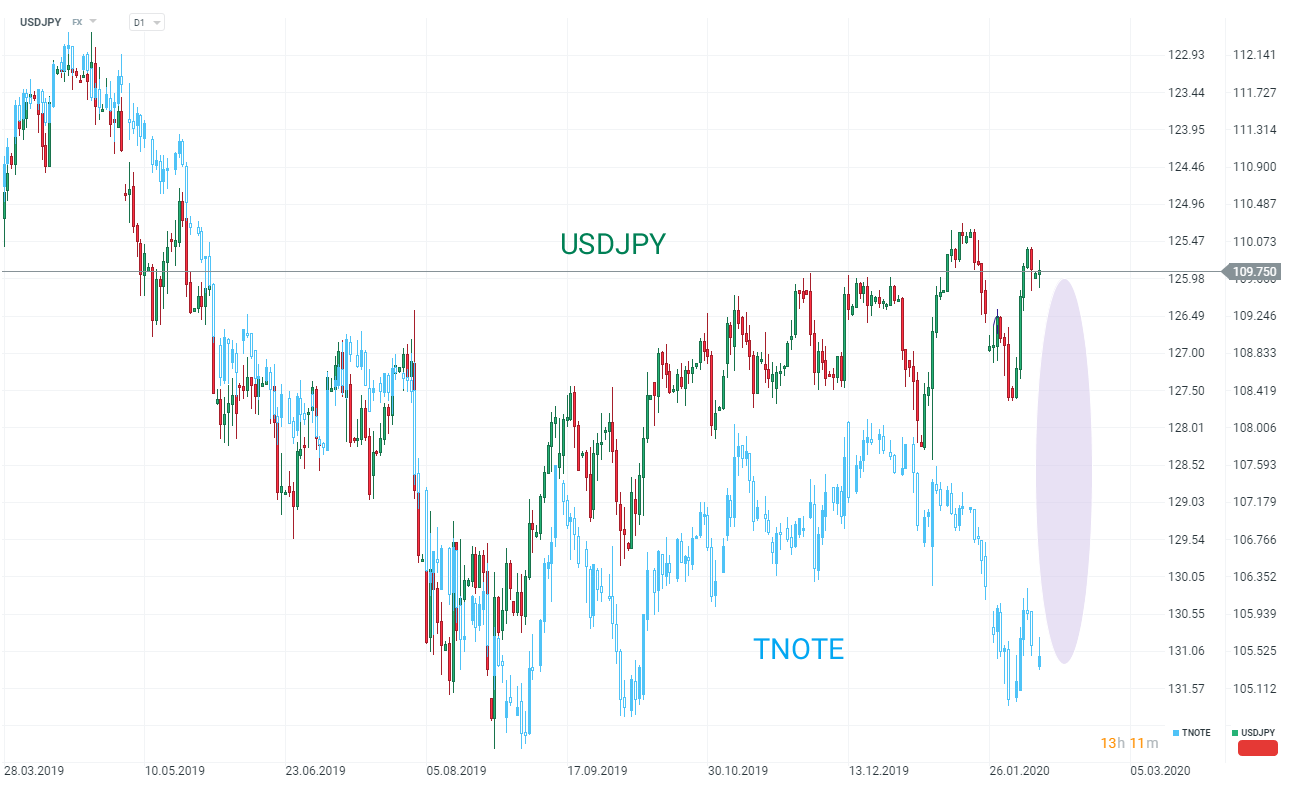

USDJPY fx pair is usually strongly correlated with the TNOTE (correlation is negative therefore TNOTE chart is reversed). We saw that throughout 2019 but this years these markets have diverged strongly. Strong TNOTE seems to reflect risk aversion and at the same time high USDJPY rate reflects sanguine moods on equity markets. One would assume that such contradicting market behaviours may not persist and these instruments could converge again. This could happen via USDJPY decline, TNOTE declines or a combination of the two.

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️