The US dollar is trading higher against most of the other major currencies in the early Tuesday afternoon. Investors are waiting for a key macro release of the day - US CPI data for March at 1:30 pm BST. A significant pick-up in the headline price growth is expected. Reading is likely to have an impact on USD and equities as overshooting expectations could intensify debate over QE tapering and normalization of the monetary policy. So far, Fed was quick to play down any increases in inflation saying they were transitory. A total of 7 speeches from Fed members will be delivered between 5:00 pm BST and 8:50 pm BST, so investors should keep in mind that central bankers may attempt to play down any concerns once again.

Market expectations

Month-over-month

-

Headline. Expected: 0.5% MoM. Previous: 0.4% MoM

-

Core. Expected: 0.2% MoM. Previous: 0.1% MoM

Year-over-year

-

Headline. Expected: 2.5% YoY. Previous: 1.7% YoY

-

Core. Expected: 1.5% YoY. Previous: 1.3% YoY

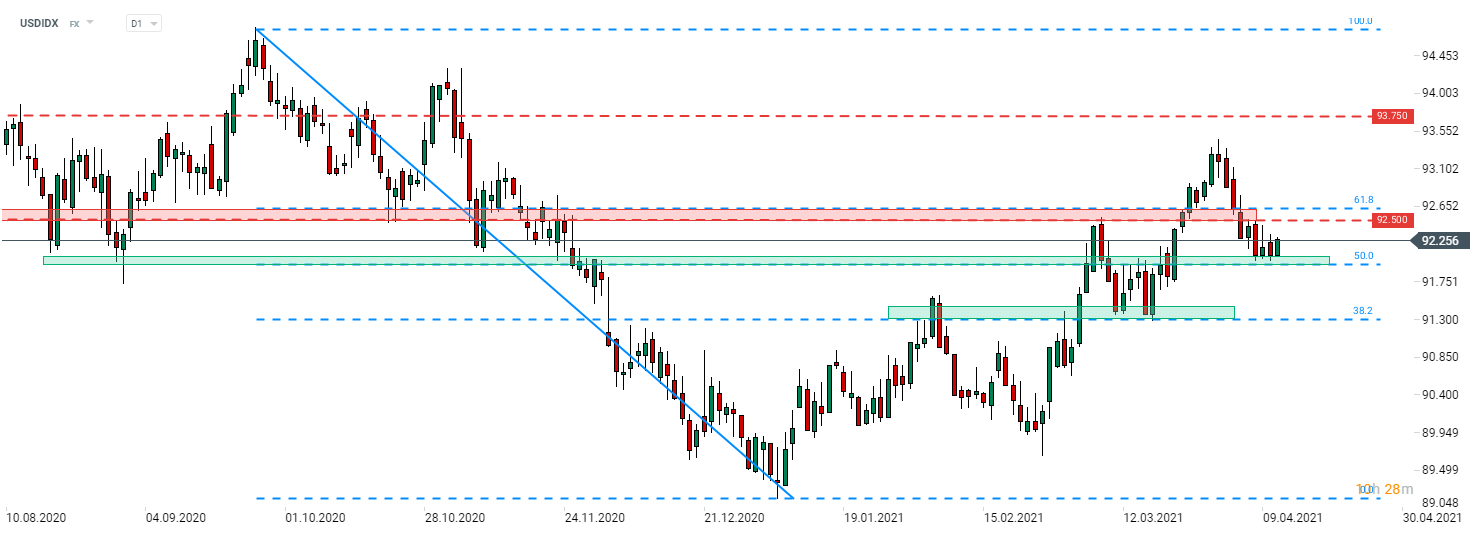

US dollar index (USDIDX) pulled back from a recent 5-month high and dropped back below the price zone marked with 61.8% retracement of the downward move launched at the end of September 2020. USDIDX found support at 50% retracement (92 area) and tries to launch a recovery move today. Source: xStation5

US dollar index (USDIDX) pulled back from a recent 5-month high and dropped back below the price zone marked with 61.8% retracement of the downward move launched at the end of September 2020. USDIDX found support at 50% retracement (92 area) and tries to launch a recovery move today. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)