Crude inventories in the US dropped by 3.25 million barrels in the week ended January 8th, following an 8.01 million decrease in the previous week and compared with analysts’ estimates of a 2.7 million drop, according to the EIA Petroleum Status Report.

Cushing Crude Oil inventories dropped by 1.975 million barrels, following a 0.792 million barrels increase from last week.

Gasoline inventories rose by 4.395 million barrels, following a 4.519 million increase in the prior period and above analysts’ expectations of 2.695 million barrels advance.

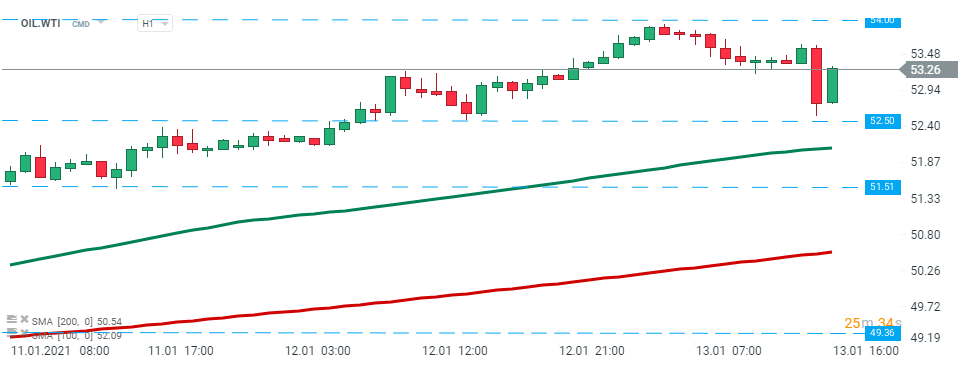

The publication of today's report did not have a significant impact on the oil prices. WTI Oil (OIL.WTI) continues to trade around the $53,00 level. Source: xStation5

The publication of today's report did not have a significant impact on the oil prices. WTI Oil (OIL.WTI) continues to trade around the $53,00 level. Source: xStation5

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Strong Service ISM Reading as activity expanded most since 2022