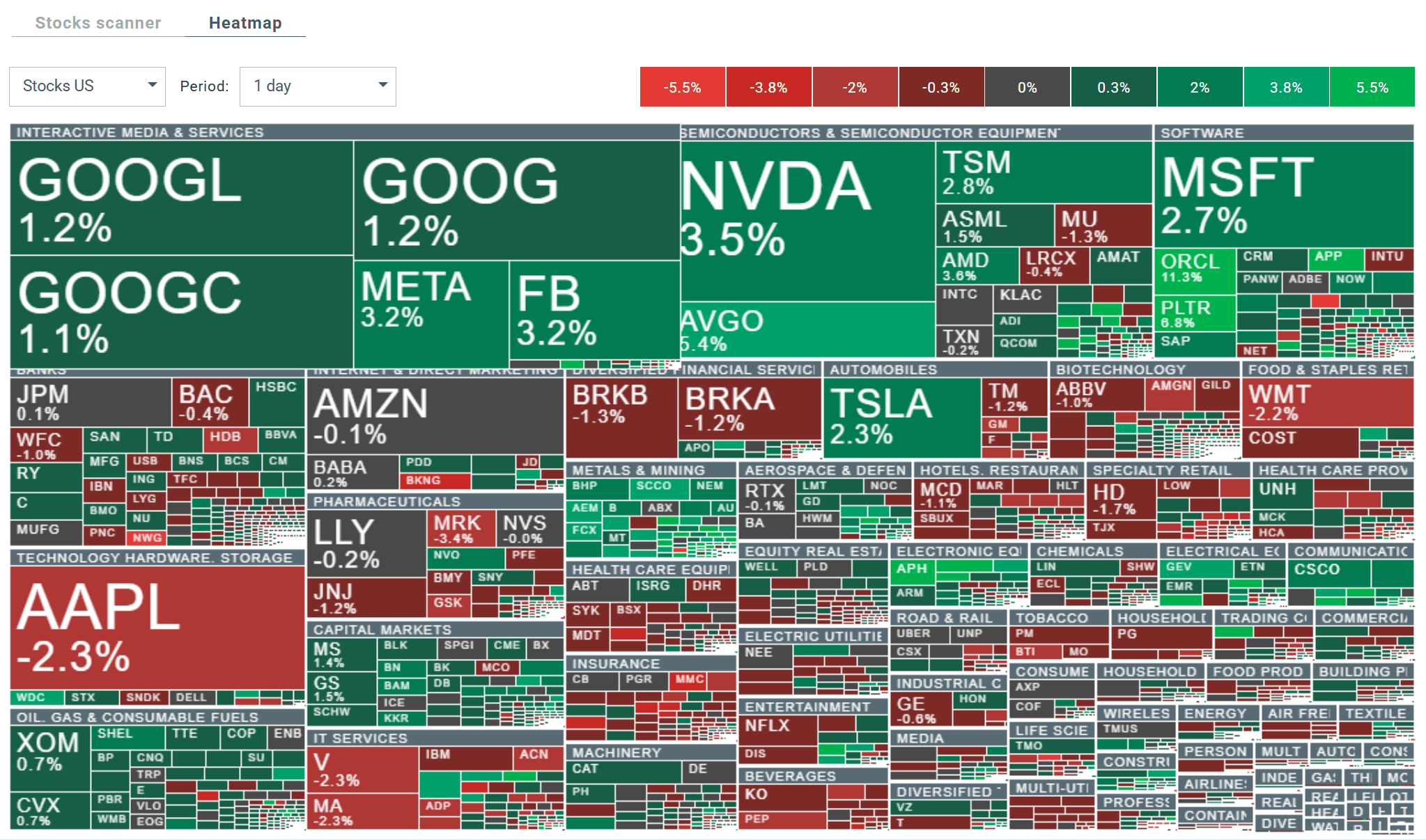

Sentiment at the end of the day in Europe and in the second phase of the Wall Street session is clearly improving. The US100 contract is already up more than 1%, while the US500 and US2000 are up 0.7% and 0.8% respectively. Today's gains are primarily driven by large-cap technology companies. Shares in companies such as Oracle, Palantir and Applovin are gaining between +7% and +15%. At the same time, Nvidia is up 3.5% and Broadcom 5.4%.

Source: xStation

The US100 changed its outlook in response to what was happening at the opening of Wall Street. The increases accelerated and currently managed to break through the 100-day EMA (purple curve), which has repeatedly been a key point of support for the upward trend on the chart. The longer the price remains above this barrier, the greater the chance of extending the overall upward trend.

Source: xStation

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment