The Fed's minutes have been interpreted as another hint towards a rate hike, although there seems to be significant disagreement among bankers. Nonetheless, since yesterday, we've been witnessing increased selling in American contracts, although today, as time passes, there is a desire to recover losses. However, this might change after the start of the Wall Street session at 3:30 PM.

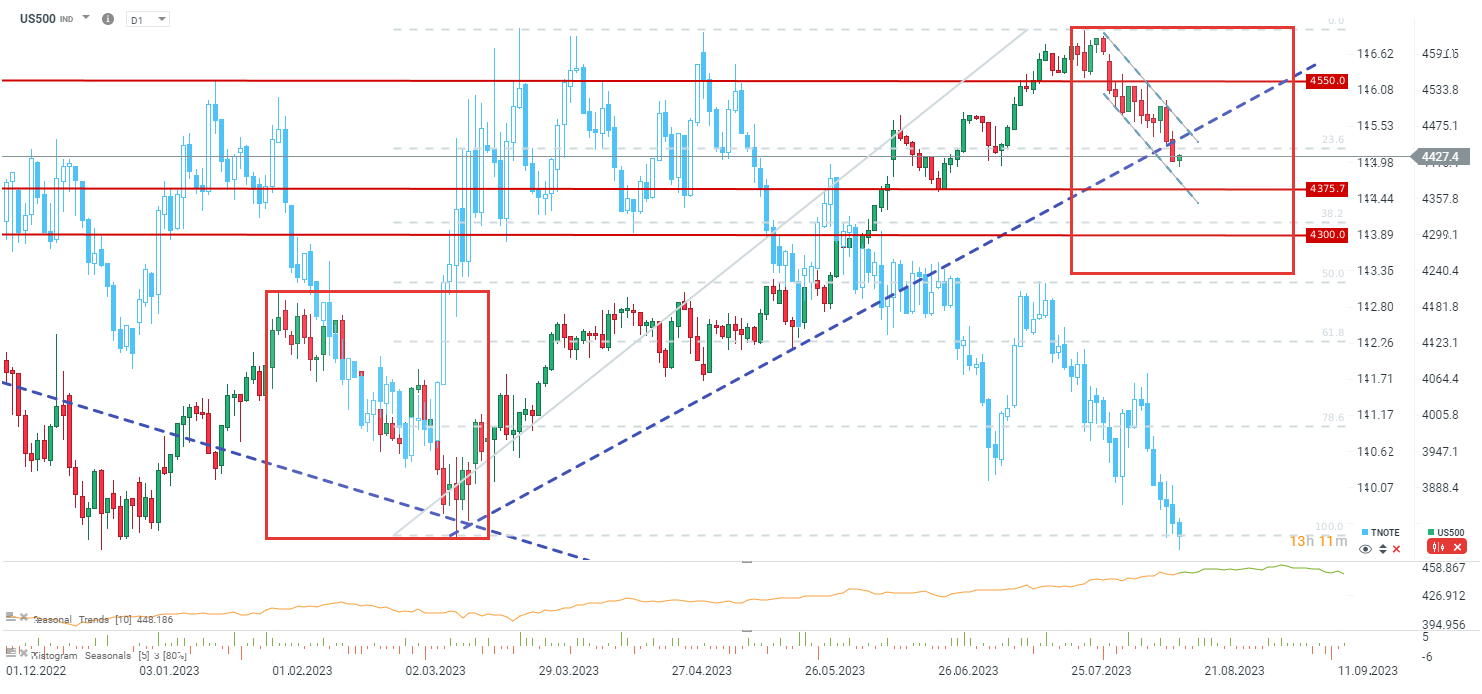

The US500 index has broken the upward trendline and is currently below the 23.6% retracement of the last upward impulse that began in March. At the same time, it's noticeable that within the current corrective decline in the upward trend, there is a sustained downward sequence within a descending trend channel. Today's revival is occurring as we approach the lows from July. Bullish problems could arise around the 23.6% retracement, potentially leading to a continuation of the downward trend towards the vicinity of 4375 points. The scope of the entire major correction in the long-term trend suggests a possible descent even to around 4200 points.

Source: xStation5

The US100 index has long surpassed the downward trendline and is currently below the 15,000 point level. Only after rising above 15,080 points could we consider a larger revival attempt. Nevertheless, the US100 is defending the range of the largest correction in the trend, where there is also the 23.6% retracement of the entire upward trend that began in autumn 2022.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report