- What next for the gold price?

- What next for the gold price?

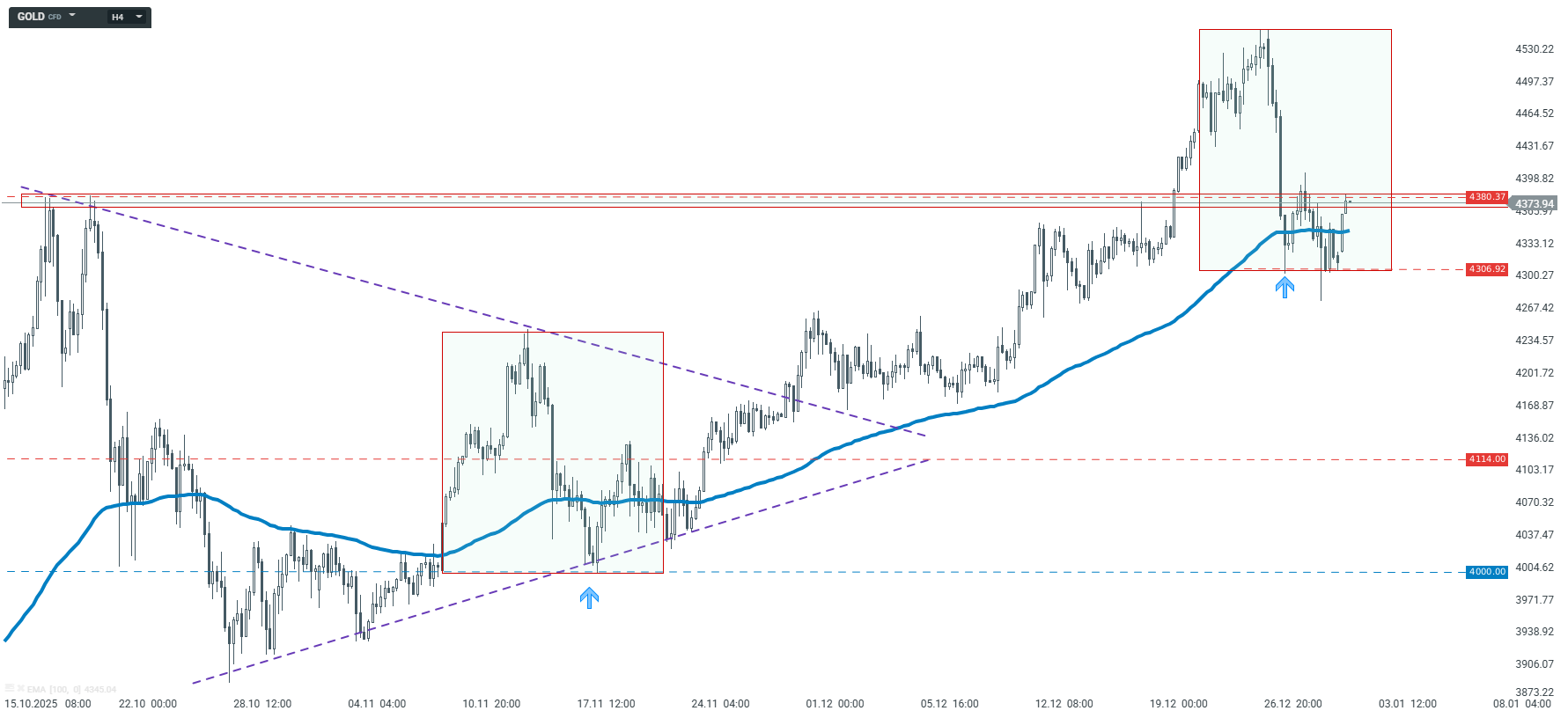

Gold remains in an upward trend, with the latest impulse developing since the beginning of November 2025. Between November 13 and 18, there was a correction, after which the market broke out with another upward impulse. The latest stronger pullback stopped exactly at the level of the previous correction, at 4,306, which, according to the Overbalance method, suggests the possibility of a continuation of the upward movement. In addition, the price remains above the 100-period average (marked in blue on the chart) and is simultaneously attempting to break above the 4,380 zone resulting from previous peaks. A sustained return above 4,380 would open the way for continued growth and new highs, while a drop below 4,306 would increase the risk of a deeper correction.

GOLD – H4 interval | Source: xStation5

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

Bitcoin jumps above $70k USD despite stronger dollar📈

OIL: prices continue to rise despite the US Navy escort proposal for ships📌