US dollar is losing ground ahead of October's NFP report release. Market consensus hints at 600k increase in the US employment accompanied with unemployment rate dropping from 7.9% to 7.6%. However, ADP data on Wednesday signalled a weakish 365k increase in US employment in the previous month. If confirmed by official government data today it would mark the lowest jobs gain since labour market recovery started in May. Recovery on the US labour market has been slowing in recent months and lack of new stimulus measures does not hint at reversal of this trend anytime soon.

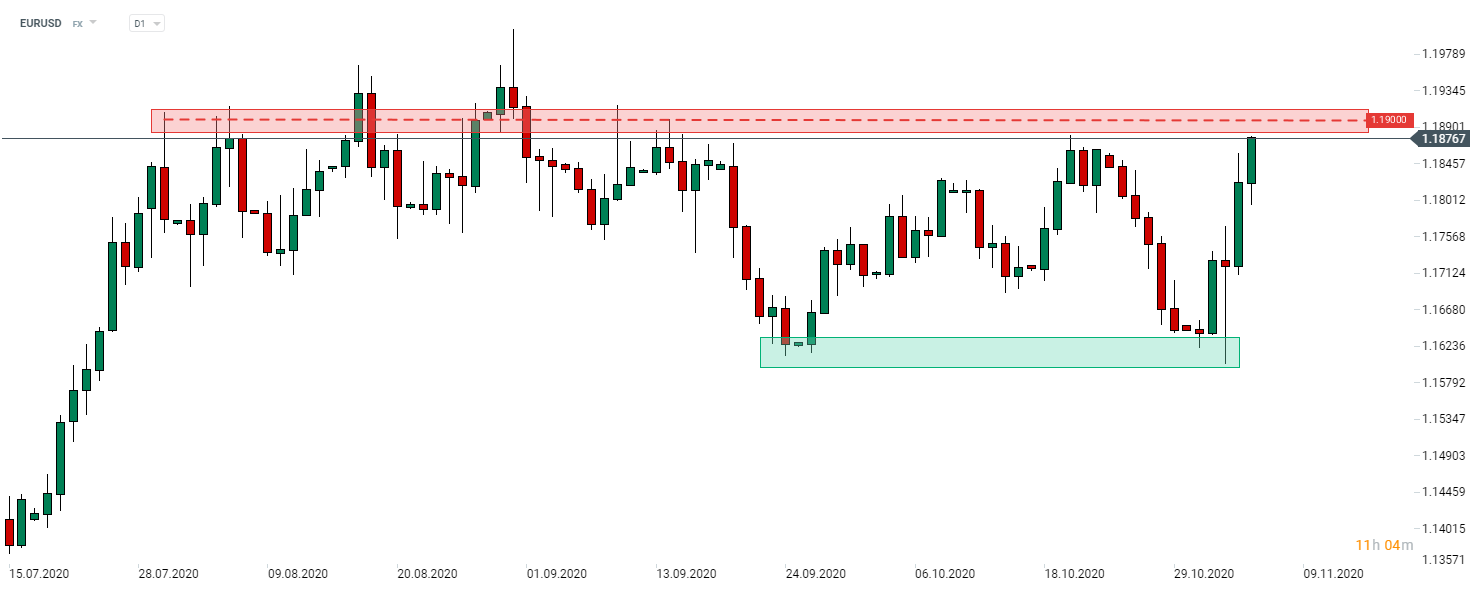

EURUSD has been steadily moving higher this week amid US election uncertainty. Main FX pair is closing in on the key resistance at 1.1900. Source: xStation5

EURUSD has been steadily moving higher this week amid US election uncertainty. Main FX pair is closing in on the key resistance at 1.1900. Source: xStation5

Three markets to watch next week (27.02.2026)

BREAKING: GDP collapse in Canada; US producer inflation accelerates🚨

Chart of the Day: EURUSD in Consolidation Ahead of Macro Data from Europe and the US

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)