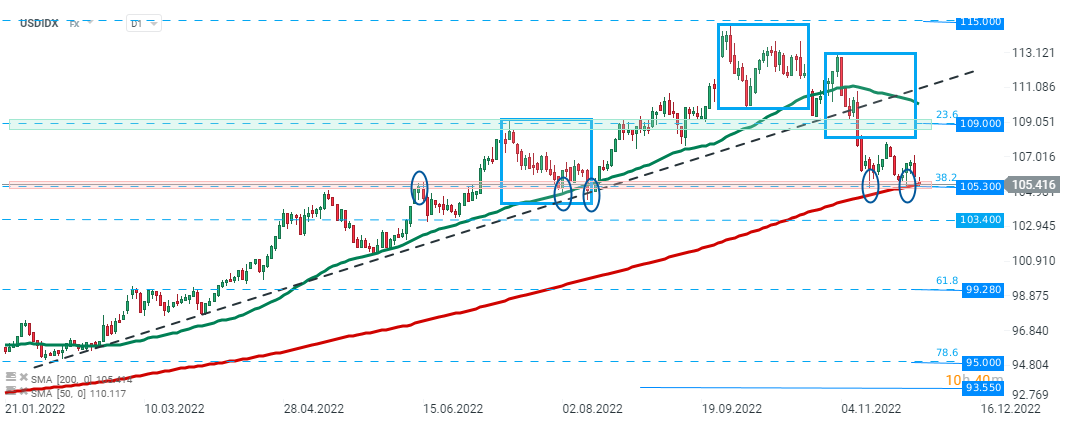

Dollar index plunged to a 15-week low of 105.30 following yesterday’s dovish comments from Powell. Fed Chair said that “slowing down at this point is a good way to balance risks,” and that the central bank could moderate the size of rate hikes as soon as December, which weakened the US dollar. Index is testing key support at 105.30 which is marked with previous price reactions, 200 SMA (red line) and 23.6% Fibonacci retracement of the upward wave launched in May 2021. Should break lower occur, local support at 103.40 may be at risk. On the other hand, if bulls will manage to halt declines, then another upward impulse towards resistance at 109.00 may be launched

USDIDX, D1 interval. Source: xStation5

USDIDX, D1 interval. Source: xStation5

Chart of the day: JP225 jumps on unexpected upward GDP revision 🇯🇵 📈 Japan is back in the game❓

Morning wrap (10.03.2026)

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster