- Wall Street indices open lower

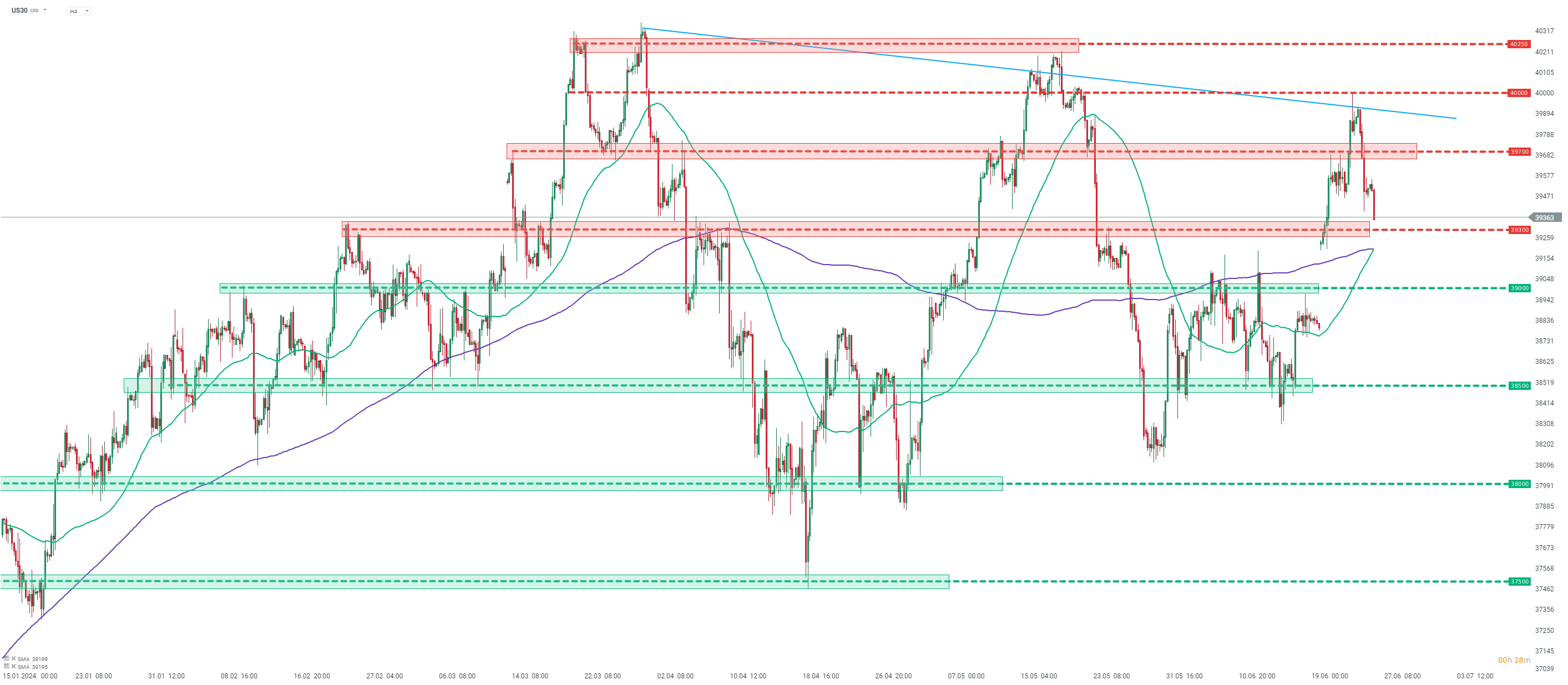

- US30 looks towards 39,300 pts support zone

- FedEx rallies over 10% after fiscal-Q4 earnings

- Rivian surges 30% on Volkswagen partnership

- General Mills drops 5% after fiscal-Q1 results

Wall Street indices launched today's trading slightly lower, following a rather downbeat trading during the first half of a European cash session. S&P 500 opened 0.2% lower, Dow Jones and Nasdaq dropped 0.1%, small-cap Russell 2000 slumped 0.8% at session launch.

Economic calendar for today's US trading session is almost empty. Traders will be offered US new home sales report for May at 3:00 pm BST, followed by DOE report on US oil inventories at 3:30 pm BST. However, neither of those two releases tends to move the markets.

Source: xStation5

Source: xStation5

Dow Jones futures (US30) are trading lower today. Taking a look at US30 chart at H4 interval, we can see that the index made a failed attempt at breaking above the short-term downward trendline and began to pullback. The first major support zone to watch should declines continue to can be found ranging around 39,300 pts mark. The 50- and 200-period moving averages can be found slightly lower and may also offer some support. However, a key near-term support is the area above 39,000 pts handle. On the other hand, should bulls regain control over the market, the 39,700 pts could be the first potential target for buyers, followed by 40,000 pts area marked with recent highs.

Company News

FedEx (FDX.US) launched today's trading session with a big bullish price gap. Company reported a 0.9% YoY increase in fiscal-Q4 2024 revenue of $22.1 billion (exp. $22.1 billion) as well as an increase in adjusted EPS from $4.94 a year ago to $5.41 now (exp. $5.34). FedEx said it expects 'low- to mid-single digit revenue growth' in fiscal-2025, as well as full-year adjusted EPS of $20.00-22.00 (exp. $20.85). FedEx said that it is in the middle of achieving its $4 billion cost reduction target. Company also intends to spend $2.5 billion in buybacks in fiscal-2025.

Rivian Automotive (RIVN.US) surges over 30% today. Company announced that it intends to set up a joint venture to create next-generation electrical architecture and best-in-class software technology. As part of the partnership, Volkswagen will invest $5 billion in Rivian, with the first $1 billion investments be paid upon receiving regulatory approvals.

General Mills (GIS.US) is trading lower after reporting 6.3% YoY drop in fiscal-Q1 net sales to $4.71 billion (exp. $4.87 billion), with organic net sales declining 6% YoY (exp. -3.3% YoY). Drop was driven by lower sales volume as were as less favourable price/mix. Adjusted gross margin declined from 35.0% a year ago to 34.9% now. Adjusted EPS came in at $1.01 (exp. $1.00). General Mills expects full-year fiscal-2025 organic net sales to by 0% to 1% higher (exp. +1.2%), adjusted operating loss of -2 to 0%, and adjusted EPS little changed compared to fiscal-2024.

Southwest Airlines (LUV.US) trades lower after company announced that it expects revenue per available seat mile to decline 4.5% year-over-year in the quartern ending June. This is deeper drop than 1.5-3.5% decline expected in previous forecast.

Analysts' actions

- Aptiv (APTV.US) downgraded to 'underweight' at Piper Sandler. Price target set at $63.00

- Robinhood Markets (HOOD.US) upgraded to 'outperform' at Wolfe. Price target set at $29.00

- Sarepta Therapeutics (SRPT.US) downgraded to 'neutral' at Citi. Price target set at $176.00

General Mills (GIS.US) launched today's trading lower, following release of a disappointment fiscal-Q1 earnings report. Stock launched today's trading below the $65 support zone, and is trading at the lowest level since March 2024. Source: xStation5

General Mills (GIS.US) launched today's trading lower, following release of a disappointment fiscal-Q1 earnings report. Stock launched today's trading below the $65 support zone, and is trading at the lowest level since March 2024. Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks