- US stock market sentiments are mixed today; US500 and US100 fluctuate around all-time highs

- US CPI in line with expectations; Fed Logan sees a cautious rate cuts in the future; actual Fed Fund Rate one step closer to neutral

- Fed Kashkarki sees a softer labour market conditions with Fed in a good position to support growth if needed

- 10-year treasury yields 'sticky' at 4.43% today; US dollar gains; Bitcoin-related stocks Coinbase and Microstrategy little changed despite Bitcoin surge above $92k

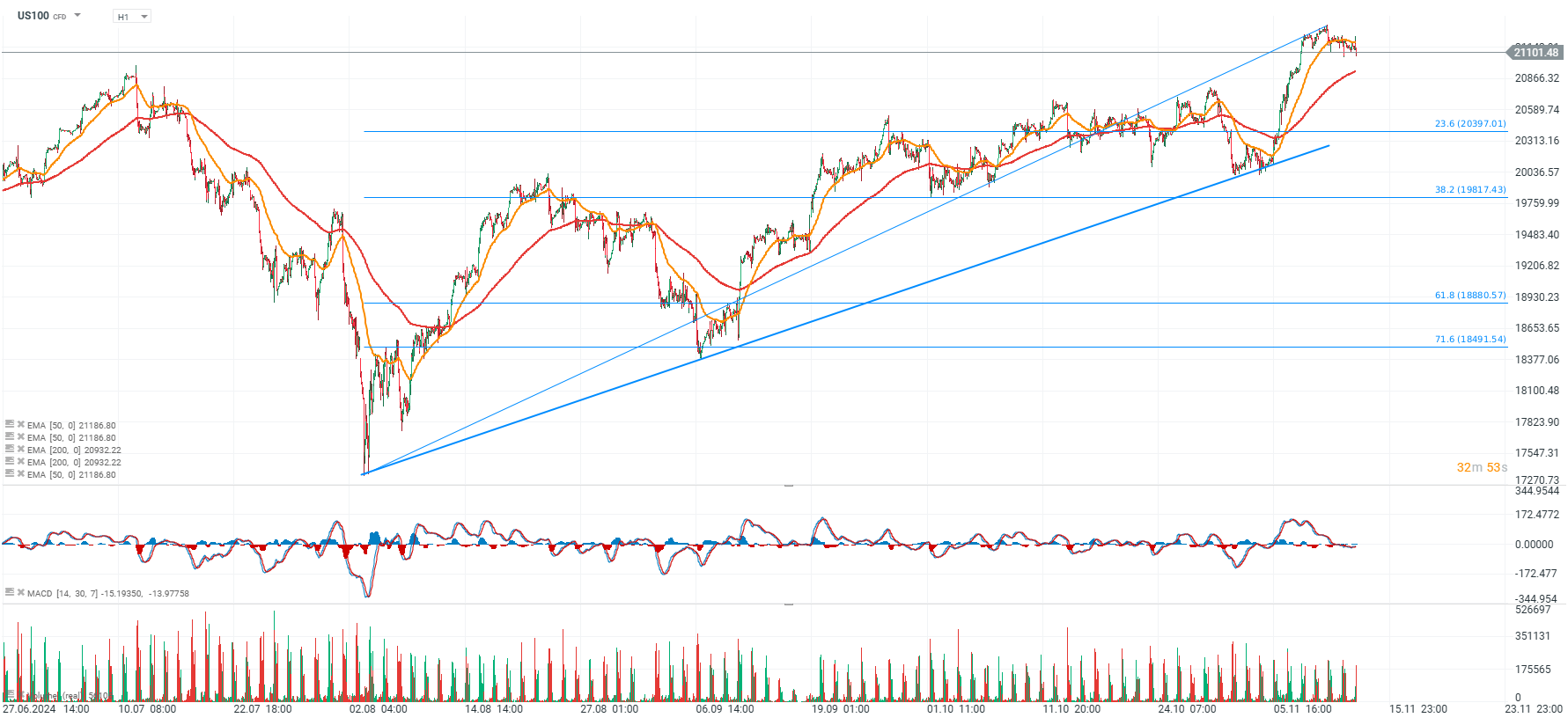

US100 (D1 interval)

Source: xStation5

Source: xStation5

Overall sentiments on US stock market session today are mixed. Source: xStation5

US stock market news

- Amgen (AMGN.US) rises 4% after the drugmaker says its phase 1 study results on MariTide don’t suggest bone safety concern and don’t change its conviction.

- Coty (COTY.US) declines 2% after the beauty company was downgraded to hold from buy at TD Cowen, which noted limited near-term catalysts.

- CyberArk Software (CYBR.US) is up 7%, after the security software company reported third-quarter results that beat expectations and raised its full-year forecast.

- MARA Holdings (MARA.US) slips 4% after the Bitcoin mining company reported third-quarter revenue that missed expectations.

- Spire Global (SPIR.US) soars 27% after the space-based data and analytics company agreed to a sell its maritime business to Kpler for about $241 million. We can see also soaring today shares of Momentus (MTUS.US) and RocketLab (RKLAB.US)

- Cava Group (CAVA.US) jumps 17% after the Mediterranean restaurant chain increased its annual projections for comparable sales.

- The biggest US-based lithium miner and EV supplier, Albemarle (ALB.US) surges 7%, continuing the rebound as big lithium miner Liontown plans production cuts, potentially benefiting

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war