US CPI inflation report for December is scheduled for release at 1:30 pm GMT today. Report is expected to show an uptick in the headline CPI inflation as well as a drop in the core measure. The timing of the first FOMC rate cut is still an open question, and today's reading may help investors find an answer.

What are markets expecting?

- Headline (annual). Expected: 3.2% YoY. Previous: 3.1% YoY

- Headline (monthly). Expected: 0.2% MoM. Previous: 0.1% MoM

- Core (annual). Expected: 3.8% YoY. Previous: 4.0% YoY

- Core (monthly). Expected: 0.3% MoM. Previous: 0.3% MoM

Source: Bloomberg Finance LP, XTB Research

Source: Bloomberg Finance LP, XTB Research

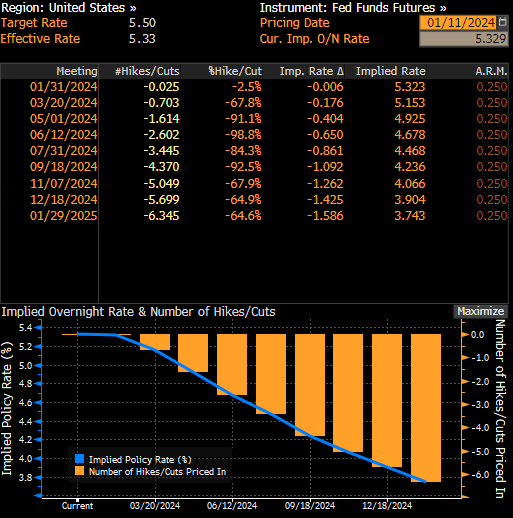

Median expectations among economists surveyed by Bloomberg and Reuters suggest a small acceleration in headline CPI from 3.1% to 3.2% YoY, while core CPI is seen slowing from 4.0% to 3.8% YoY. The drop in core inflation is expected to be driven by discounts offered during the end-of-the-year holiday season, as well as by imported disinflation from China. Currently, money markets price in an over-65% chance of FOMC delivering the first rate cut at March meeting.

Source: Bloomberg Finance LP

The first rate cut of a cycle coming in as soon as at January meeting (31 January 2024) is almost certainly out of question. Money markets see less than 5% chance of such a move. Fed members themselves have been split over whether a March cut is too soon, not to mention January. However, data from the US economy continues to be solid and the case for cutting rates as early as March is there. A dovish surprise in inflation data today may help reinforce market expectations for the first rate cut at the end of Q1 2024. This, in turn, may help revive bearish trend on the USD market as well as allow equity indices to break above late-2023 highs.

A look at the markets

US dollar has been pulling back since the beginning of November 2023 as FOMC rate cut expectations began to mount. Sell-off on the US dollar index (USDIDX) was halted at the turn of the year and the currency began to recover. However, recovery move on USDIDX lost steam after testing the upper limit of the local market geometry near the 102.15 resistance zone. A dovish surprise in inflation data today could see the index resume downward move and pullback from this area. This would support the bearish outlook and confirm that the downtrend on USDIDX is still in play.

Source: xStation5

Source: xStation5

Sentiment towards Wall Street indices improved in the second week of January 2024, with major US equity benchmarks recovering a bulk of losses made during the final week of 2023 and the first week of 2024. S&P 500 futures (US500) tested the late-2023 highs this week but bulls failed to break above, at least for now. Stock market bulls would welcome lower-than-expected CPI reading as it would boost the chance of a March rate cut and would provide more fuel for indices.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡