Twitter (TWTR.US) reported Q2 results today ahead of the Wall Street session open. Social media company reported an adjusted loss per share of $0.08 while the market expected profit per share of $0.14. Revenue at $1.18 billion was also lower than $1.32 billion expected. However, the company reported a small beat in the number of daily active users (DAU). Twitter reported average monetizable DAU at 237.8 million in Q2 2022 (exp. 237.5 million).

Twitter explained that its revenue was negatively affected by current macroeconomic environment. Similar explanation was offered by Snap for its poor performance and outlook and it is a growing theme among tech companies in Q2 reports. Twitter also said that its revenue was impacted by uncertainty relating to deal with Elon Musk. Company said due to pending acquisition it will not host an earnings call or provide financial guidance.

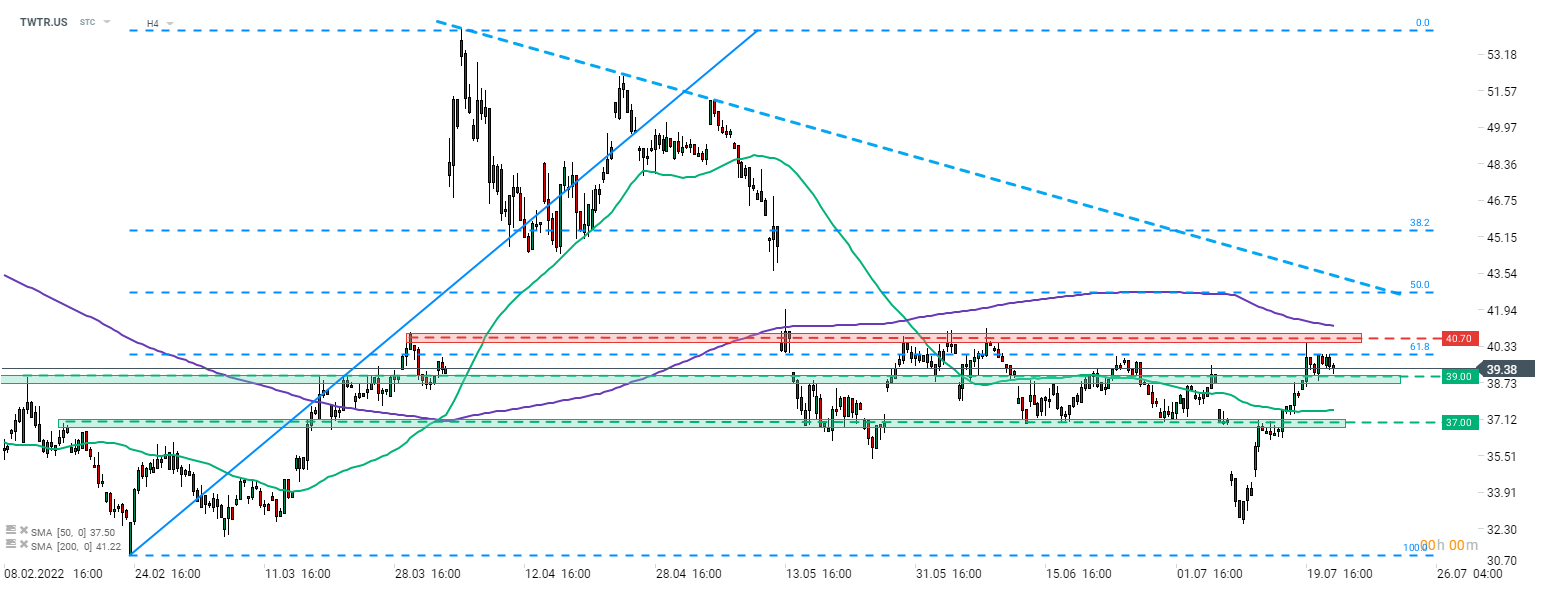

Twitter (TWTR.US) is trading around 2% lower in premarket at press time following earnings and revenue miss. Lack of guidance is also discouraging. Stock is currently trading near $38.70, at the lower end of a near term support zone. A drop below would pave the way for a test of the $37 support.

Source: xStation5

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records