Microsoft, Nvidia, and Anthropic have entered a strategic agreement that could significantly impact the artificial intelligence and cloud services market. Anthropic has committed to purchasing $30 billion worth of computing power from Microsoft Azure to develop its Claude models. Initially, the company will utilize up to one gigawatt of computing power based on Nvidia’s latest Grace Blackwell and Vera Rubin systems. Despite this substantial engagement with Azure, Anthropic remains an Amazon Web Services customer, providing greater flexibility and reducing operational risk. Previously, Amazon had invested around $8 billion in Anthropic.

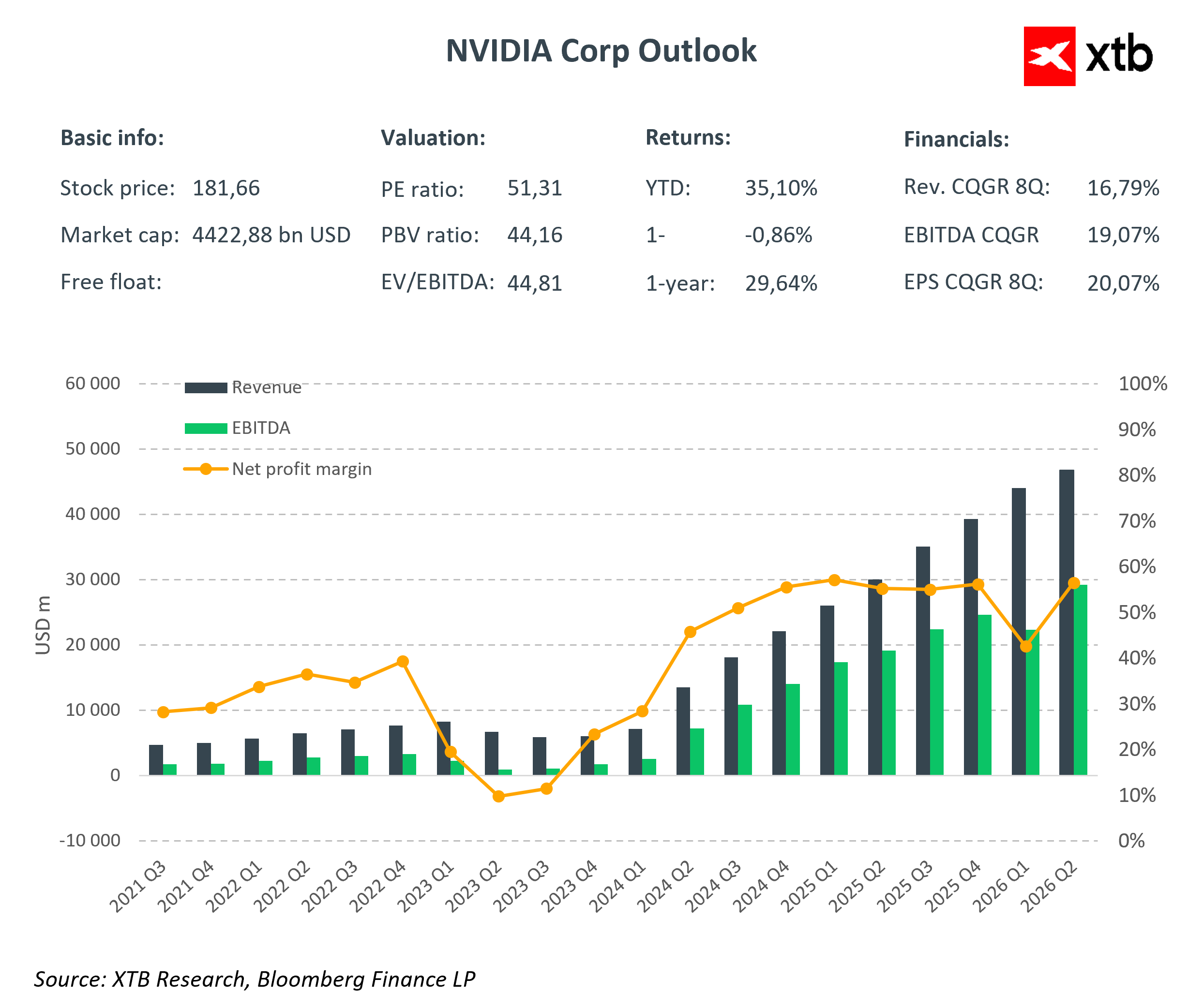

Under the agreement, Nvidia will invest up to $10 billion in Anthropic, while Microsoft will contribute up to $5 billion. The partnership also includes technological collaboration aimed at jointly designing and optimizing AI architecture. This ensures that Claude’s development is supported both financially and technologically, while simultaneously strengthening Nvidia’s and Microsoft’s positions in the rapidly growing generative AI sector.

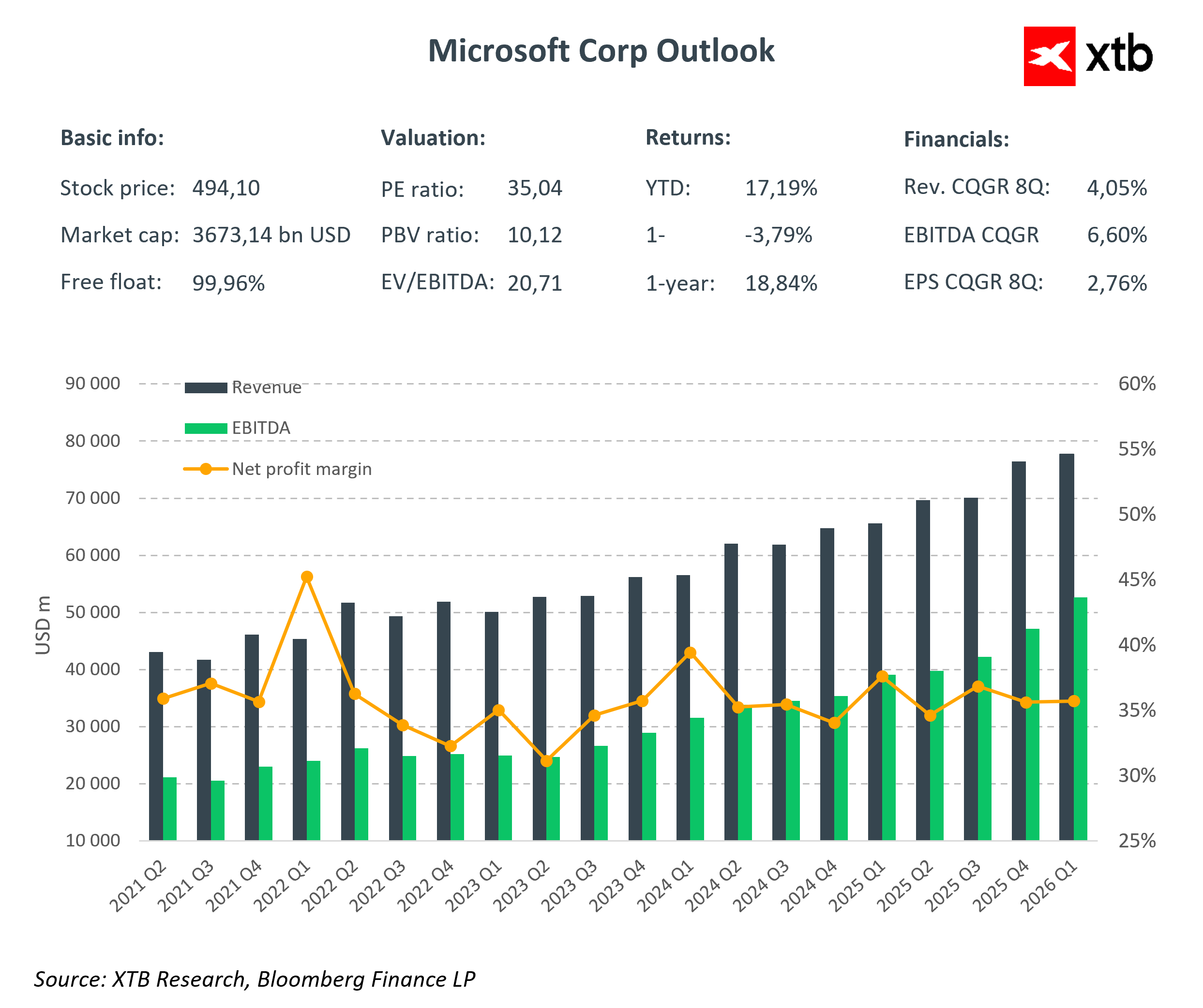

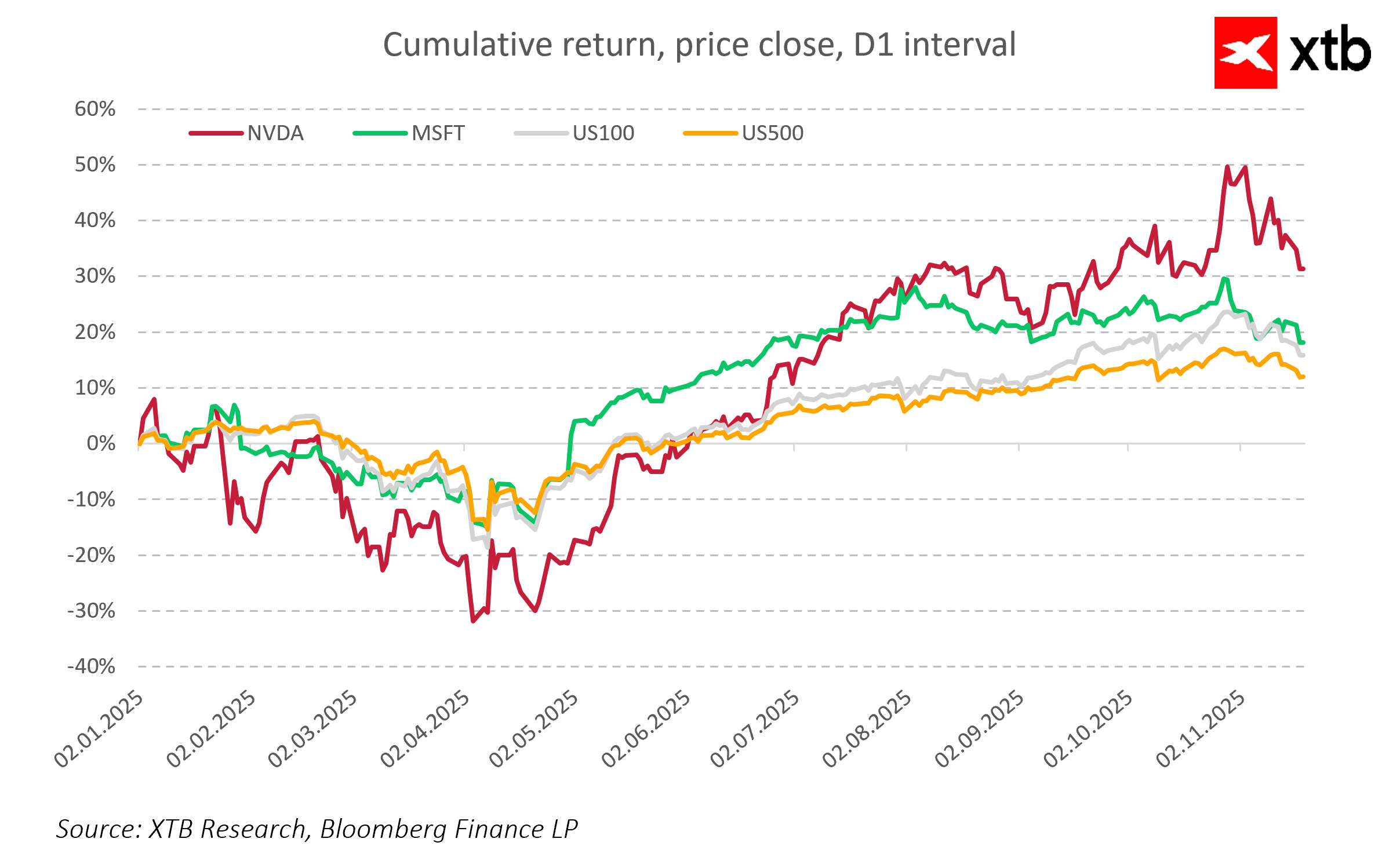

The scale of the initiative is enormous. AI infrastructure spending is expected to exceed $400 billion in 2025, with forecasts suggesting global expenditures could reach $3–4 trillion by 2030. Microsoft Azure is currently growing at a year-over-year rate of 39 percent, outpacing AWS’s growth of 17.5 percent. This underscores Microsoft’s increasing role as a key player in cloud computing and AI infrastructure.

For Microsoft and Nvidia, the deal secures access to cutting-edge technologies and a stable demand for their services and hardware. For Anthropic, it guarantees access to critical infrastructure and financing, enabling intensive development of Claude while maintaining its partnership with AWS, which enhances operational security. However, the company does not expect to achieve profitability before 2028, representing a significant financial risk.

Markets are also watching the move for signs of potential overexpansion in the AI sector. Experts point out that rising infrastructure investments could pressure financial performance if AI revenue growth does not keep pace with spending. The trend of mutual investments among companies may support short-term development but raises questions about the stability of the sector’s financial foundations.

In summary, the partnership between Microsoft, Nvidia, and Anthropic is reshaping the generative AI landscape. Markets may interpret it as a strengthening of Microsoft’s and Nvidia’s positions in cloud and infrastructure, while offering Anthropic an opportunity for faster technological advancement, albeit with ongoing financial and operational challenges.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%