Summary:

-

US benchmarks firmly higher on improving sentiment

-

US trade deficit higher than expected

-

S&P500 set to retest key resistance (2946) once more

There’s been a clear push higher in global equities today with sentiment improving markedly on reports that the protests in Hong Kong could soon come to an end. European markets have rallied broadly with the German Dax back above the 12000 level and US indices are trading firmly in the green ahead of the cash open.

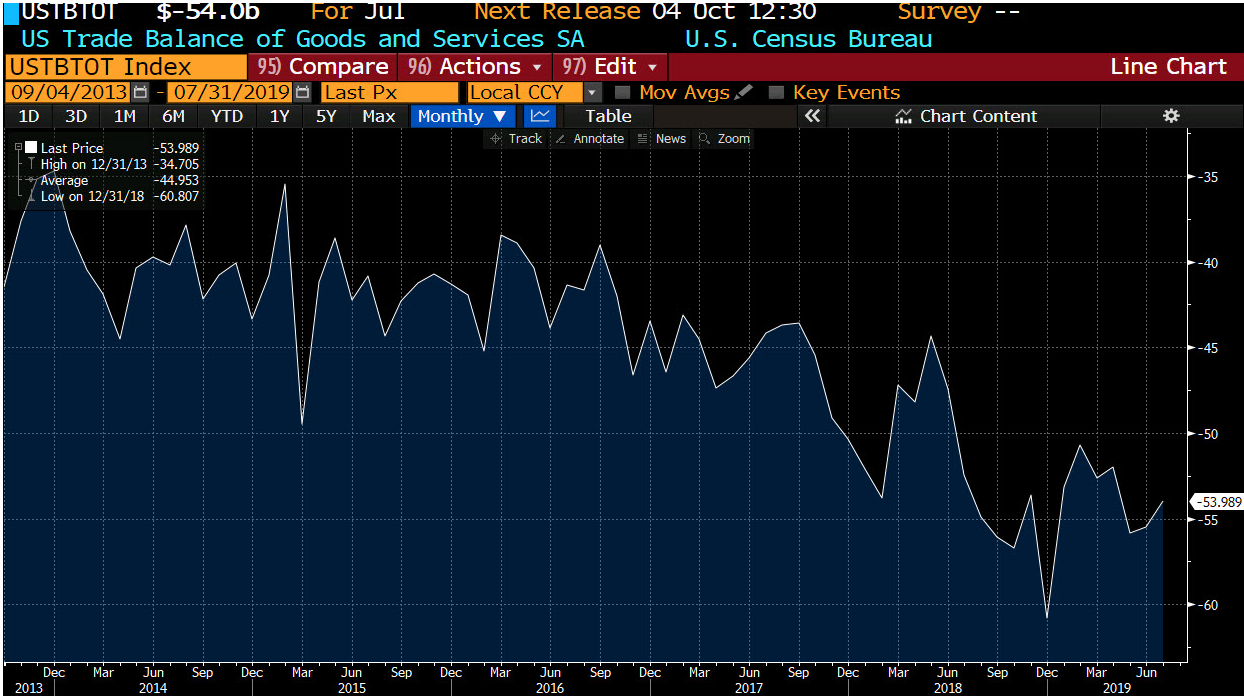

The US trade balance for July came in at $-54.0B and while this is a reduction in the deficit compared to the $-55.5B seen last time out, it is still more negative that the expected $-53.4B. The prior month was also revised lower after initially coming in at $-55.2B. Looking at the breakdown of trade, exports rose by 0.6% vs a 1.9% drop in June whereas imports fell by 0.1% compared to a -1.7% print previously.

While the US trade deficit improved in July, the improvement was less than had been hoped and the level still remains low compared to recent years. Source: Bloomberg

There’s no more major US economic releases due during the forthcoming session with Fed speak from Williams, Bullard and Evans the main things to keep an eye on. Bullard in particular could be worth watching as he has recently been outspoken, both in his criticism of the Trump administration and also in calling for larger than 25 bps rate cuts.

The S&P500 has once more moved back up near the prior resistance zone around 2946. Numerous previous attempts to break above this level have failed, but a clean move above there would end the recent consolidation phase. Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%