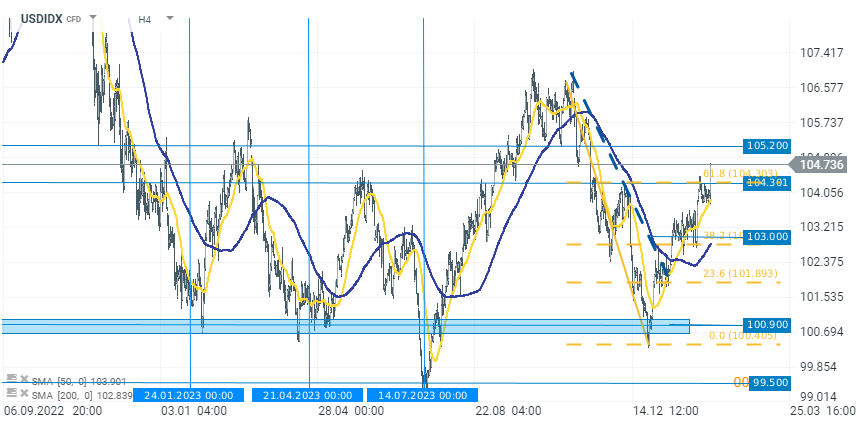

The dollar is gaining after today's CPI report and is currently the strongest currency among the G10 currencies. The Dollar Index (USDIDX) gains over 0.70% and breaks above key levels.

The high inflation reading could be a catalyst for short-term USD appreciation. However, the reaction is likely to be limited until the next labor market reports in two weeks and the next month's CPI report. Markets may also quickly shift their attention from higher inflation readings back to the stock markets, due to the upcoming Nvidia report next week, which could reignite emotions around tech companies.

Looking at the USDIDX chart, we see that the dollar has broken above the key resistance zone at the 104.300 points level. This was also the 61.8% Fibonacci retracement of the last downward move. If the current upward momentum is extended, the next level of resistance worth noting is 105.200. Otherwise, the support for bulls is the aforementioned level of 104.300 points.

Source: xStation 5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Daily summary: Red dominates on both sides of Atlantic