Wall Street indices dropped to 1-month lows as banking concerns returned to the markets following Q1 2023 earnings release from First Republic Bank (FRC.US). Bank acknowledged that it has suffered from an intense $100 billion deposit flight during the SVB-induced turmoil and has been close to collapse. What made things worse and more worrisome was management's refusal to take and answer analysts' questions during an earnings call. Shares of First Republic Bank are trading over 40% lower on the day as worrying media reports on the company continue to mount. It was reported that First Republic Bank may have to sell assets worth up to $100 billion in order to repay emergency loans. Rating agencies warned any strategic options for the bank would most likely be challenging and costly to investors. To sum up, there seems to be a real risk of the third US bank collapsing in 2023!

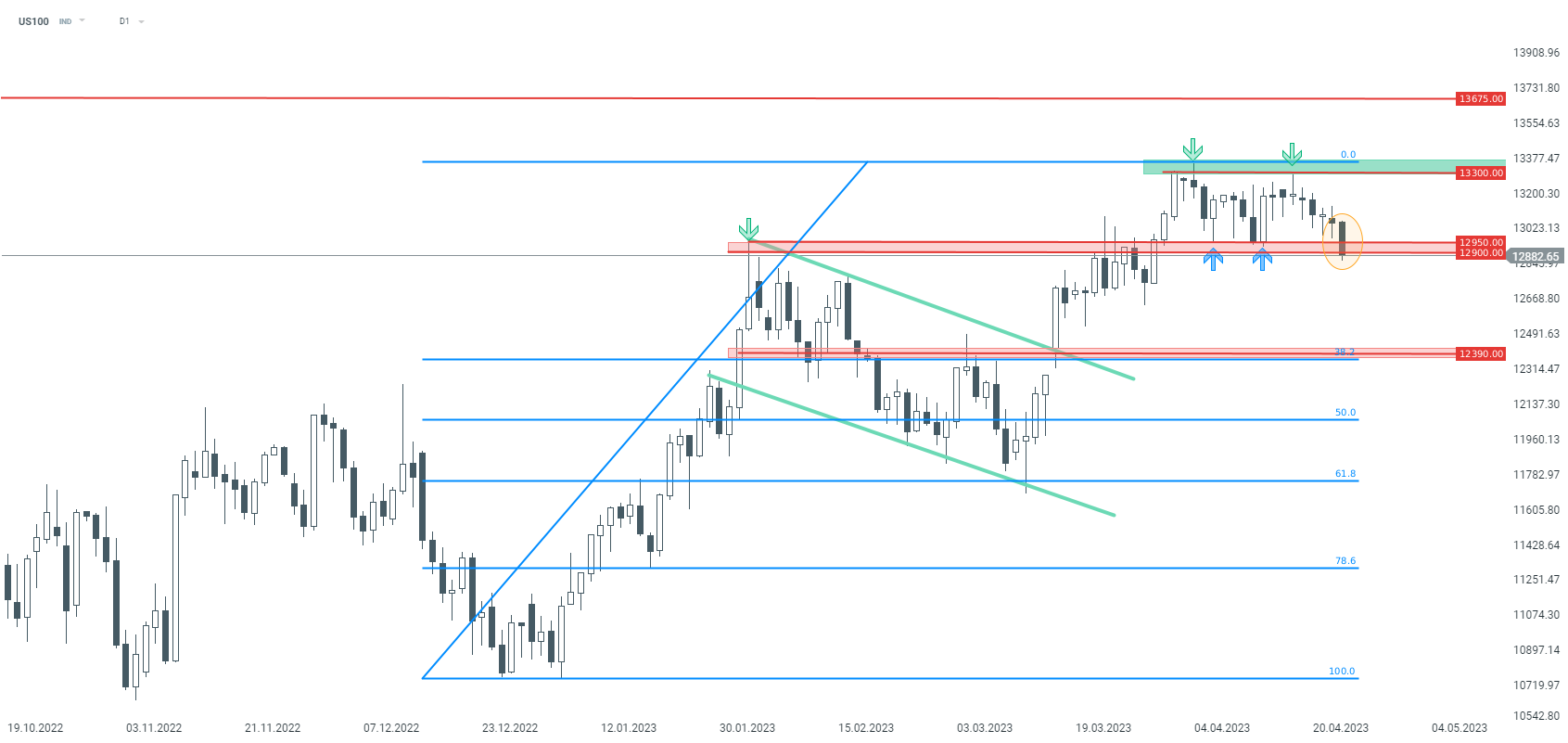

Taking a technical look at US100 at D1 interval, we can see that the index has been trading in a range recently with 12,900 pts support serving as lower limit and 13,300 pts resistance as the upper. Should we see a break below the lower limit, the sell-off may deepen and potentially extend towards the next major support in the 12,390 pts area, marked with previous price reactions and 38.2% retracement. On the other hand, should bulls regain strength and defend 12,900 pts area, a recovery move towards the upper limit of the range at 13,300 pts may be on the cards.

US100 at D1 interval. Source: xStation5

US100 at D1 interval. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report