The US dollar is the best performing G10 currency in the early afternoon. The US dollar remains on the rise after yesterday's GDP data showed price pressures in the US economy persisting in Q1 2023. While US yields are pulling back a bit today, with the 10-year yield dropping around 5 basis points to 3.47%, the greenback continues to gain.

The upcoming PCE release for March will be the final piece of US hard data ahead of the FOMC rate decision scheduled for Wednesday, 7:00 pm BST next week. It is expected to show a slight deceleration in core PCE inflation, from 4.6% YoY in February to 4.5% YoY in March. Headline PCE data is expected to show quite significant deceleration from 5.0 to 4.1% YoY, highlighting that current pullback in inflation is still mostly driven by base effects in energy. Apart from PCE data, traders will also be offered personal spending and income data for March, with income expected to increase and spending to drop.

1:30 pm BST - US, data pack for March.

- Headline PCE. Expected: 4.1% YoY. Previous: 5.0% YoY

- Core PCE. Expected: 4.5% YoY. Previous: 4.6% YoY

- Personal Income. Expected: 0.2% MoM. Previous: 0.3% MoM

- Personal Spending. Expected: -0.1% Mom. Previous: 0.2% MoM

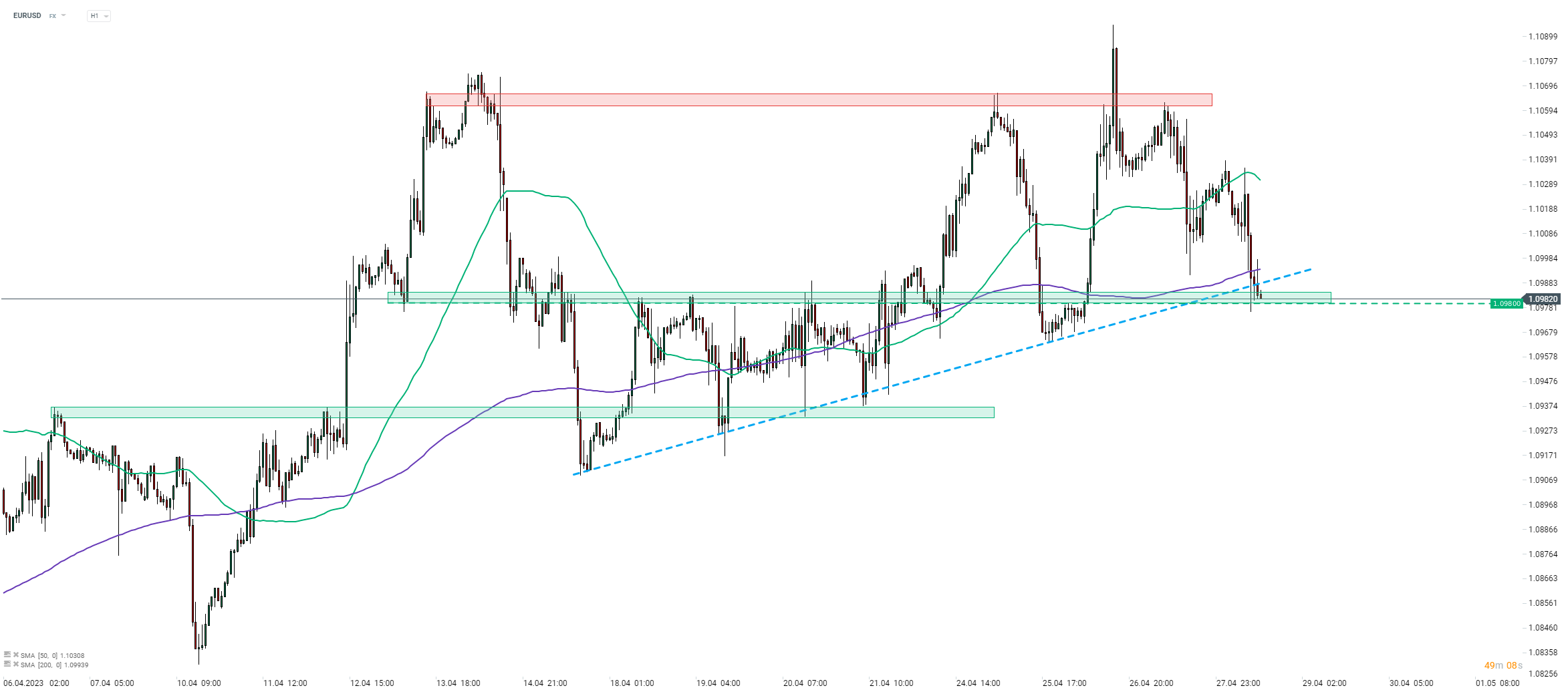

EURUSD is pulling back today as USD continues to gain and EUR underperforms after lackluster German GDP reading. Taking a look at the chart at H1 interval, we can see that the pair managed to break below 200-hour moving average (purple line) and short-term upward trendline earlier today, and is now testing swing area ranging above 1.0980 mark.

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Market Wrap: Capital Flees Europe 🇪🇺 📉