The Federal Reserve delivered a second 75 basis point rate hike in a row. Decision was in-line with expectations and therefore did not result in any major move in the markets. However, volatility picked up during Powell's press conference, especially after the Fed Chair said that rate increase may have to slow down. Interestingly, this was one of few dovish mentions during the whole press conference as Powell sounded rather hawkish. A point to note is that a similar surge occurred after the meeting in June but back then it proved to be short-lived.

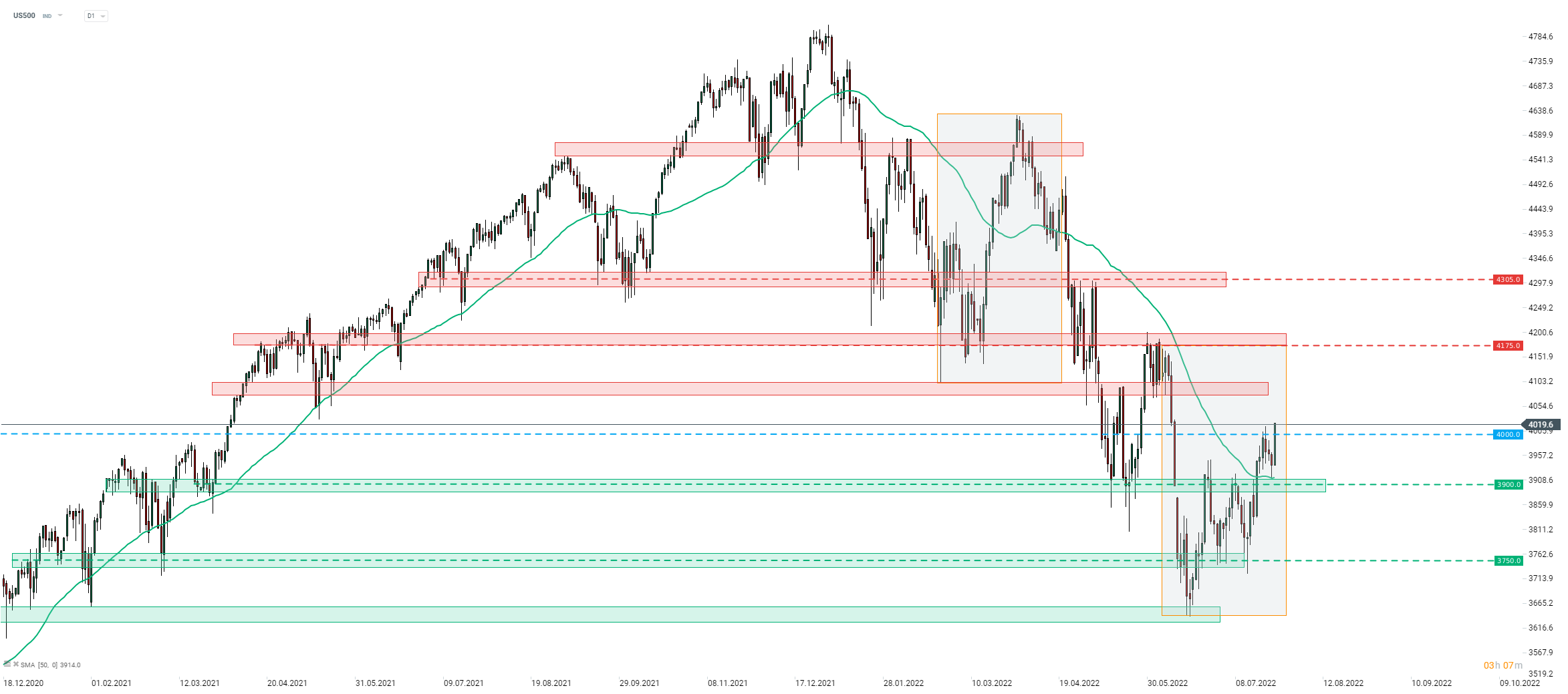

S&P 500 (US500) jumped above 4,000 pts during Powell's presser as Fed Chair hinted that pace of tightening may need to slow. Source: xStation5

S&P 500 (US500) jumped above 4,000 pts during Powell's presser as Fed Chair hinted that pace of tightening may need to slow. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%