clearly exceeded market expectations. Quarterly revenue reached NT$1,046.09 billion, approximately 33.2 billion USD, representing a 20.5% year-on-year increase and the highest level in the company's history. Net profit amounted to NT$505.74 billion, or 16 billion USD, a 35% increase compared to the same period last year. These strong financial results demonstrate TSMC’s ability to maintain high profitability even amid rising capital expenditures and growing chip demand.

Gross margin remained at a very high 62%, and operating margin reached 54%, highlighting the company’s operational efficiency. The high net margin of 48.3% confirms that TSMC effectively manages production costs while maintaining strong pricing power in the high-end chip segment.

Advanced technologies continue to drive growth. 3-nanometer, 5-nanometer, and 7-nanometer processes accounted for 77% of wafer revenue, with 3 nm contributing 28%, 5 nm 35%, and 7 nm 14%. At the beginning of 2026, TSMC launched mass production of 2-nanometer chips, which now serve as a foundation for future growth and strengthen the company’s position in artificial intelligence and high-performance computing. The revenue structure demonstrates the company’s focus on the most technologically advanced market segments, ensuring high margins and a competitive edge for years to come.

Stable growth and strong financial position

For several years, TSMC has consistently grown, increasing quarterly revenue from around 200 billion TWD to over 1,046 billion TWD by the end of 2025. The dynamic growth of net profit confirms rising profitability, while operating and net margins remain exceptionally high at over 50% and 40%, respectively. This level of profitability reflects the company’s operational efficiency, ability to maintain pricing power, and effective cost management in the most advanced market segments.

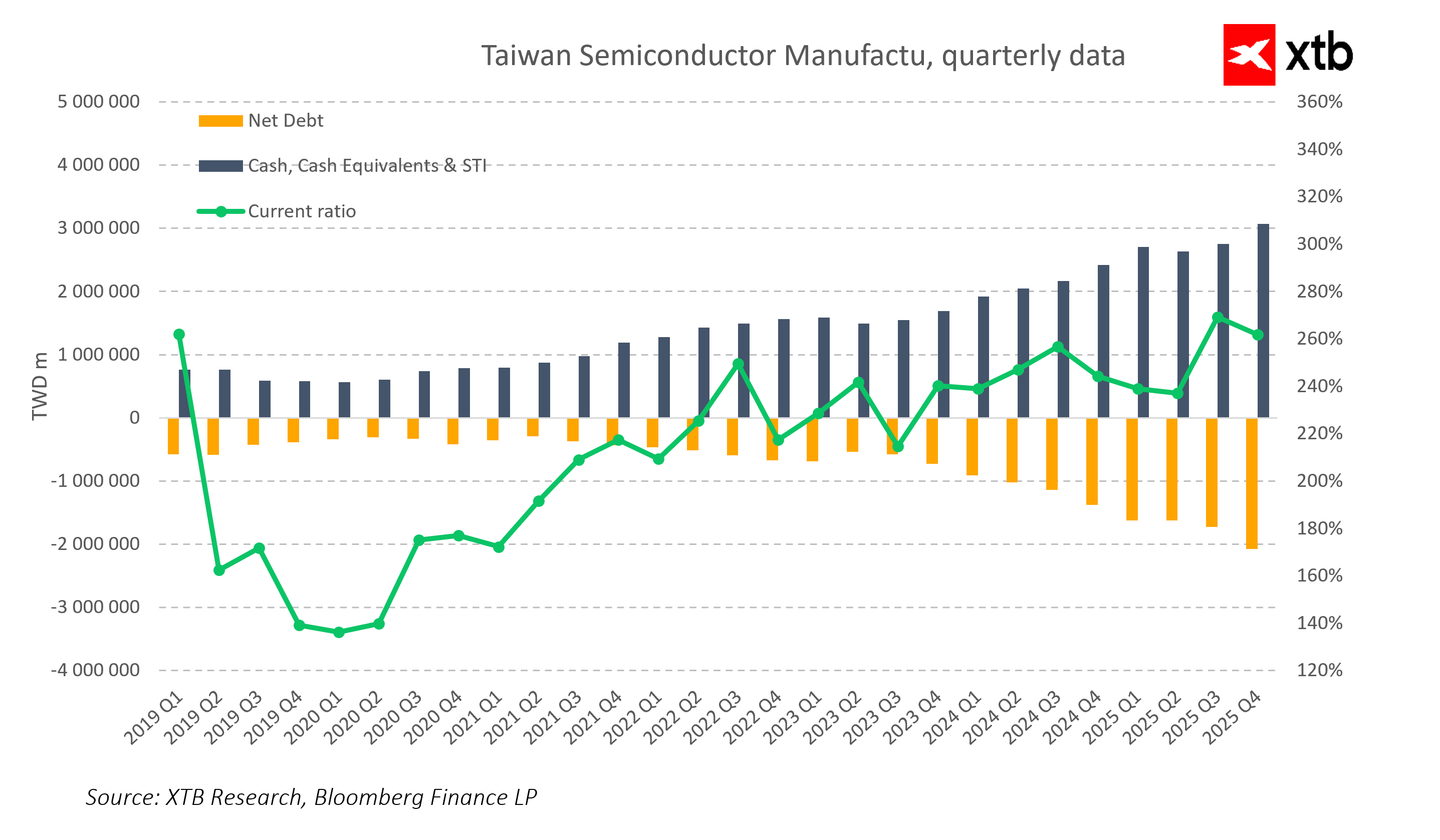

Financially, the company is solid and stable. Cash and cash equivalents significantly exceed liabilities, providing financial flexibility and freedom to fund development and ambitious investments. The current ratio remains at a safe level, enabling the company to meet obligations without difficulty and maintain stability even during periods of increased market volatility.

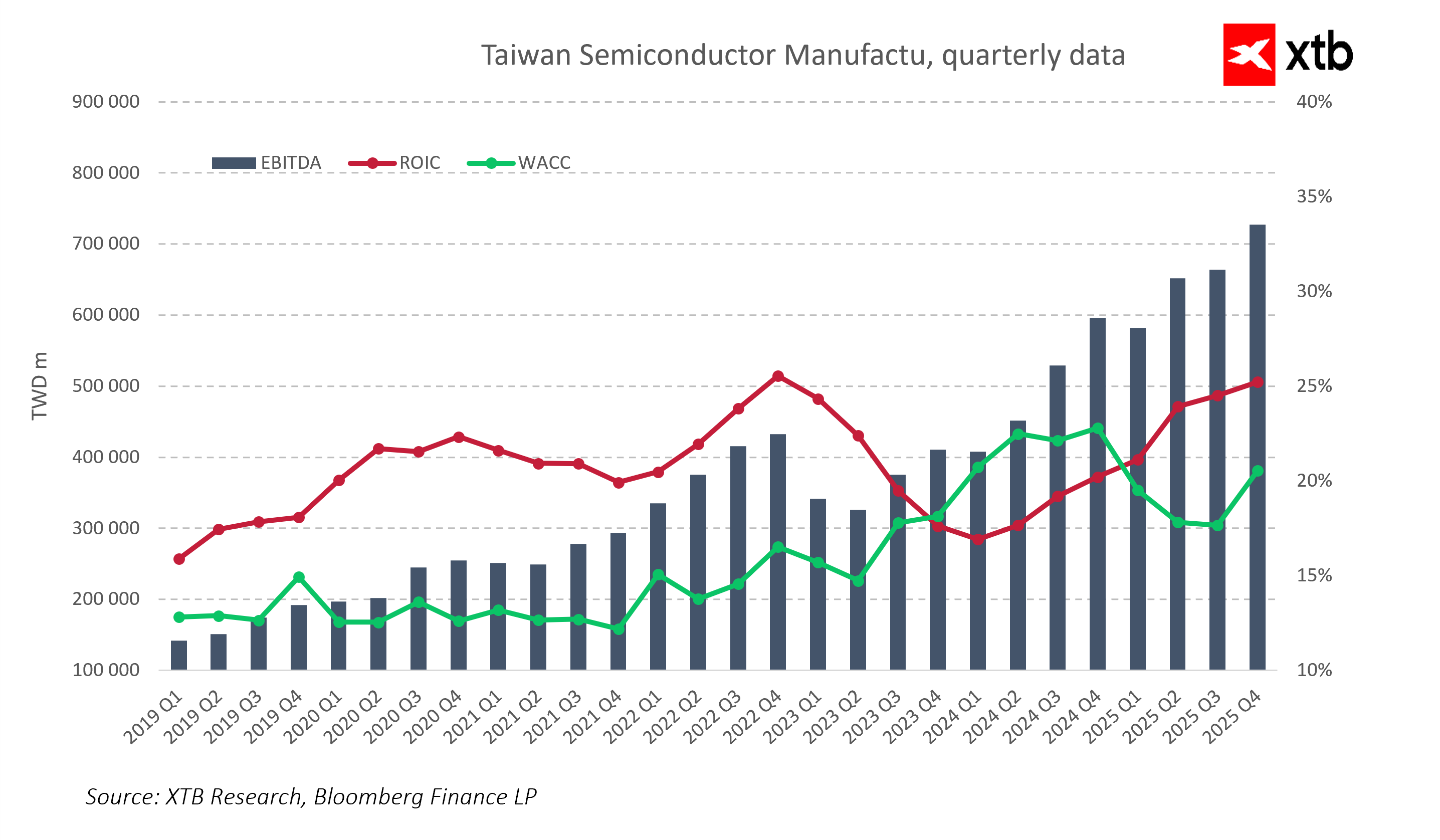

Capital management efficiency is also exceptionally high. EBITDA grows proportionally with revenue, and return on invested capital (ROIC) significantly exceeds the cost of capital, demonstrating TSMC’s ability to generate long-term shareholder value and maintain stable and profitable operations. Additionally, the revenue structure shows that advanced technology nodes play a key role, accounting for the majority of sales and forming the foundation for future growth. This allows TSMC to meet rising demand for AI and high-performance computing chips while maintaining a competitive edge in the global market.

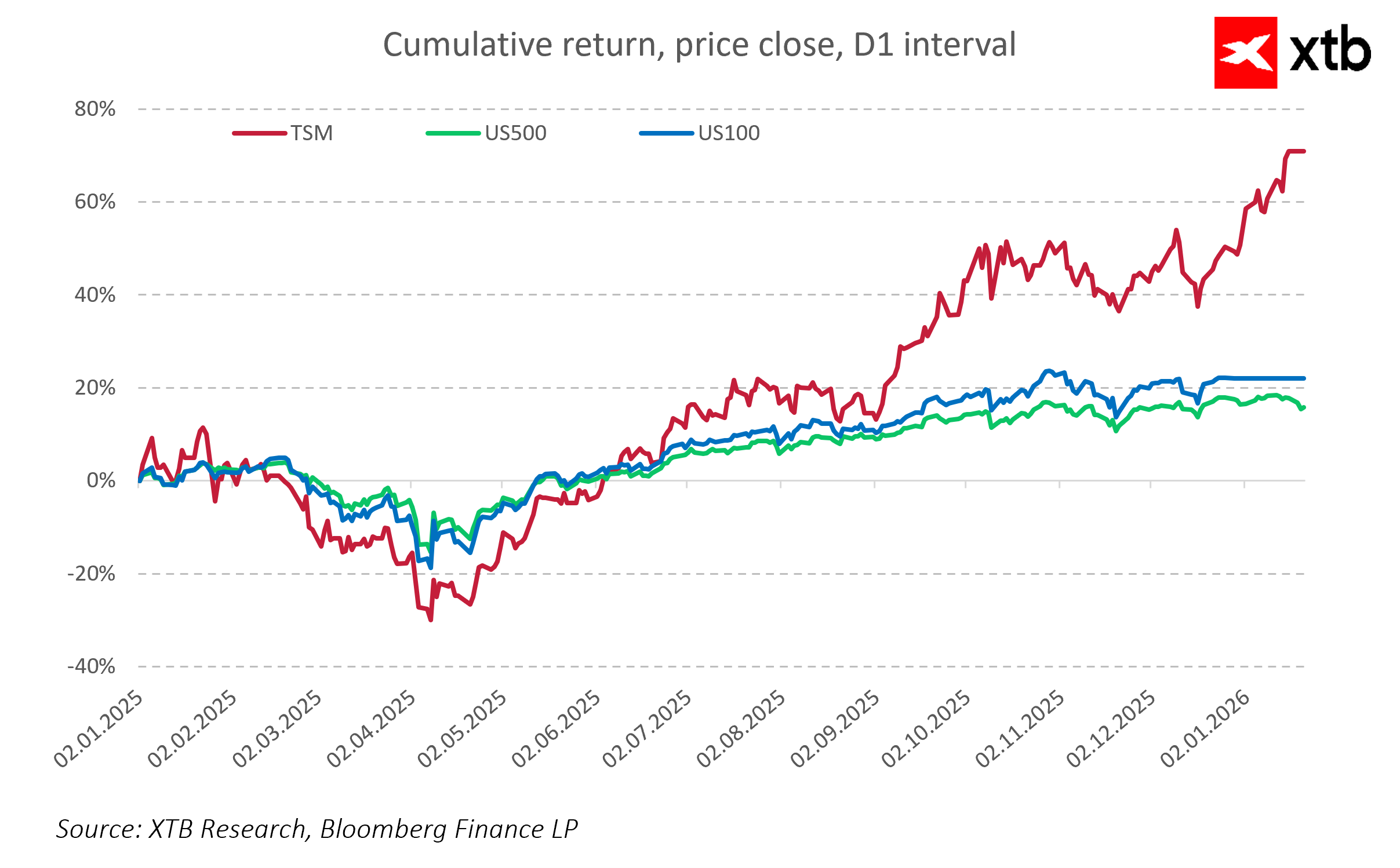

Return analysis further confirms TSMC’s strong market position. Cumulative return charts show that TSMC shares clearly outperformed both the S&P 500 and Nasdaq 100 during the analyzed period. Despite higher volatility earlier in the year, the company quickly recovered and entered a dynamic growth phase, ending the period with over 60% gains, while major US indices posted increases of only a dozen to twenty percent. This relative outperformance reflects the market’s positive assessment of TSMC’s fundamentals, particularly its key role in the global semiconductor supply chain and exposure to long-term trends such as artificial intelligence and high-performance computing.

Outlook for 2026 and planned investments

TSMC enters 2026 with strong momentum and optimistic forecasts. Management expects first-quarter revenue to range between 34.6 and 35.8 billion USD, implying continued double-digit year-on-year growth. Gross margin is projected at 63–65% and operating margin at 54–56%, showing the company’s ability to maintain high profitability even amid rising AI and HPC chip demand.

The most impressive element of TSMC’s strategy is its capital expenditures. The company plans to invest a record 52–56 billion USD in 2026 to develop and modernize production capacity, a more than 25% increase compared to the previous year. These massive investments focus on the most advanced 3 nm, 5 nm, and 7 nm nodes, as well as mass production of 2 nm chips, forming the foundation for future growth. The scale of investment clearly demonstrates that TSMC views the AI boom as a permanent shift in the global semiconductor market rather than a temporary trend.

Through these investments, the company strengthens its technological lead and secures production capabilities for its largest customers, including Nvidia, AMD, Apple, and major hyperscalers. A strong revenue structure, high margins, and strategic investment in cutting-edge technology show that TSMC is not only ready to meet current demand but is also building the foundation for long-term, stable growth.

Valuation overview

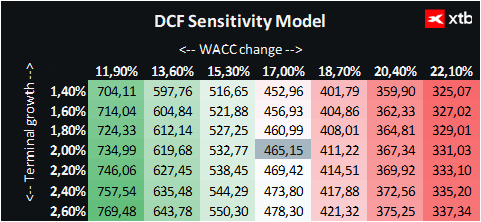

We present a discounted cash flow (DCF) valuation of Taiwan Semiconductor Manufacturing Company. This valuation is for informational purposes only and should not be considered an investment recommendation or precise valuation.

TSMC is the world’s largest contract semiconductor manufacturer, supplying the most advanced chips for artificial intelligence, high-performance computing, and data center applications. The company benefits from growing demand for AI chips and high-performance processors, and its strategic investments in 3 nm, 5 nm, 7 nm nodes, and mass production of 2 nm chips provide a solid foundation for further growth.

It is worth noting that TSMC maintains very high profitability and a technological edge over competitors, limiting market risks and allowing safe planning for the coming years. The valuation remains conservative, accounting for potential competitive pressures and volatility in the global semiconductor market.

Based on this analysis, the estimated value of one TSMC share is approximately 465 USD, compared to the current price of 326 USD, implying a potential upside of around 43%. This indicates that the company not only has strong financial fundamentals but also offers an attractive opportunity for investors who believe in the continued growth of the semiconductor and artificial intelligence sectors.

Source: xStation5

Summary and value prospects

TSMC ends 2025 in excellent financial shape, with record revenue and impressive profitability. Strong revenue growth, high margins, and strategic investment in the most advanced technologies, including mass production of 2 nm chips, show that the company is not only maintaining its leadership position but also building a foundation for long-term growth.

With planned capital expenditures of 52–56 billion USD in 2026, TSMC secures technological leadership and production capacity for key clients such as Nvidia, AMD, Apple, and major hyperscalers. This demonstrates that the company views the AI boom as a permanent trend rather than a temporary fad.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment