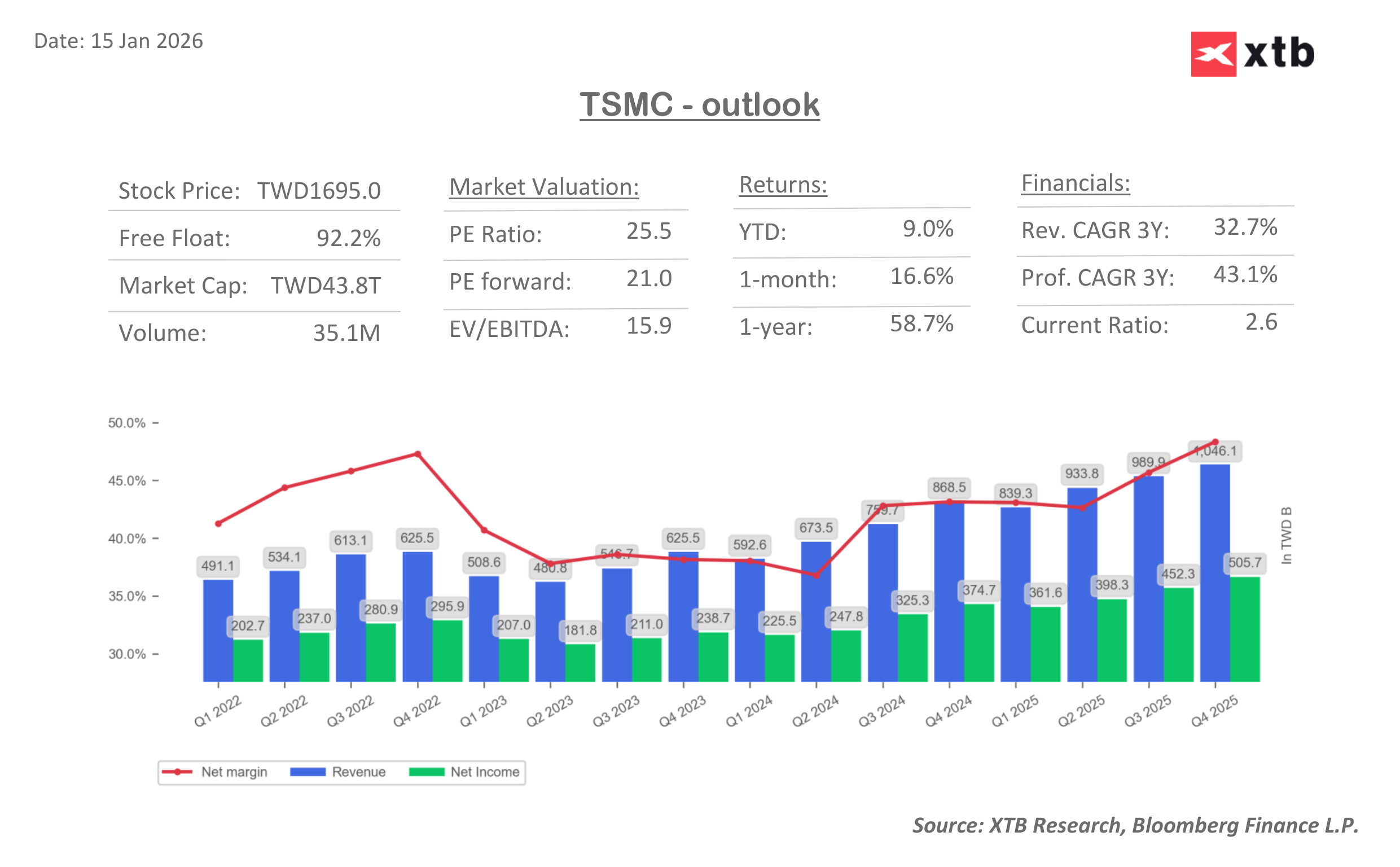

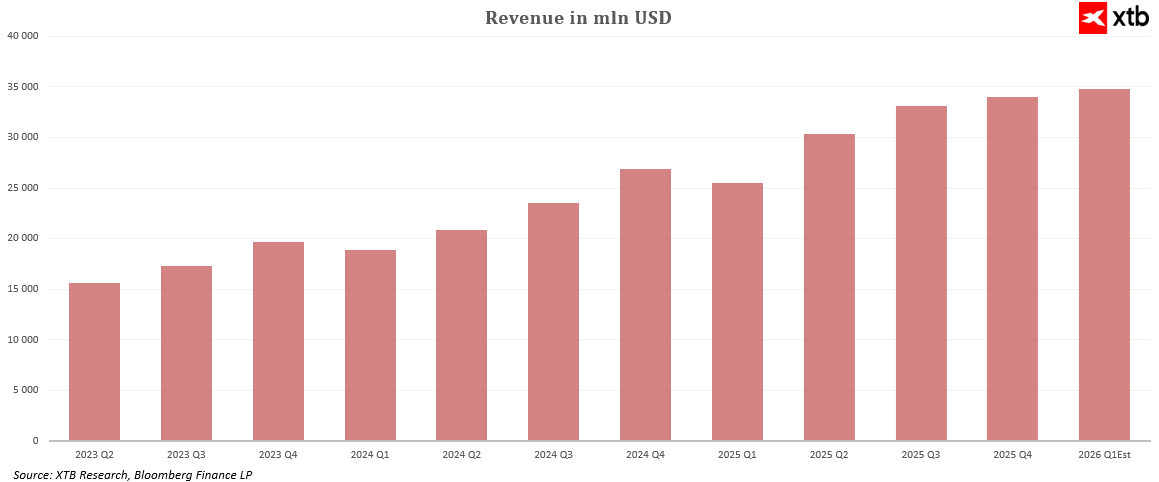

Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract semiconductor manufacturer, today reported fourth-quarter 2025 results that can be summed up in one word: phenomenal. The company closed the year with record revenues exceeding USD 122 billion, representing a year-over-year increase of more than 35% and marking the highest level in the company’s history. Net income in the fourth quarter alone rose 35% to USD 16 billion, significantly exceeding analyst expectations.

TSMC announced capital expenditures for 2026 in the range of USD 52–56 billion, more than 25% higher than in 2025, signaling that the Hsinchu-based giant sees lasting foundations for the growth of artificial intelligence. These results confirm that the AI boom is not a temporary trend, but a structural shift in the global digital economy, with TSMC at its undisputed technological core. The company’s growth is driven by advanced 3nm, 5nm, and 7nm process technologies and rising demand from key customers such as Nvidia, AMD, and hyperscalers, creating a solid base for continued dynamic expansion.

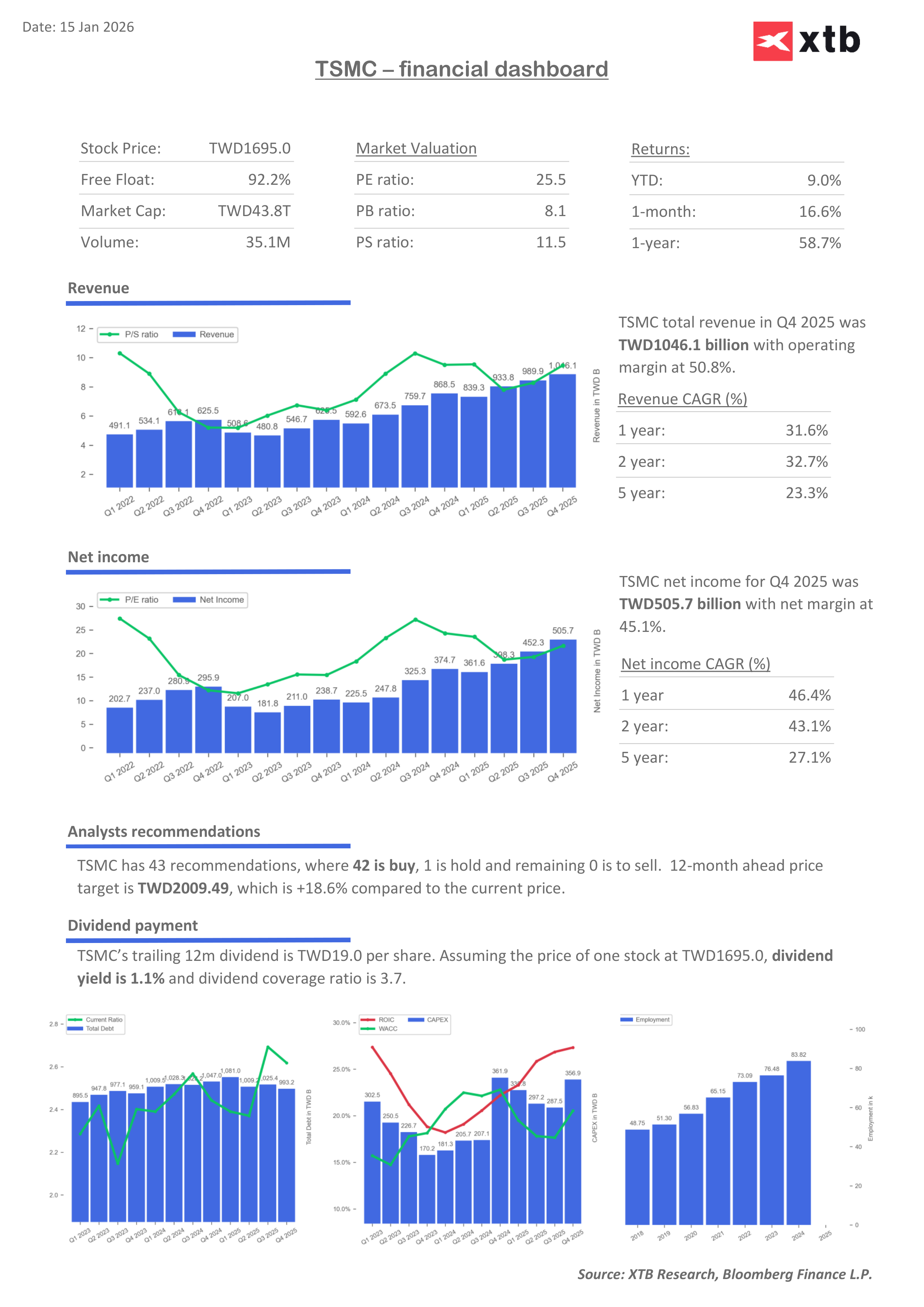

Key Financial Results

TSMC closed Q4 2025 with results that clearly surpassed analyst expectations. Quarterly revenues reached approximately USD 33.2 billion, a year-over-year increase of more than 20%, marking the highest quarterly level in the company’s history. Net income for the period rose 35% to USD 16 billion, highlighting not only the scale of the business but also the company’s exceptional ability to generate high profitability while simultaneously increasing capital investments.

Financial Data for 4Q25:

- Consolidated revenues: NT$1,046.09 billion (USD 33.73 billion) — up 20.5% YoY

- Net income: NT$505.74 billion (USD 16 billion) — up 35% YoY

- EPS (diluted): NT$19.50 (USD 3.14)

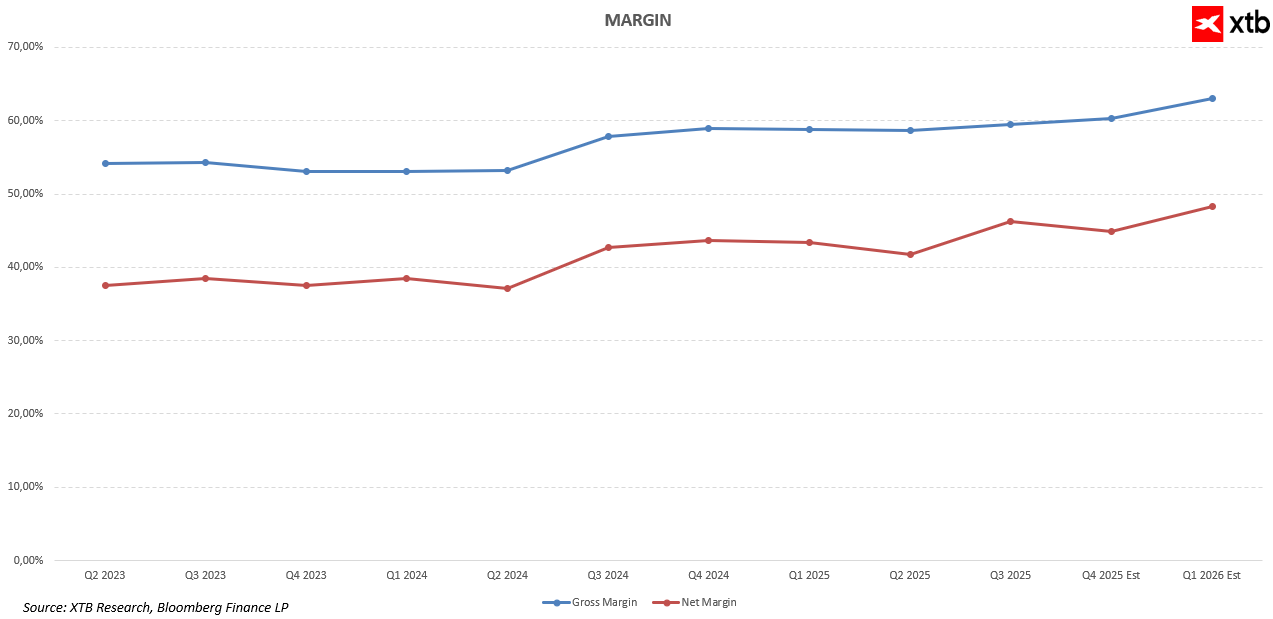

- Gross margin: 62.3%

- Operating margin: 54.0%

- Net margin: 48.3%

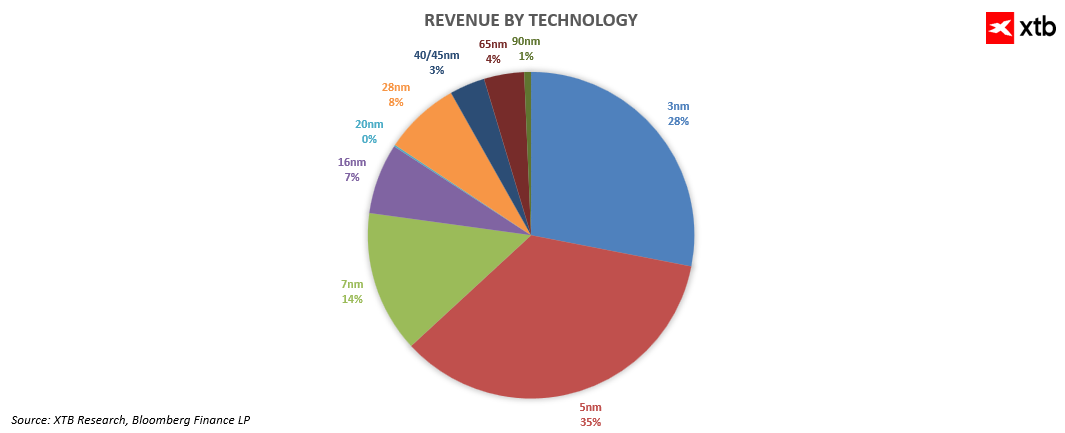

A key driver of success was advanced process technology. Chips manufactured at 3nm, 5nm, and 7nm nodes accounted for 77% of wafer revenue, with 3nm representing 28%, 5nm 35%, and 7nm 14%. This demonstrates that TSMC not only meets the growing demand for AI and high-performance computing chips but does so with exceptionally high manufacturing efficiency.

At the same time, the customer structure underlines TSMC’s strategic position in the global semiconductor supply chain. Major customers, including Nvidia, AMD, and Apple, as well as key hyperscalers, are reserving increasing production capacity, enabling the company to maintain a competitive edge and generate stable revenues despite growing pressure from other chipmakers. The high gross margin demonstrates that the company excels in the high-end segment, where production costs are high but profits are even higher.

TSMC Forward Guidance

- Q1 2026 revenues: USD 34.6–35.8 billion

- Gross margin: 63–65%

- Operating margin: 54–56%

- Capital expenditures (CapEx) 2026: USD 52–56 billion

TSMC is entering 2026 with strong momentum and very optimistic projections. The management expects Q1 revenues in the range of USD 34.6–35.8 billion, indicating continued double-digit growth year-over-year. Gross margin is projected at 63–65%, and operating margin at 54–56%, demonstrating the company’s ability to maintain high profitability even amid rising capital expenditures and dynamic demand for AI chips.

Management emphasizes the continued focus on advanced 3nm, 5nm, and 7nm nodes, which remain the core of the company’s high-margin product segment. This strategy enables TSMC to maintain technological leadership over competitors, including the rising capabilities of other chipmakers, while solidifying its position as a key player in the global semiconductor supply chain. Combined with growing orders from major customers such as Nvidia, AMD, Apple, and hyperscalers, the guidance indicates that TSMC is positioned for sustained, multi-year revenue and margin growth in the high-end segment.

Impact of TSMC’s Results on the Tech Rally

Record Q4 2025 results and optimistic guidance for 2026 confirm that TSMC is one of the main engines of the global technology rally. Growing demand for AI and high-performance computing chips drives not only TSMC’s revenues but also impacts the entire semiconductor supply chain. Advanced 3nm, 5nm, and 7nm processes allow the company to offer products unavailable to most competitors, translating into stable margins and competitive advantage.

At the beginning of 2026, TSMC also introduced 2nm processors, enabling the company to pull further ahead of competitors and laying the groundwork for long-term revenue growth, especially in AI and high-performance computing. Investors monitoring the tech sector can view TSMC as a barometer of the chip market, and the company’s results signal that the AI boom has strong and lasting fundamentals.

Report Summary

TSMC closed 2025 with record results that confirm its dominant position in the global semiconductor market. Management is not only increasing capital expenditures to USD 56 billion in 2026 but also focusing on the development of advanced process nodes, including 2nm processors, which ensure high margins and further competitive separation. Strong orders from key customers such as Nvidia, AMD, Apple, and major hyperscalers indicate that TSMC is prepared for sustained, multi-year revenue growth while maintaining its technological edge.

Key Takeaways:

- Strong profitability: TSMC achieved over 62% gross margin and nearly 50% net margin, surpassing many competitors and demonstrating the company’s scale, cost efficiency, and pricing power.

- Technological leadership: 77% of revenue generated by advanced process nodes confirms that TSMC meets AI chip demand on the most cutting-edge processes, translating into high margins and customer loyalty. The introduction of 2nm processors at the beginning of 2026 further strengthens the company’s competitive advantage and potential revenue growth.

- Robust guidance: Planned Q1 revenues of USD 34–35 billion and record CapEx of USD 52–56 billion reflect management’s confidence that demand for advanced technology chips, particularly AI, will remain strong and long-lasting.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood