Volatility is limited at the end of the week. After yesterday’s declines following stronger-than-expected GDP data, today’s PCE report is calming market sentiment.

After yesterday’s release, investors feared the U.S. economy was running hotter than previously expected, which could in turn limit potential Fed rate cuts. However, emotions were tempered by today’s PCE report, which came in line with expectations. It is worth remembering that this is the Fed’s preferred indicator, favored over CPI. The month-over-month increase was higher, but not alarming. Expectations for the October meeting still point to an 85% chance of a 25 bp cut.

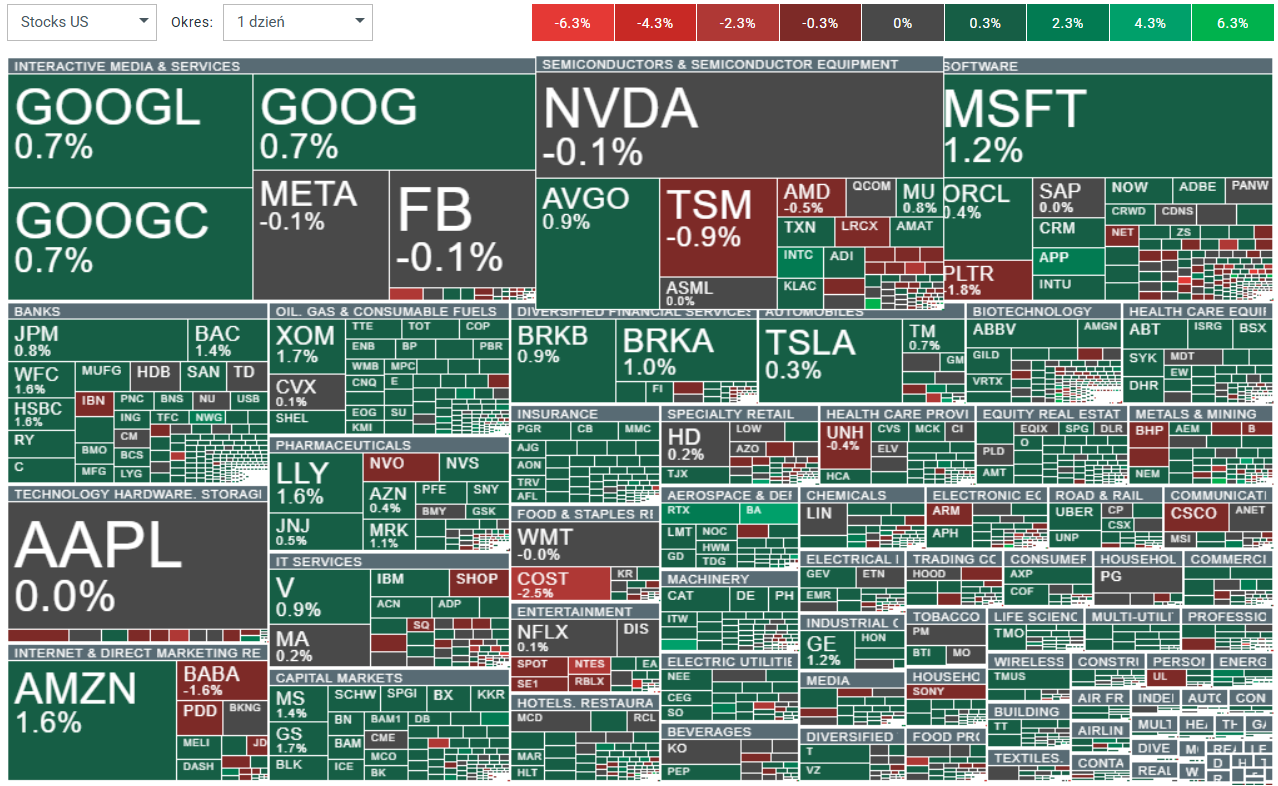

Mild gains in today’s indices are not concentrated in specific sectors. Most companies are seeing a small rebound after yesterday’s declines. Source: xStation 5

US2000 (D1)

The small-cap index is posting its first deeper correction since early August. At the same time, the current sell-off is a reaction to testing historical highs above the 2470-point level.

Stock news

-

Intel (INTC.US) +2.80% rose on WSJ report the U.S. may require a 1:1 ratio of chips made domestically vs. imported, with tariffs for shortfalls.

-

GlobalFoundries (GFS) +5.60% climbed on the same potential U.S. chip-manufacturing mandate/tariff framework.

-

Concentrix (CNXC) -10.00% plunged after a profit miss; Q4 EPS guide $2.85–$2.96 vs. $3.32 est., EBITDA margin -180 bps Y/Y, and full-year EPS $11.11–$11.23 below $11.69 consensus.

-

Meta (META.US) said it will launch ad-free Facebook/Instagram in the U.K.: £2.99/month on web, £3.99 on iOS/Android for the first account.

-

Regeneron (REGN.US) - FDA expanded Evkeeza’s label to U.S. children aged 1–5 with HoFH (with Ultragenyx).

Daily summary: Risk assets keep sliding on US rate cut jitters (17.11.2025)

Soybean at 15-month high on USDA report and US-China trade optimism 📈 🫛

Quantum Computing after Earnings: Quantum Breakthough?

Chart of the day: USDJPY (17.11.2025)