The US100 is poised to recover recent losses, fueled by Nvidia's 2.6% premarket surge following CEO Jensen Huang's ambitious AI technology announcements at CES 2024. The chipmaker's latest innovations in gaming, robotics, and personal computing are reinforcing its dominant position in the AI ecosystem.

Key Market Moves:

-

Nvidia trading at $153.4 premarket, extending 2024 momentum

-

US100 futures erases premarket decline

-

Heavy trading volume expected as investors digest CES announcements

-

Market sentiment boosted by Microsoft's $80B AI infrastructure commitment

Groundbreaking AI Developments

Nvidia unveiled several major initiatives at CES, including Project Digits, a $3,000 personal AI supercomputer powered by the new GB10 Grace Blackwell Superchip. The desktop system, launching in May, promises to democratize AI development by bringing data center-grade computing power to individual developers and researchers.

Strategic Partnerships Expand

The company announced significant partnerships in the automotive sector, with Toyota adopting Nvidia's DRIVE AGX Orin chips and DriveOS operating system for its next-generation vehicles. Additional collaborations with Continental and Aurora aim to bring autonomous trucks to roads by 2027, targeting what Huang describes as "the first multi-trillion-dollar robotics industry."

Analyst Reception

Wall Street firms remain overwhelmingly bullish on Nvidia's prospects:

-

Stifel maintains Buy rating with $180 price target, highlighting "multi-billion dollar advancements"

-

Wedbush emerges "even more bullish" after CES announcements

-

KeyBanc Capital Markets (overweight, $180 PT) emphasizes Blackwell chip production progress

Looking Ahead

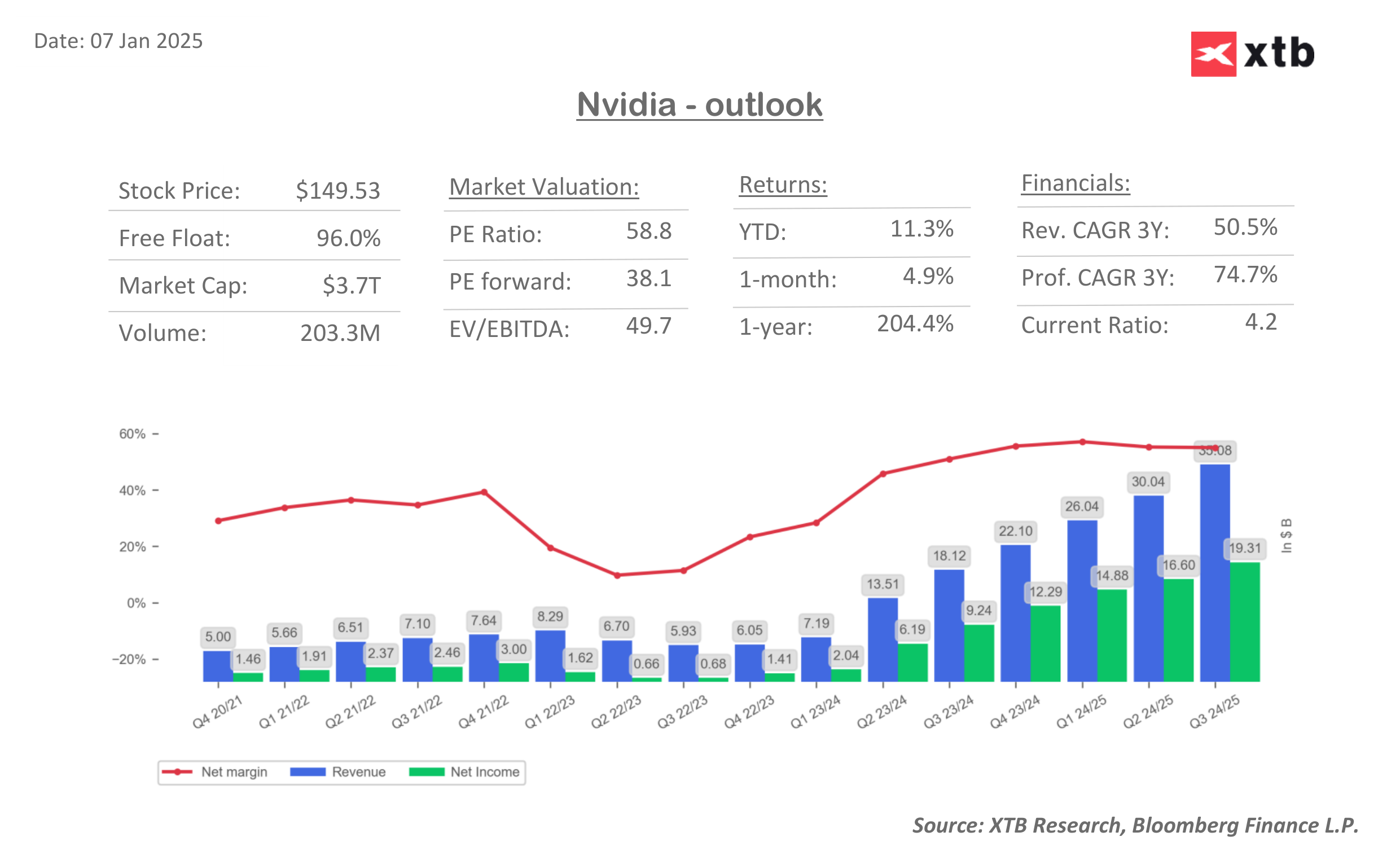

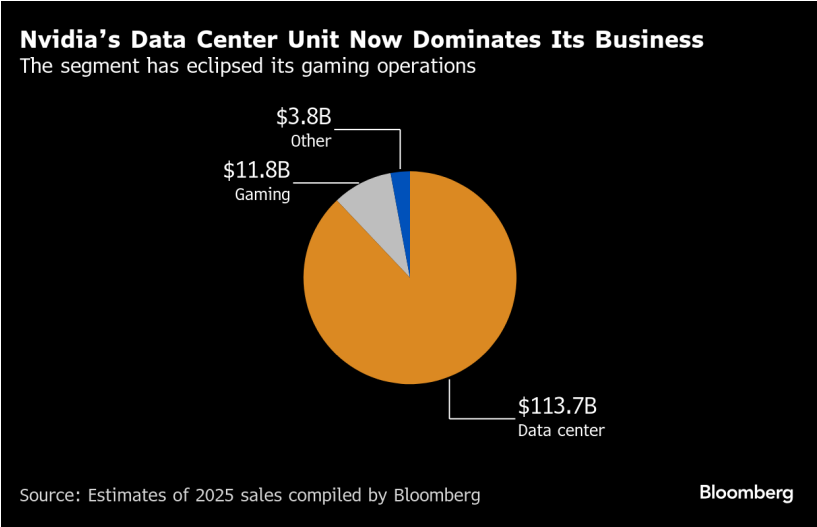

The focus now shifts to whether Nvidia's latest innovations can maintain the company's remarkable growth trajectory, with its stock up 204% over the past 12 months. The expansion into robotics, autonomous vehicles, and personal AI computing suggests multiple new revenue streams beyond its core data center business, which currently generates the bulk of its $35.1 billion annual revenue.

2025 Sales Estimates. Source: Bloomberg

Investors are particularly watching for details about the next-generation Blackwell platform, expected to be fully unveiled at Nvidia's GTC conference in March, which could provide another catalyst for both the stock and broader tech sector.

US100 (D1 Interval)

The Nasdaq-100 index, represented by the US100 contract, is trading above the early December high of 21,668. This level serves as support for bulls and coincides with 23.6% Fibonacci retracement level.

For bears, key downside targets include the 38.2% Fibonacci retracement level, followed by the mid-November high at 21,255 and 50-day SMA at 21,179.

The RSI is started bullish divergence from key support level that has historically acted as a retracement zone, potentially signaling a pause or reversal in the current trend. Meanwhile, the MACD continues to narrow with potential bullish crossover. Source: xStation

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war