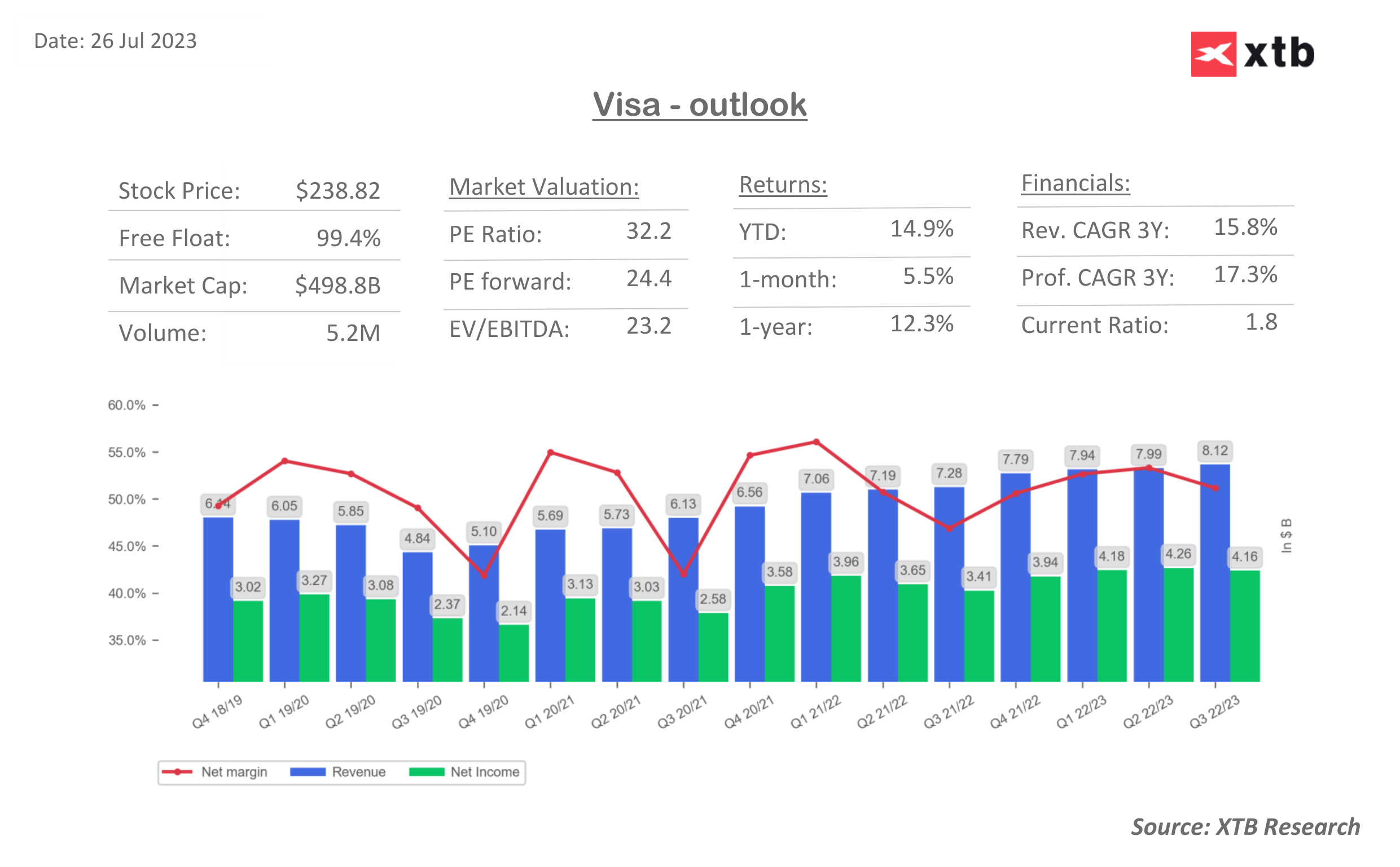

Visa Inc., the global payment processor, reported a modest increase in its fiscal Q3 2023 net income of $4.16 billion, with adjusted earnings surpassing estimates at $2.16 per share. This marks the smallest quarterly profit growth in over two years due to the ongoing impact of high inflation and rising borrowing costs. Nevertheless, the company's international transaction revenue grew by 14%, albeit short of the anticipated 18%. Visa's CFO, Vasant Prabhu, attributed the slowdown in U.S. payment volume growth since March to moderating inflation, as a decline in inflation typically impacts credit card companies, which charge a percentage on transaction values. However, despite concerns over a slowdown, the company forecasts low double-digit net revenue growth and mid-teens EPS growth for fiscal year '23.

Key financial metrics:

- Q3 2023 revenue: $8.12 billion

- Q3 2023 net income: $4.16 billion

- Adjusted EPS: $2.16

- International transaction revenue growth: 14%

- Forecasted net revenue growth for fiscal year '23: low double digits

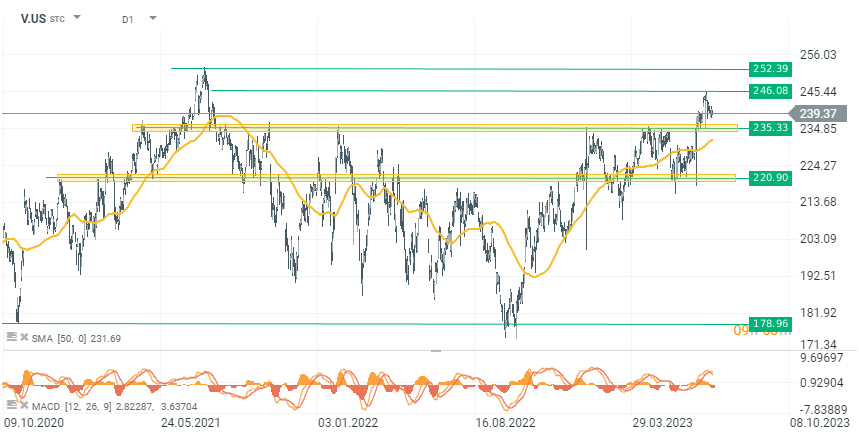

From a technical point of view, Visa shares are not far from the All-Time High (ATH) in mid-2021 at 252 dollars. However, after yesterday's quarterly release, the shares are down by 2.2%. A continuation of the declines could indicate a return to the nearest resistance zone around 230-235 dollars.

Visa (V.US), D1, source x Station 5

Visa (V.US), D1, source x Station 5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records