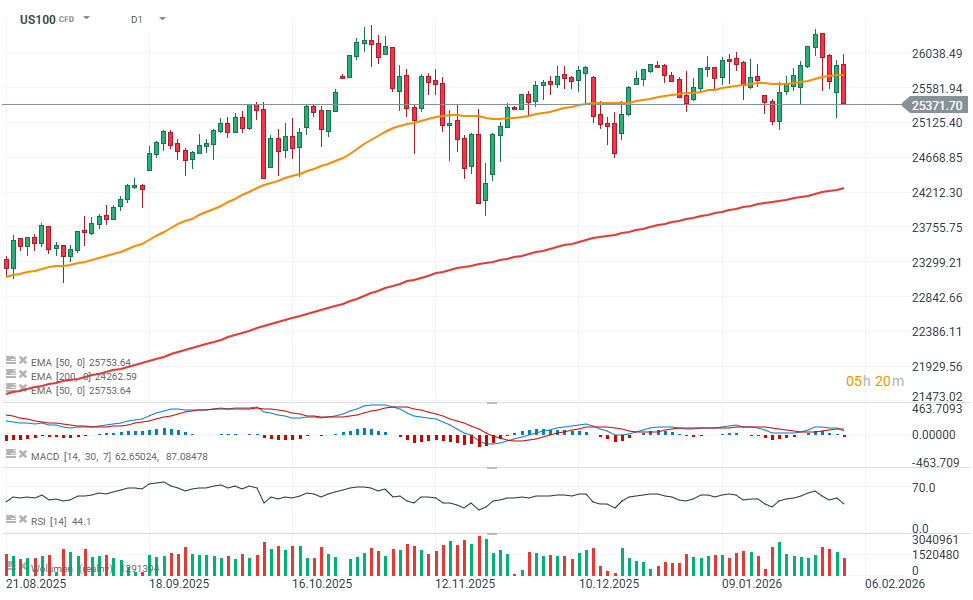

U.S. technology stocks are having a very weak session today, with Nasdaq 100 futures (US100) sliding to around 25,370 points, down nearly 2% on the day. The drop is being driven mainly by an accelerating sell-off across the tech sector, where Nvidia and Microsoft are both down more than 3%. However, today not only BigTech stocks are bleeding, but broader IT & Software stocks are seeing 'systematic selling' with potentially institutions realizing profits or exiting big trades. The downside impulse was further amplified by reports that an Iranian Shahed drone was shot down by an F-35 fighter near the USS Abraham Lincoln carrier strike group. The prospect of higher oil prices could undermine market hopes for Fed rate cuts later this year.

Source: xStation5

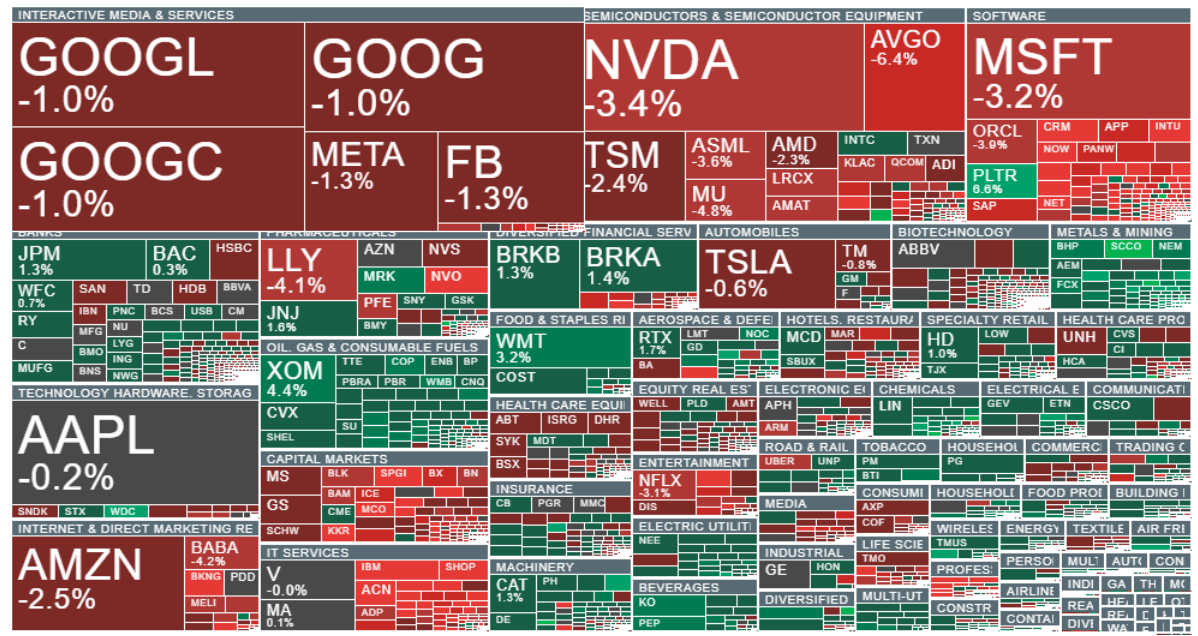

Broadcom shares are down more than 6%, while major software names are also taking heavy losses, including Intuit, ServiceNow, Salesforce, and NetApp. The sharp declines across IT have ultimately spilled over into semiconductors and memory suppliers, with Micron falling nearly 5%. Eli Lilly and Novo Nordisk are also down more than 4%. In contrast, stocks tied to precious metals, oil and gas, as well as banks and the defense sector, are holding up notably better.

Source: xStation5

Daily summary: Semiconductors, US dollar and oil put pressure on Wall Street

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

📉US100 loses 2%

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%