DE30

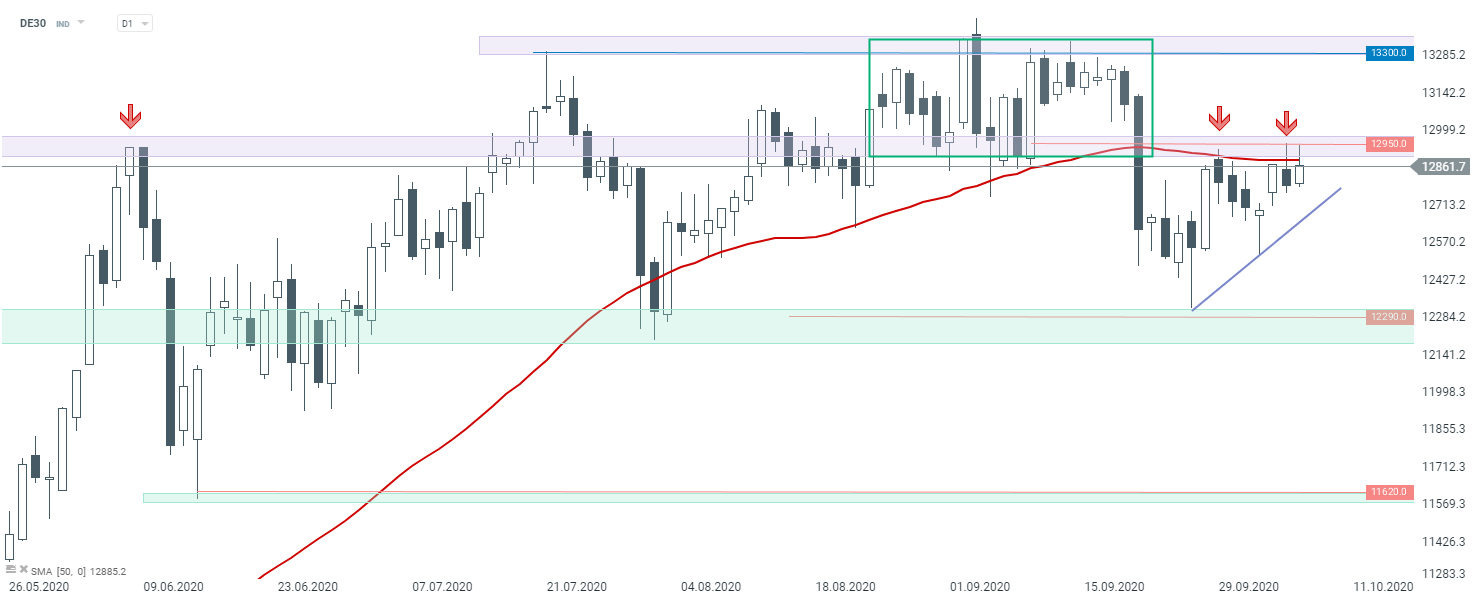

Looking at the DE30 chart from a technical point of view, one can see that the German index has bounced off the key resistance area at 12,950 pts once again. According to the classic technical analysis, as long as the price stays below it, continuation of downward correction move looks to be the base case scenario. However, one should keep in mind that the chance of breaking above increases with each subsequent test. In case a break above occurs, the upward move may accelerate towards 13,300 pts. DE30 D1 interval. Source: xStation5

DE30 D1 interval. Source: xStation5

SILVER

Silver has been trading in a downward trend recently. Buyers tried to draw a bigger correction but they finally gave up yesterday. Silver price bounced off the resistance at $24.35, marked with the 100-period moving average and local high from September. The downward move stopped at a local support near $23.22. However, this support is being tested once again. Should we see a break lower, downward move may accelerate towards recent lows at $21.80. A break back above the $24.35 handle could herald a potential significant upward move.

Silver H4 interval. Source: xStation5

Silver H4 interval. Source: xStation5

OIL.WTI

Oil market has been trading in an upward move this week. The price of the commodity managed to break above the upward trendline but moved lower after Trump's tweet yesterday. Looking at the H4 chart, one can see a local support at 38.2% Fibonacci retracement of recent upward impulse. Should the correction be deepen below it, the next support lies in the vicinity of $38.50, where previous price reactions can be found. Key resistance can be found at $46.60.

OIL.WTI H4 interval. Source: xStation5

OIL.WTI H4 interval. Source: xStation5

Key support on Ethereum 💡

S&P 500 futures retreat 1% amid hawkish Fed rhetoric and robust data

Technical Analysis - Ethereum (14.01.2026)

Technical Analysis - GOLD (02.01.2026)