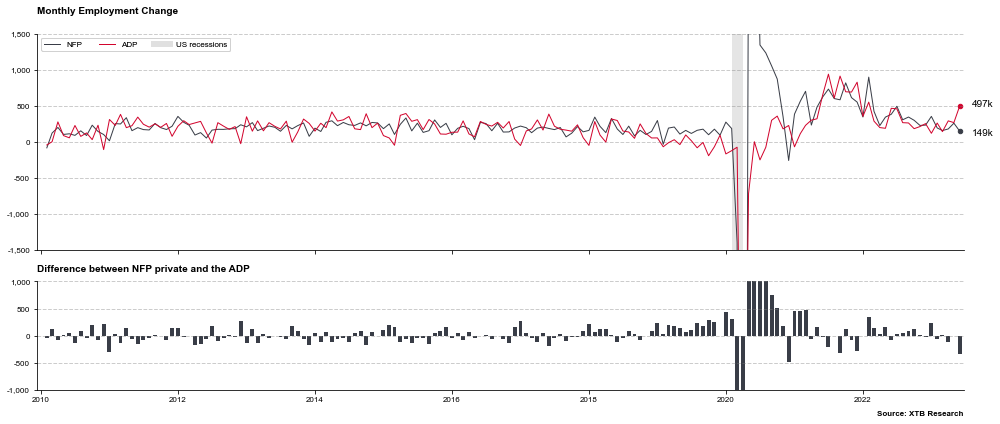

Fitch downgrading US credit rating from AAA to AA+ is the main story of the day. However, investors should not forget about more 'regular' events scheduled for today that also have a chance to move markets. A key macro report of the day is scheduled for 1:15 pm BST - ADP jobs report for July. Report is expected to show a 190k employment increase, following an almost half a million increase in June (+497k). However, it should be noted that last month's ADP reading turned out to be a poor predictor of NFP as the official jobs report showed an employment gain of just 209k (149k for private payrolls). A better-than-expected report could trigger a hawkish reaction in the markets - USD gains and equity losses. However, any reaction is likely to be short-term with investors more focused on Friday's NFP data.

There was a massive mismatch between ADP and NFP data for June. ADP showed an almost half a million increase in employment while NFP showed just 149k increase in private payrolls. Source: Bloomberg Finance L.P., XTB

US dollar and US equity index futures weakened following Fitch downgrade announcement yesterday in the evening. However, moves on the FX market have been completely erased already and now EURUSD is trading below pre-announcement levels. Meanwhile, US index futures also recovered part of losses but still trade around 0.7% below pre-announcement levels.

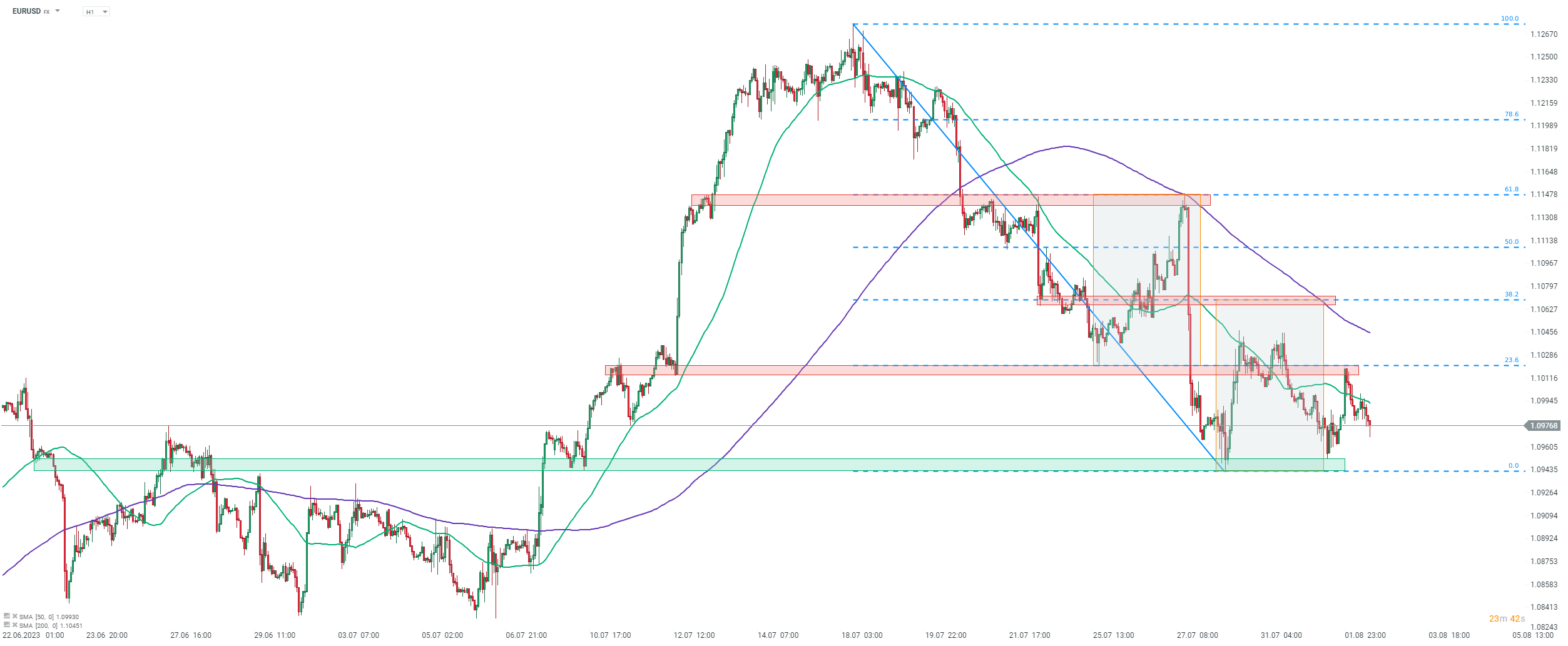

EURUSD

EURUSD jumped following Fitch downgrade and tested the 23.6% retracement of the downward move launched in mid-July. Bulls failed to break above and the pair started to pull back. Gains were fully erased later on and the pair trades at daily lows at press time. A positive ADP surprise could trigger some short-term USD bids. The near-term support to watch can be found in the 1.0950 area.

EURUSD at H1 interval. Source: xStation5

US500

S&P 500 futures (US500) gapped lower when overnight trading resumed, responding to Fitch downgrade (orange circle). While index recovered part of losses after trading was launched, another wave of selling arrived with European cash session open. Index slumped further and bulls managed to halt declines after a test of the 4,560 pts price zone, marking the lower limit of the ongoing trading range.

US500 at H1 interval. Source: xStation5

US500 at H1 interval. Source: xStation5

US OPEN: Cautious gains after GDP disappointment

BREAKING: Canada Labor market keeps deteriorating 📉

BREAKING: PCE in lane, GDP growth slows down! 🔥🚨

Market Watch: Calm European Session, Weak Industry, Easing Inflation