The first opening bell on Wall Street this week brings declines on the major benchmarks of the US stock market. Investors are viewing Wednesday's FOMC decision on an interest rate hike with uncertainty. Yields on 10-year U.S. bonds today momentarily broke above the 3.5% barrier, a level not seen since 2010.

The market is now pricing a 22% chance of a 100 basis point rate hike at the Fed's September meeting. Source: Bloomberg

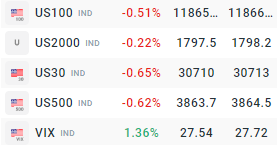

US index quotes. Source: xStation 5

Compiled charts of the US500 and VIX index on the D1 interval. The benchmark of technology companies starts today's session lower. The VIX fear index is gaining nearly 2% today. Source: xStation 5

News:

-

The apparent weakness in the cryptocurrency market earlier this week is putting pressure on listed companies in the industry. Shares of Coinbase (COIN.US) and MicroStrategy (MSTR.US) are trading down more than 5% today.

-

Adobe Systems (ADBE.US) shares were downgraded by Weels Fargo bank to an "equal weight" rating from an earlier "overweight" rating. The company's shares are trading down more than 1% today.

-

Wix (WIX.US) shares are gaining more than 4.5% early in the session after Starboard Value (an activist investor) unveiled itself with a 9% stake in the company.

-

Take-Two Interactive (TTWO.US) shares are losing more than 6% today following leaked footage of the upcoming Grand Theft Auto VI game.

News from US companies. Source: Bloomberg

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

CHN.cash under pressure despite positive Trump remarks 🚩

Wall Street optimism tempers amid falling odds of December Fed rate cut

DE40: Decline of sentiment in Europe