-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

-

UBS raises Micron’s price target to $225.

-

Despite potential production constraints until 2027, investors remain optimistic.

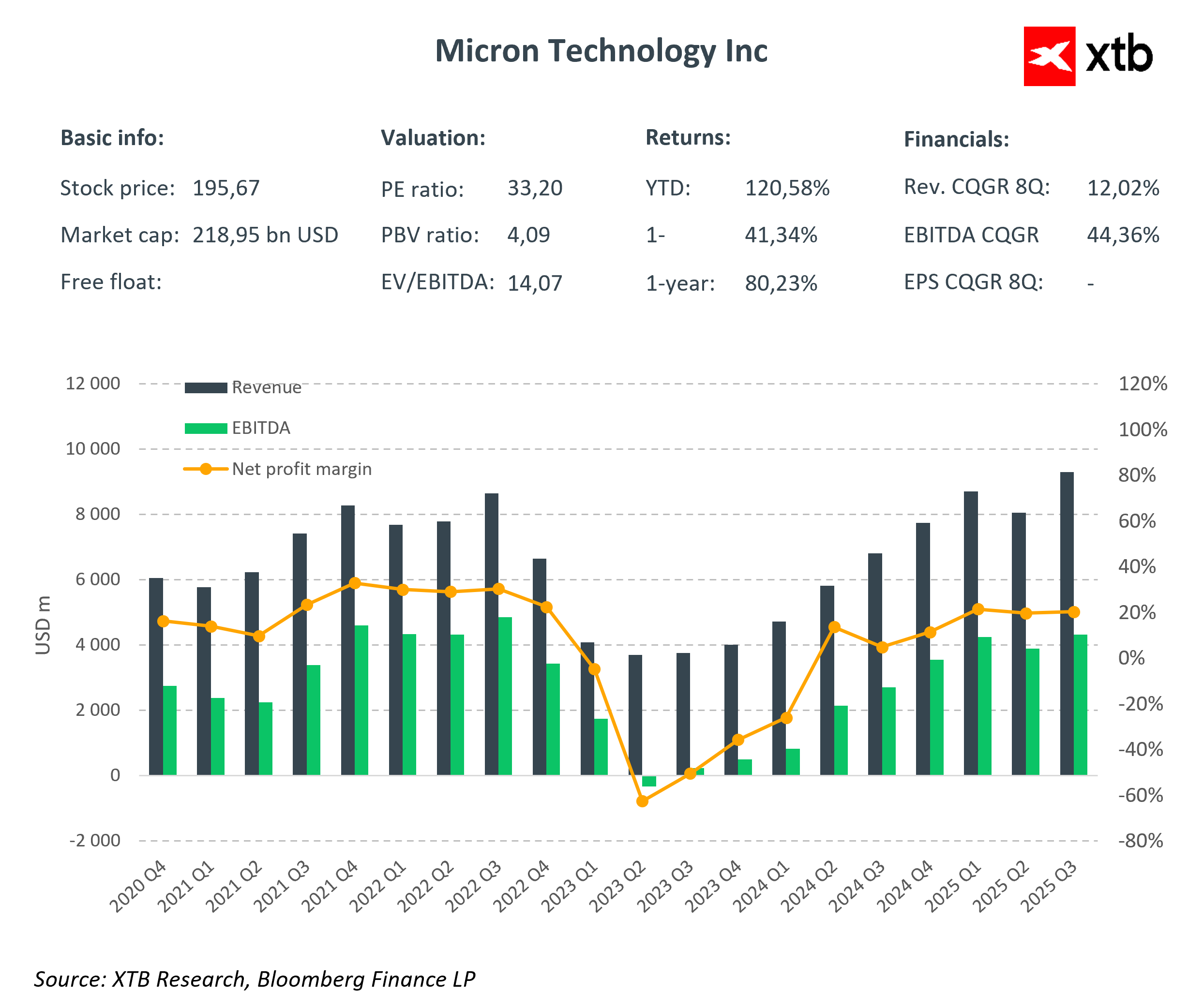

Positive news for Micron seems to be coming nonstop. UBS has just raised the stock price target from $195 to $225, maintaining its “Buy” recommendation. This is another sign of growing optimism around the memory chip manufacturer, mainly driven by the dynamic increase in demand for HBM (High Bandwidth Memory), a key component in the development of artificial intelligence and advanced computing systems.

UBS has revised its forecasts, expecting global demand for HBM to reach 17.1 billion GB in 2025 and rise to 27.2 billion GB in 2026, which is higher than previous estimates. One of the key customers is expected to be NVIDIA, further strengthening Micron’s revenue growth prospects. On the other hand, UBS points out production capacity constraints. The full capacity of the new factory in Idaho will only be reached in the second half of 2027, which may limit the pace of expansion. Despite this, the market remains positive.

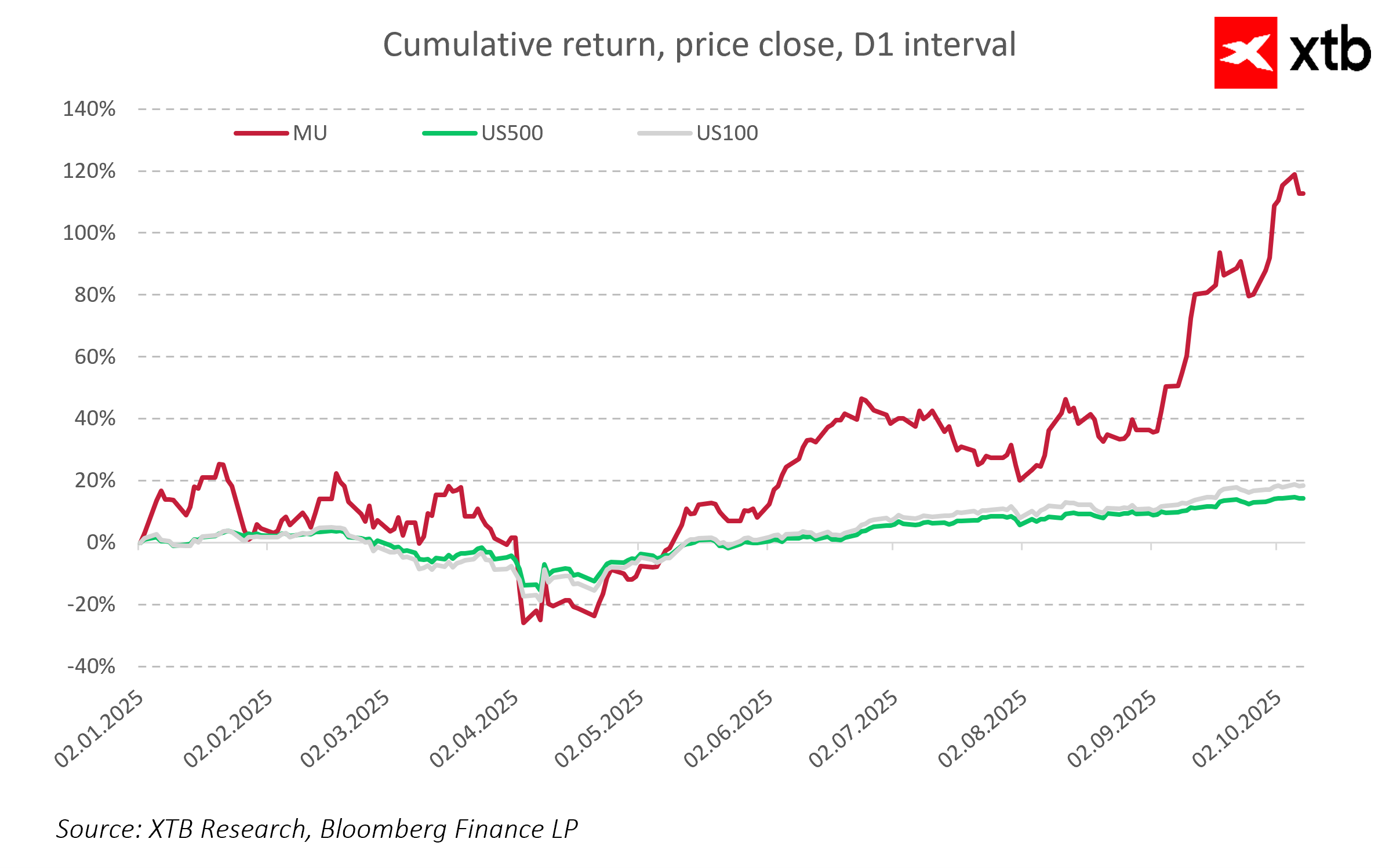

Micron’s shares are up 5 percent in today’s session and have already gained over 120 percent since january. The new valuation from UBS may act as an additional catalyst, but with such dynamic growth, it is wise to remain cautious and closely monitor whether the company can maintain its current growth pace.

Daily Summary: Euphoria on Wall Street; SILVER rebounds 10% 📱

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?