Market sentiments are again weak today, despite quite strong rebound of risky assets and main sentiments benchmarks (such as EURUSD or Bitcoin) as Iran didn't respond directly to Israeli attack. As for now, Nasdaq100 (US100) loses more than 1% and EURUSD erases previous gains, but remains higher as US dollar index lost sam momentum. Austan Goolsbee, from Chicago Fed, commented that soft landing may be more difficult as persistently high inflation in housing pressures on higher Fed rates and progress on lowering inflation 'has stalled'.

Fed's Goolsbee

- The golden path is more difficult for 2024.

- If you hold at this level of restrictiveness for too long, you will have to start thinking about the impact on jobs.

- The Fed's current restrictive monetary policy is appropriate.

- Proper Fed policy going forward will depend on the data.

- Persistently high housing inflation is the main short-run problem.

- I see more space for progress on services inflation from labor supply increases.

- Not all data suggests the labor-market overheating.

- Progress on US inflation has stalled.

- It makes sense to wait to get more clarity before moving

- I don't know if recent inflation a sign of overheating.

- We will get inflation to 2% over a reasonable period of time.

- It is harder to get to 2% inflation absent housing progress.

- The policy tradeoffs are harder this year.

- We have done great on the employment mandate, but we have not succeeded on the inflation mandate.

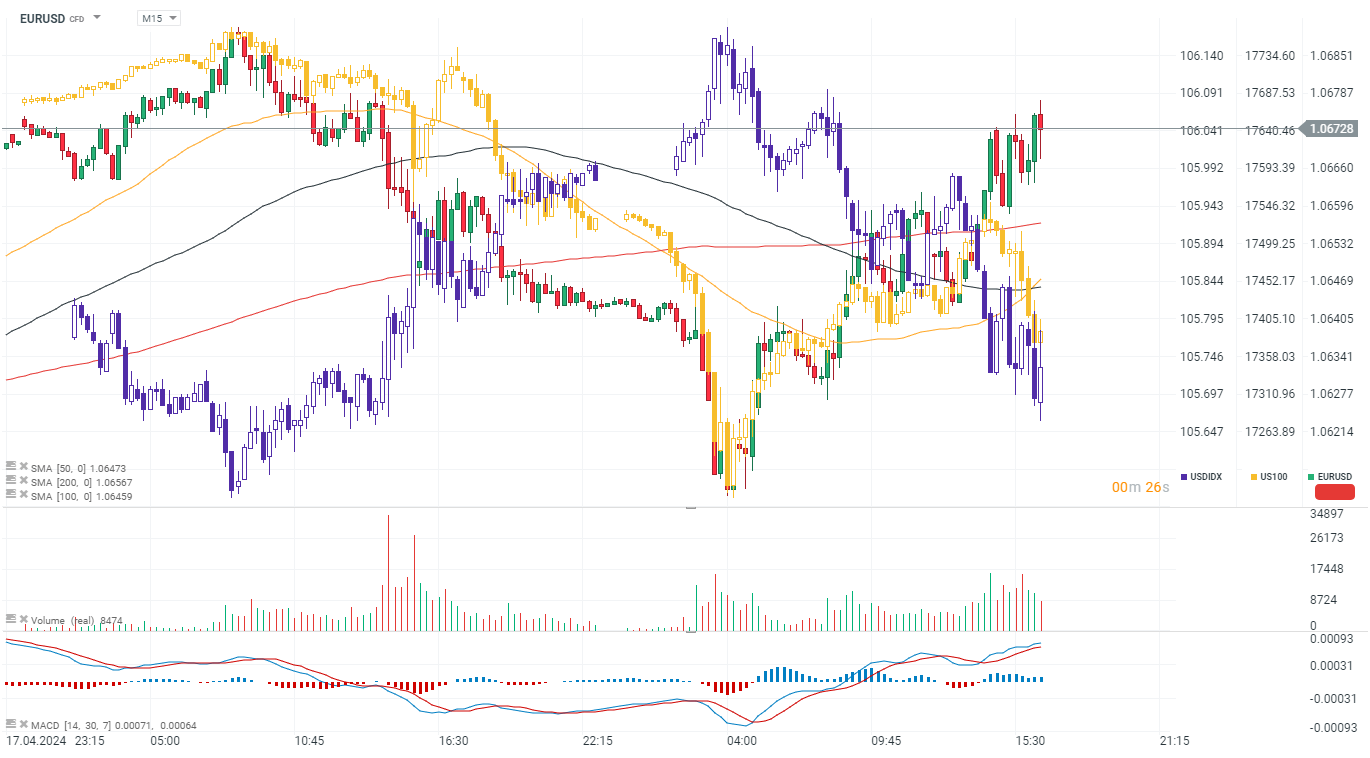

EURUSD (M15 interval)

Despite short-term rebound on Eurodollar (supported by the weakening US dollar, the purple chart) we can see that sellers activity is still high as real trading volume shows. What's important, is that also US dollar loses today with USDIDX dropping more than 0.2%. Reason for that may be in profit taking and recession concerns, as higher for longer Fed policy may indicate higher medium-term downside risks to US economy. GOLD rises 0.4% today.

Source: xStation5

Source: xStation5

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

BREAKING: EURUSD muted after stable US CPI report 🇺🇸 📌