Summary:

-

S&P500 close to record highs ahead of the Fed

-

Solid but not spectacular ADP report

-

Apple jumps after earnings beat

Today is the day as far as the markets are concerned with the eagerly anticipated Fed rate decision due at 7PM (BST) with Chairman Powell’s press conference 30 minutes later. The markets are fully pricing in the first rate cut in over a decade, with the consensus of the belief that it will be a 25 basis point reduction. There is still a noteworthy chance according to this pricing for a 50 basis point cut, with the odds seen as around 1 in 5.

On top of this traders should also be on the lookout for suggestions of any further easing with the consensus at present feeling that another rate cut before year end would be about par for the course. Finally, any comments on the balance sheet reduction programme, or Quantitative Tightening (QT) as it’s known, could sway the balance of the message along the dovish to hawkish spectrum.

The NASDAQ remains close to its highest level on record. Dips in recent sessions have been keenly bought as shown by the wicks below the D1 candles and a break above 8050 would pave the way for another leg higher. Source: xStation

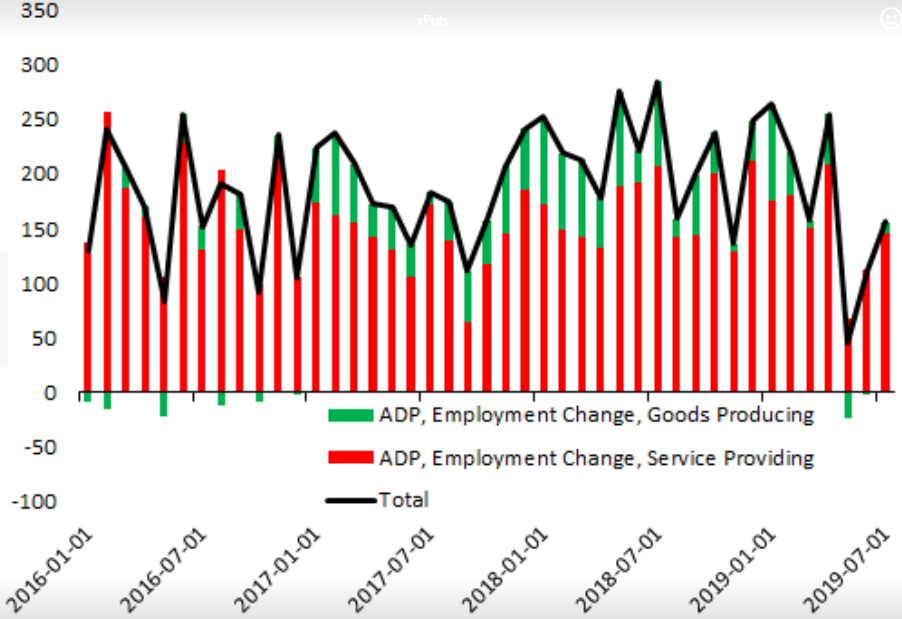

Given the focus on the Fed, it’s easy to overlook another big US event this week with Friday seeing the release of the July jobs report. While this remains very much of secondary importance to the central bank decision later, it could well still be market moving and at the least will provide further evidence as to the strength of the US labour market. The ADP release can provide an early insight into Friday’s release and if today’s number is anything to go by then a further improvement can be expected. After a disastrous print of 27k at the start of June, the next release saw an improvement to 102k before today’s data relating to July came in at 156k. What is more, the prior reading was revised up by 10k meaning that 5 of the past 6 months have seen positive revisions.

After a terrible print for May, the ADP employment index has recovered with the latest reading coming in at 156k. Source: XTB Macrobond

Apple shares to gain after earnings update

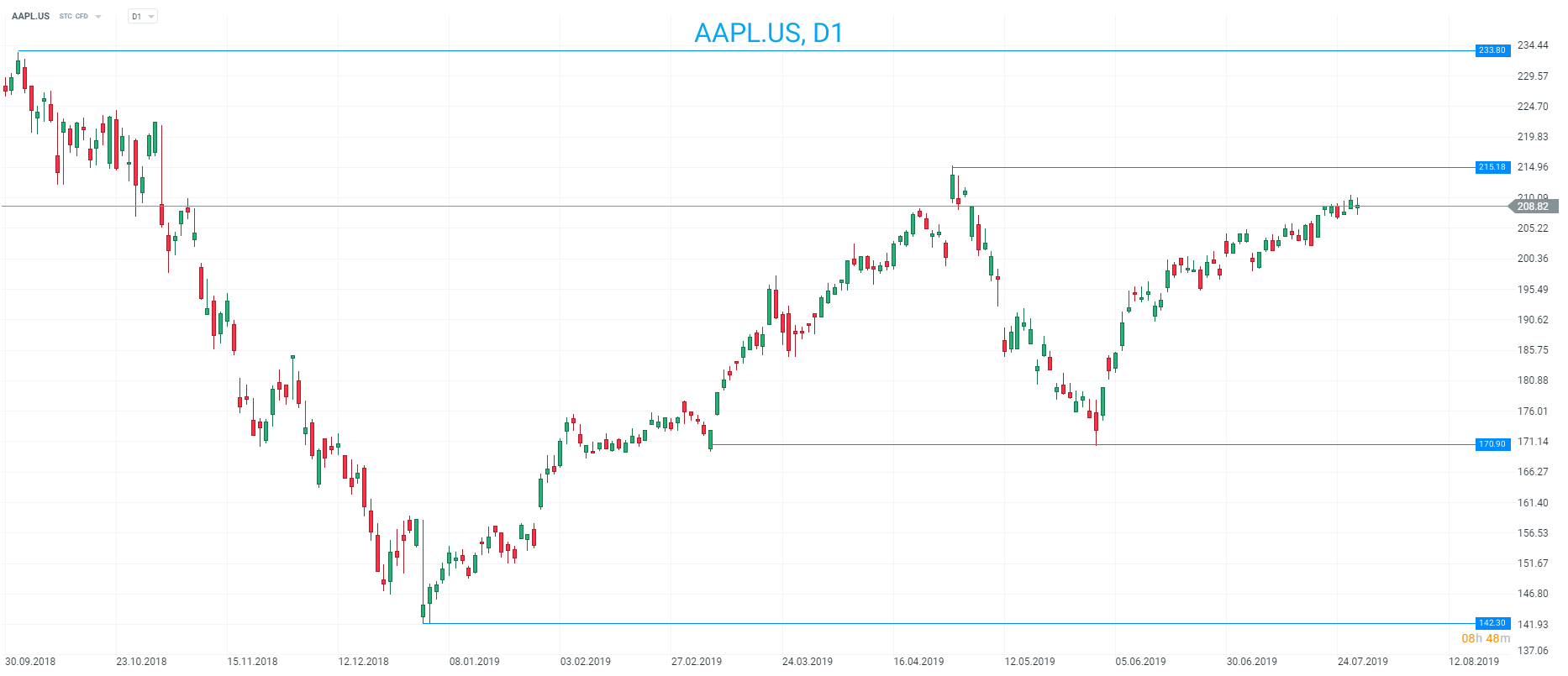

It’s set to be a good afternoon for investors in Apple, with the stock called to open higher by as much as 4% after the latest trading update was delivered last night. For the fiscal 3rd quarter ended June, Apple posted a 1% rise in revenue to $53.8B and a 7% drop in earnings per share to $2.18. Both of these reflect favourably compared to consensus analyst forecasts of $53.4B and $2.10 respectively and an optimistic outlook for the next quarter that predicts revenue above current forecasts have both contributed to the positivity surrounding the release. For the first time in 7 years iPhones sales dropped to less than 50% of revenue, but CEO Tim Cook put a positive spin on this claiming the change was a result of successfully diversifying away from a single product.

Apple shares are trading higher in the premarket with the stock called to begin at its highest level since last November. Source: xStation

Apple shares are trading higher in the premarket with the stock called to begin at its highest level since last November. Source: xStation

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎