- Stock indices in the USA open flat

- The dollar drops significantly at the start of the session

- Bond yields remain relatively unchanged

Today is calm in terms of both the macroeconomic calendar and other events in the financial markets. The opening of the cash session in the USA reflects low volatility in the first part of the day. At the time of publication, no major changes are observed, although gains slightly prevail. This is particularly noticeable among smaller-cap companies. The US2000 is up 0.40%, the US500 by 0.22%, and the US100 by 0.05%.

US2000

The Russell 2000 Index (US2000) had a very good July, during which the index rose from 2000 points to 2300 points. Unfortunately, investor panic and speculation about a recession caused nearly all of July's gains to be erased in August, with the index price returning to the 2000-point levels. Currently, optimism is making a comeback, supported by upcoming interest rate cuts and easing recession fears after stronger data last week. Today, the index price is rebounding to 2160 points and approaching the nearest resistance level at 2200 points.

Source: xStation 5

Company News

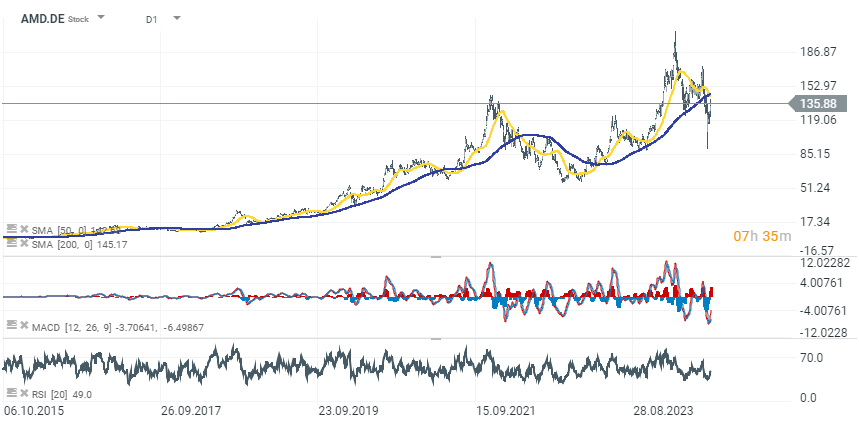

Advanced Micro Devices (AMD.US) increases by 1% following the announcement of the acquisition of AI infrastructure provider ZT Systems for approximately $4.9B. The acquisition strengthens AMD's AI and data center capabilities and is expected to positively impact financial performance by the end of 2025.

FuboTV (FUBO.US) gains 31% after a federal judge temporarily blocked the launch of a competing sports streaming service. This follows a 17% gain on Friday. FuboTV had filed a lawsuit alleging that the new service would stifle competition and harm consumers.

ZIM Integrated Shipping Services (ZIM.US gains 21% after a strong Q2 performance. The company reported an 11% year-over-year volume increase and a 40% rise in average freight rates per TEU. ZIM also raised its full-year 2024 guidance for adjusted EBITDA to $2.6B-$3B and announced a $0.93 per share dividend.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026