Tesla (TSLA.US) is losing more than 3% ahead of the U.S. market opening, after the EV maker decided to cut production in China to 5 days a week, down from 6.5 previously, according to Bloomberg sources. The Shanghai Gigafactory will operate at reduced capacity, indicating falling demand in the world's largest EV market. Production cuts began in March and may continue through April, according to Bloomberg sources. At the same time, the company's inventories appear high; exports of models from Shanghai to Europe have fallen sharply in recent months. Tesla's Berlin factory is also operating below capacity and has struggled with outages. This makes the market likely to revise revenue and profit forecasts downward and to expect possibly record-low growth in Q1 earnings.

Competition is not sleeping - even as EV markets slowdown

- In addition to concerns around consumers, Tesla also faces stiff competition from local manufacturers like BYD, Li Auto and NIO, as well as a consumer who is increasingly opting for Chinese domestic brands (which Apple is also feeling). Analysts point out that the company is unlikely to meet its ambitious quarterly delivery target, in the first quarter of the year. Tesla has previously reported on planned car increases to improve its profitability.

- Earlier, the media reported that Tesla will slightly raise the price of Model Y vehicles starting April 1. It is also expected to follow a similar strategy in the US and Europe. Tesla is still offering rebates of $1,000 to $1,500 in China for unsold Model Ys; in the European and US markets, the rebates are even larger

- According to skeptics, lifting prices in the current environment could lead to a drastic drop in demand and give more room to Chinese brands. At the same time, Morgan Stanley analysts stressed that Tesla is positioning itself as a future winner in the EV market 'on the part of Western brands'. The price hike may also be due to Tesla's emphasis as a premium brand against local manufacturers, where the company may want to position itself, unable to engage in a price battle with Chinese competitors

- Morgan Stanley Research has indicated that the group's artificial intelligence-powered supercomputer DoJo, which drives the construction of autonomous vehicles and the licensing of Full-Self-Driving technology, could ultimately bring the company more than $500 million in additional market value for Tesla

- According to the China Passenger Car Association (CPCA), Tesla China delivered 60,365 models in February, down about 19% year-on-year. Chinese New Year lasted two weeks in February, from February 10 to 24. Deliveries of Tesla vehicles made in China in January and February totaled 131,812, a decline of 6% y/y.

- Local manufacturer, Li Auto lowered its first quarter delivery forecast, suggesting March sales that are roughly half of what the Chinese electric vehicle maker predicted as recently as March 1. According to FactSet, Wall Street still estimates first-quarter deliveries at 481,000, but some analysts have lowered forecasts in recent days. It is likely that Tesla will report Q1 figures in early April. The EV maker is expected to unveil a next-generation Roadster model later this year.

TSLA.US chart

Shares are trading below the SMA200, and the company's capitalization has already fallen by nearly $250 billion this year. The price has bounced off resistance at the 61.8 Fibonacci retracement, at $177 per share, and could theoretically test the area around the 61.8 retracement, at $157. These are also the levels of the local April 2023 low.

Source: xStation5

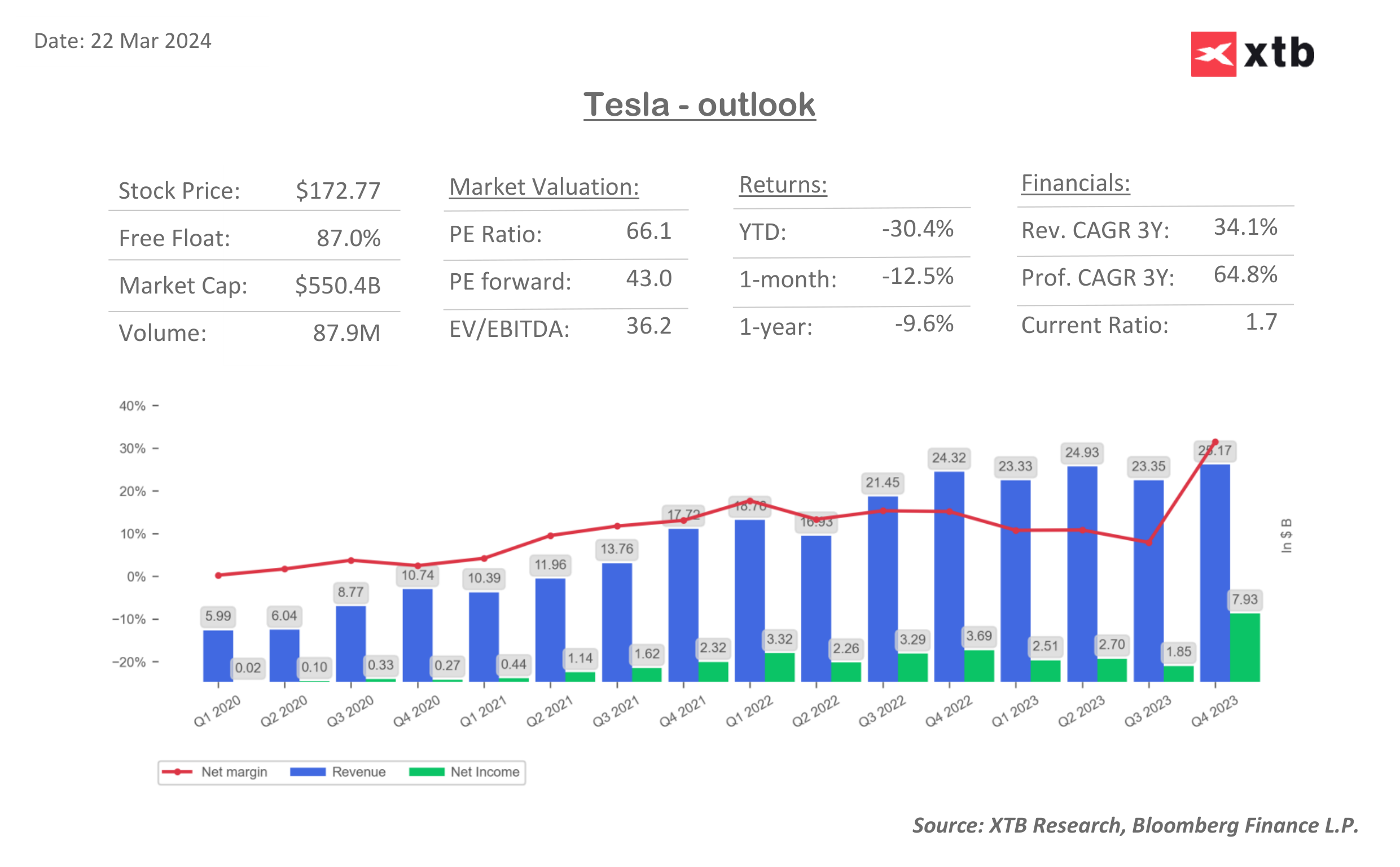

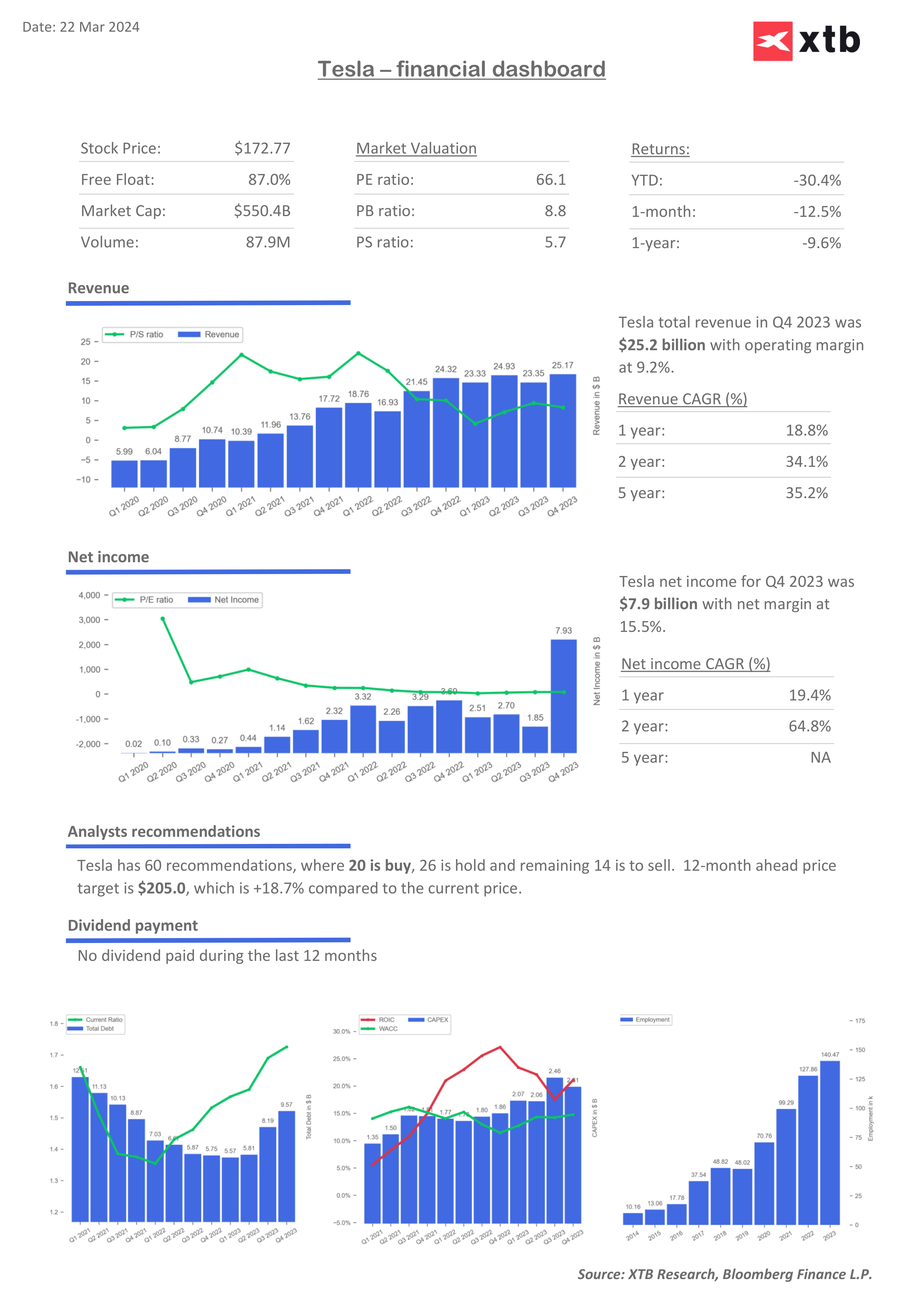

Tesla's financial dashboard and valuation![]()

Source: XTB Research![]()

Source: XTB Research

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡