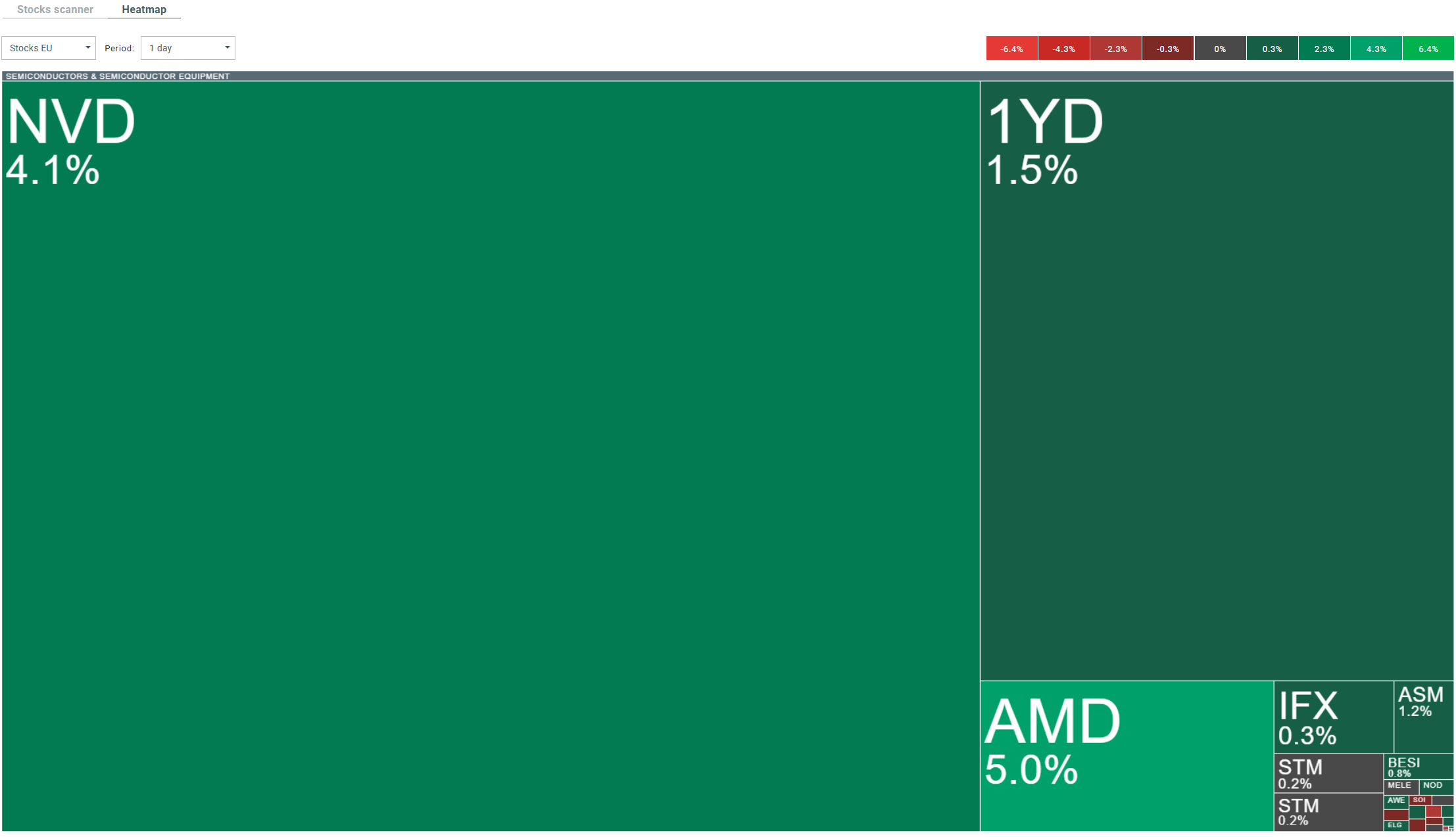

The strong reaction to TSMC's record results (+2.08%) in Taipei is spreading rapidly to global technologies—before Wall Street opens, there is a clear increase in the share prices of Nvidia (+1.92%) and AMD (+3.2%), which are benefiting from positive expectations related to the development of AI and the technology boom.

TSMC published record results for August 2025, recording a 33.8% y/y increase in sales to TWD 335.77 billion (USD 11.09 billion), confirming the strength of demand for advanced chips thanks to the artificial intelligence boom. The company not only dominates the data center chip segment, remaining a key supplier to Nvidia and AMD, but also signals an improvement in demand for consumer solutions in the coming months. TSMC's dynamic sales growth is driving profits and investor optimism, despite the potential risks associated with US-China tensions over technology exports.

The strong market reaction to TSMC's results is spreading to other technology companies – Nvidia and AMD shares are gaining strongly ahead of the Wall Street opening, with investor enthusiasm focused on the AI segment, which is ensuring continued dynamic growth in these companies' profits. The outlook for the semiconductor sector remains very positive: Nvidia points to record spending by hyperscalers on infrastructure development, while AMD is counting on a rebound in demand for personal computers and further expansion in data centers.

Key company results

-

TSMC August: sales of TWD 335.77 billion (+33.8% y/y, +3.9% m/m)

-

TSMC Q3 forecast: revenue of USD 31.8–33 billion (+38% y/y, +8% q/q, forecast confirmed by management)

ADRs of US tech giants listed in Europe are seeing even bigger gains than US stocks before Wall Street opens.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records