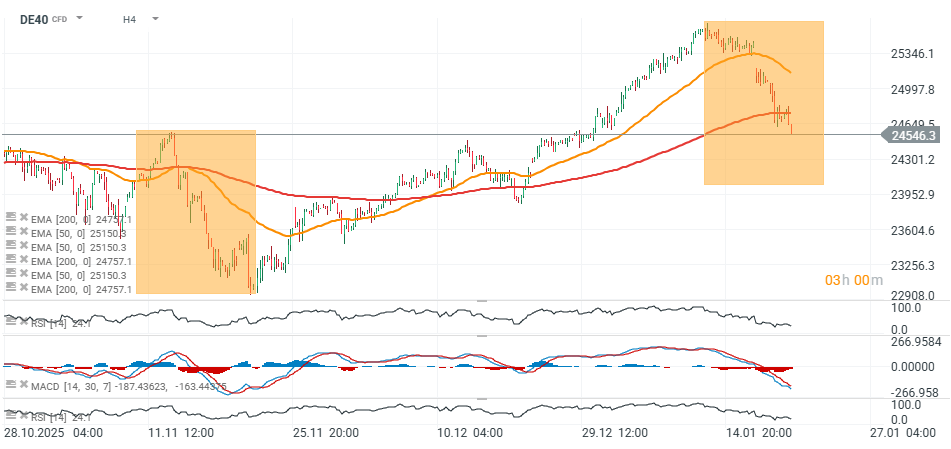

DAX (DE40) futures are extending today’s sell-off, retreating toward the 24,500-point area, where we can see the first meaningful price reactions (local highs from November 12 and December 12, 2025). This would suggest that the index may regain support and find room for a potential rebound closer to 24,300 points. On the other hand, if the downturn in the US equity market deepens, a 1:1 corrective move would imply a possible test of the 24,000 area and a “touch” of the mid-December local low.

Source: xStation5

Looking further back, breaks below the 50-day EMA on the daily timeframe have almost always been followed by an acceleration of the downtrend. Since May 2025, the three downside impulses had similar 1:1 projections, though with a slightly smaller range than the last two larger corrective legs from December and—potentially—the current move in January 2026. If the index were to test the strength of the long-term trend, the decline could extend even toward 23,800 points, where the 200-day exponential moving average currently sits on the daily chart (EMA200, red line). Conversely, a rebound from current levels could reignite the strong upward impulse, with potential resistance near 24,800 points (two local highs from July and October 2025).

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street