Investors in the US are affected by today's worse mood, which we could see in Europe. The main US stock indices launched today’s session with bearish price gaps. Despite the fact that we are seeing an attempt to recover, both the Dow Jones, S$P500, Nasdaq and Russell 2000 are still trading 1% lower.

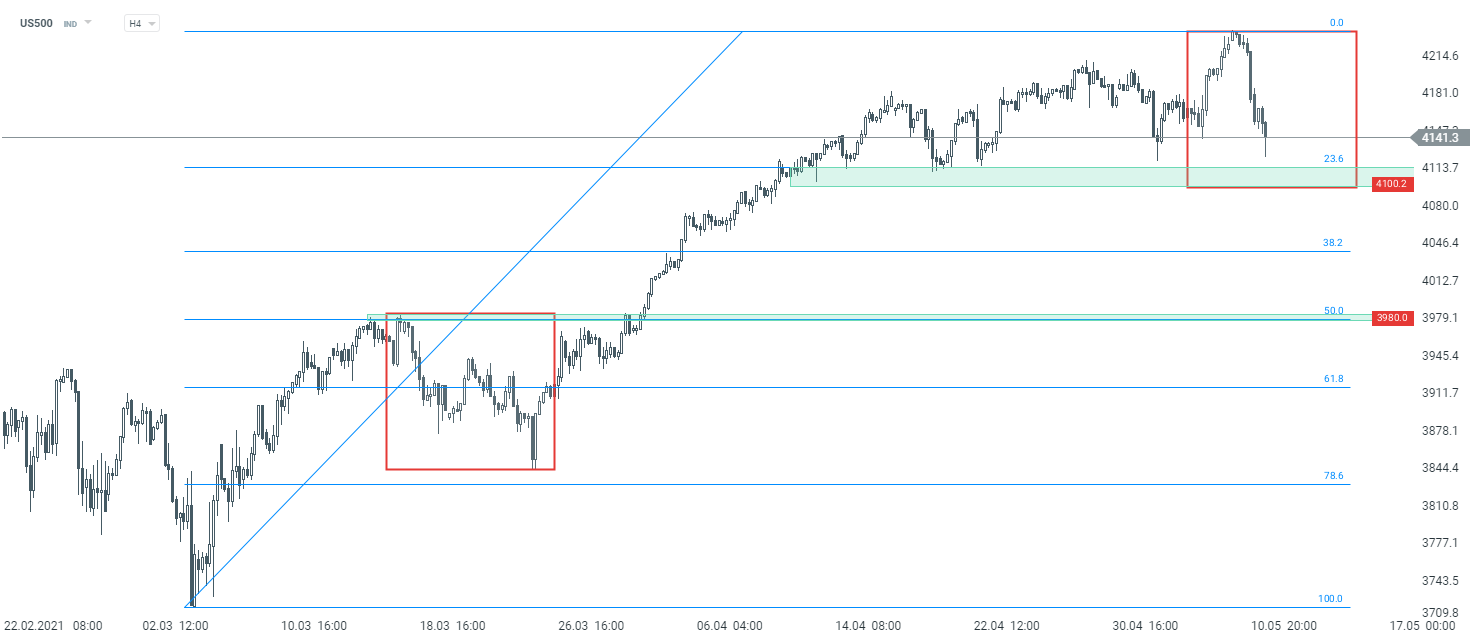

Looking technically at the S&P 500 (US500) index, we are seeing a continuation of the move as part of a downward correction. If the sell-off deepens, an attack on support around 4100 pts is possible. This level is marked with the lower limit of the 1: 1 structure. According to the Overbalance methodology, only break lower would lead to a change in the trend.

US500 interval H4. Source: xStation5

US500 interval H4. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report