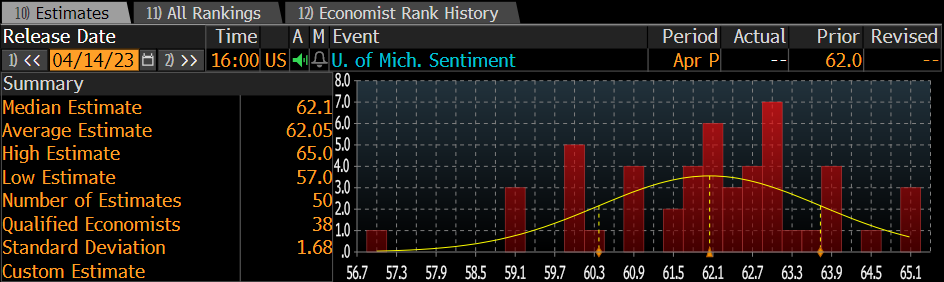

The University of Michigan consumer Index:

- Actual: 63.5 versus 62.2 forecasted and 62 previous value

- 1 year inflation outlook 4.6% versus 3.6% at the end of March

- 5 year inflation outlook 2.9%versus 2.9% at the end of March

Weakening data suggest that consumers sentiment is fading as recession expectations increase. Actual data came at 63.5 which is slightly higher than expected (62). The latest reading at the end of March was revised lower to 62 points from a preliminary 67. Investors should note that it was the first decline in sentiment in four months. Therefore, it can be assumed that households increasingly expect a recession ahead.

The one year inflation outlook - 4.6% increase may have a negative impact on the economy as consumers expect inflation to remain eleveated for an extended period of time and well above FED inflation target at 2%. The five-year gauge was unchanged at 2.9%

The University of Michigan consumer sentiment is formed on the basis of surveys conducted on a representative sample of 500 Americam households. Inflation outlook is a part of thi report.

UoM economic estimates. Source: Bloomberg

UoM economic estimates. Source: Bloomberg

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

BREAKING: US Manufacturing data above expectations! 📈🏭

BREAKING: Euro area manufacturing PMIs for February broadly confirmed a return to modest expansion