The USDJPY pair fell nearly 1.0% on Friday to the lowest levels in over three months as recent dovish comments from Fed Chair Powell weighed on dollar. Meanwhile BoJ board member Asahi Noguchi said the central bank could “pre-emptively” withdraw monetary stimulus if trend inflation exceeds the 2% for a prolonged period, but warned that it will likely take more time for wages to rise sustainably. BOJ Gov. Kuroda still believes that massive stimulus must be maintained until wages rise enough to make up for the rising cost of living. Meanwhile, a BOJ business survey pointed to rising inflationary pressures in several sectors, including those that usually are not eager to pass on higher costs to customers. From technical point of view, USDJPY broke below 200 SMA (red line) and is approaching key resistance at 133.00, which coincides with 38.2% Fibonacci retracement of the upward wave started at the beginning of 2021. A break below this level would pave a way towards next support at 127.40.

USDJPY, D1 interval. Source: xStation5

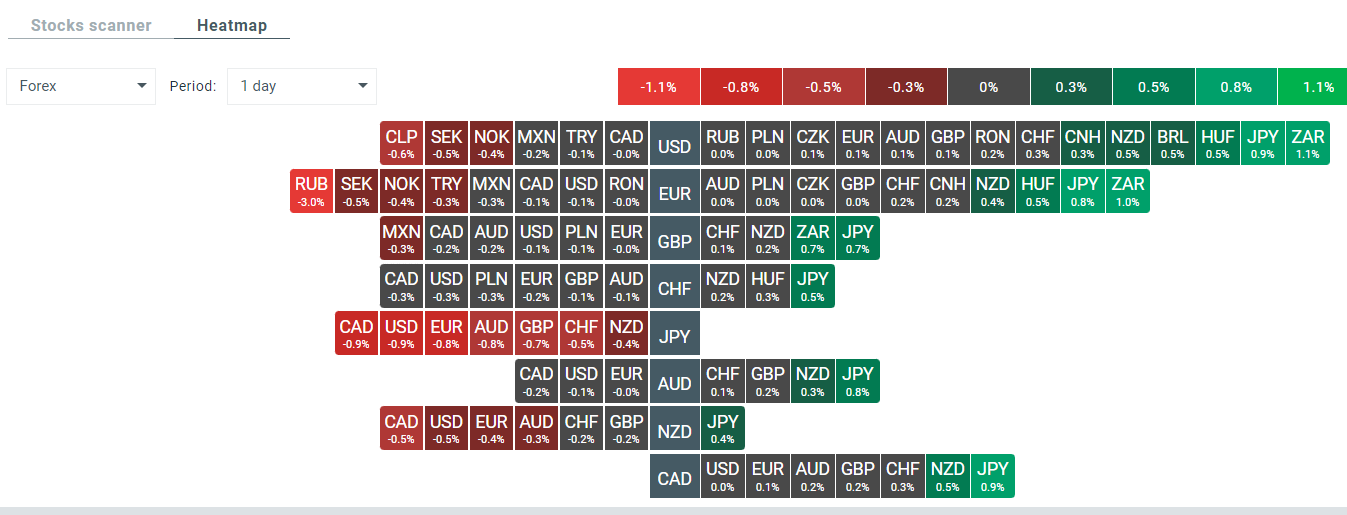

During today's session, one can observe further US dollar weakening against other major currencies. Source: xStation5

During today's session, one can observe further US dollar weakening against other major currencies. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️