Summary:

-

US indices gap lower over the weekend

-

China cancels US trade talks

-

Markets pull back after solid weekly gains

The stock benchmarks in the US are all trading lower ahead of the cash open when the Wall Street bell will sound out. The US500, US100, US30 and even the small-cap US2000 are all in the red, with the markets reopening lower last night. The gaps themselves are fairly small in nature with similar lower opens also seen in European bourses such as the UK100 and DE30.

The US500 gapped lower from last week’s closing level of 2934 to reopen around 2926. As long as price remains above the 2918 then the breakout remains valid. Source: xStation

One possible cause of the decline was news that China has pulled out of scheduled trade talks with the US. While this is no doubt negative overall, it seems highly unlikely to mark a turning point for these markets as they shrugged off the trade-war escalation between the world’s two largest economies last week en route to higher prices. The US500 remains above the prior resistance of 2918 and while this is the case then the downside is limited and the breakout remains valid.

Last week saw pleasing gains for the US500 and US30 but unusually for this year the US100 and US2000 lagged behind. The former both rallied up to post all-time highs, as well as breaking the record peak for daily and weekly closes but the US100 and US2000 ended the week little changed.

The US100 ended last week little changed with a fairly large doji candle printed. The bearish engulfing candle made a couple weeks back remains in play unless a break above 7696 occurs, but it should be pointed out that prior bearish engulfing candles haven’t always marked turning points lower. Source: xStation

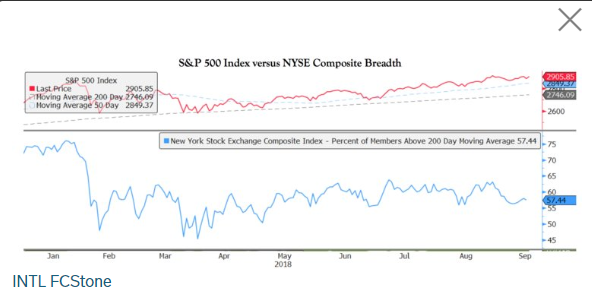

There remains plenty of skeptics to this latest rally, with it hard to find a fundamental reason to support it given the US-China trade developments. Vincent Deluard, a macro strategist at INTL FCStone has released a note that points out that record highs for stocks during periods of low breadth have historically occurred near the end of bull markets - with 200 and 2007 the most obvious.

While the S&P500 (US500 on xStation) has continued to rise to record highs the breadth - as measured by the percentage of members above their 200 day SMA - has actually fallen lower. Is this a sign that the latest gains are unsustainable? Source: INTL FCStone