- Cameco shares surge today amid US - Westinghouse deal

- US commits to invest $80 billion on nuclear energy

- Cameco shares surge today amid US - Westinghouse deal

- US commits to invest $80 billion on nuclear energy

The Trump administration has committed more than $80 billion to purchase Westinghouse nuclear reactors. The United States could acquire an approximately 8% equity stake in the company once specific profit thresholds are met, with an initial public offering (IPO) possible if Westinghouse’s valuation exceeds $30 billion by 2029.

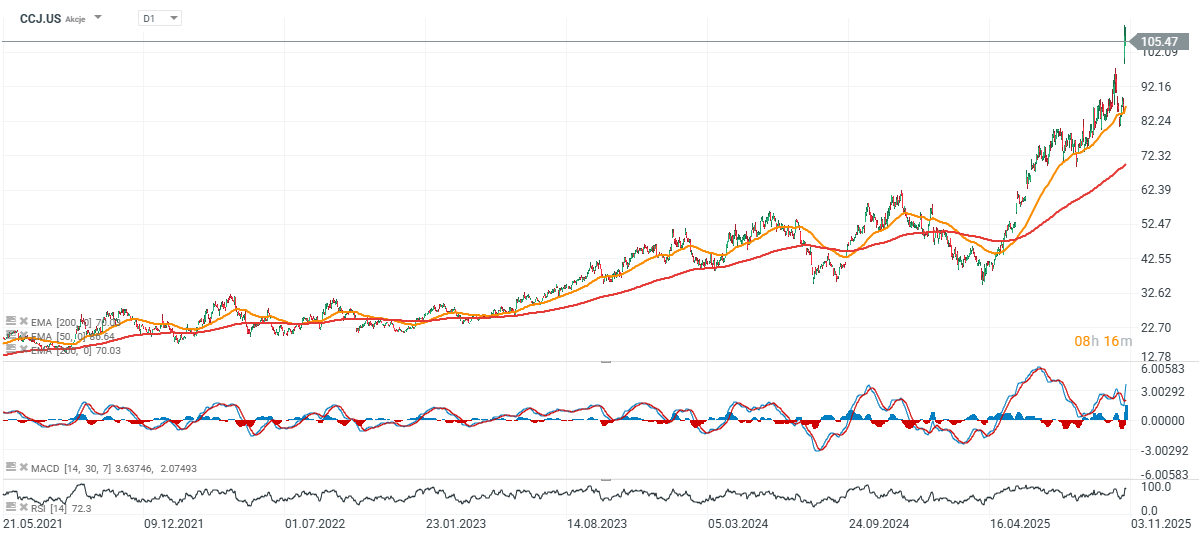

Cameco shares surged 23.4%, reaching new all-time highs, supported by its 49% ownership in Westinghouse. Meanwhile, Australian uranium stocks gained an average of 10%, led by Boss Energy, Peninsula Energy, and Alligator Energy.

The transaction adds to a wave of bullish catalysts for the nuclear sector, including Microsoft’s restart of the Three Mile Island reactor, Amazon’s $500 million investment in SMR technology, and Cameco’s 19% production cut. At the same time, operational issues at Paladin and Boss Energy highlight ongoing volatility in the uranium market.

U.S. Government Invests in the Future of Nuclear Energy

Uranium stocks rallied sharply on Wednesday following news that the Trump administration had finalized an agreement to build at least $80 billion worth of new Westinghouse nuclear reactors. The initiative is part of a broader plan to revitalize the domestic nuclear industry.

The move mirrors previous government equity investments in Intel and U.S. Steel, aimed at addressing financing bottlenecks that have stalled projects despite rising electricity demand driven by AI and data center expansion.

Under the agreement, the United States will act as the primary buyer of the new reactors, enabling project initiation and procurement of long-lead components. The investment structure could ultimately grant the U.S. government around an 8% ownership stake in Westinghouse once profitability targets are reached. An IPO is under consideration if the company’s valuation surpasses $30 billion in the coming years.

Cameco Hits Record Highs

Cameco, the world’s second-largest uranium producer, saw its shares climb more than 20%, reaching record highs. The company holds a 49% stake in Westinghouse, while the remaining 51% is owned by Brookfield Asset Management and Brookfield Renewable Partners.

The U.S.–Westinghouse deal also includes a profit-sharing arrangement for taxpayers once returns exceed $17.5 billion, as well as the possibility of an IPO if Westinghouse’s valuation exceeds $30 billion by 2029.

Following the announcement, U.S.-listed uranium stocks rose broadly — Denison Mines, Uranium Energy Corp, Ur-Energy, and Uranium Royalty Corp gained between 5% and 20% in a single session.

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records