Bank of England is scheduled to announce its next monetary policy decision tomorrow at 12:00 pm GMT. Market expects interest rates to be left unchanged, with the main policy rate staying at 5.25% for the fifth meeting in a row. What to focus expect from the Bank of England tomorrow?

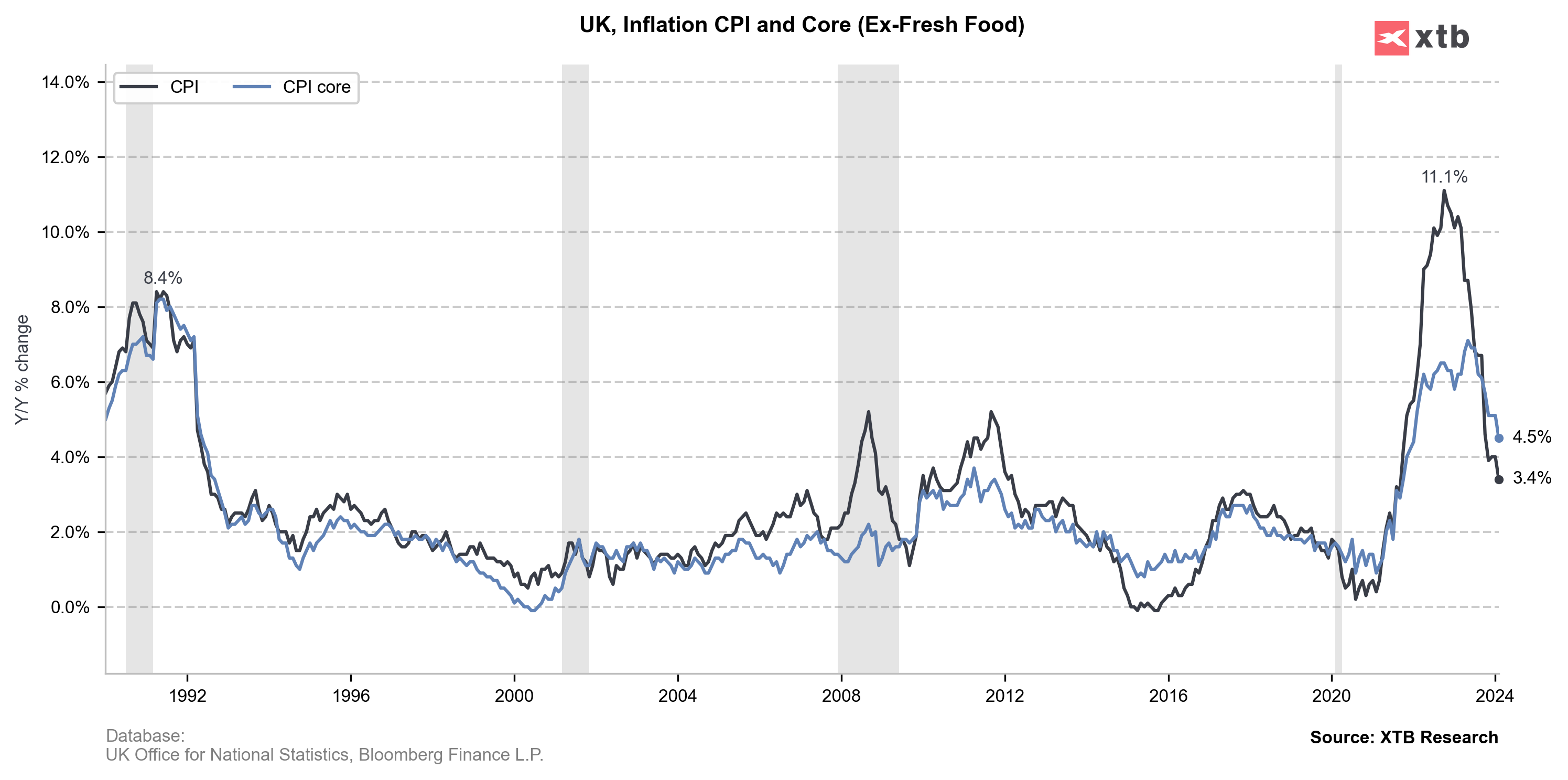

Inflation slows but still remains high

Just like its the case with many other major central banks, Bank of England is also expected to start cutting interest rates this year. Inflation data released this morning bolstered market expectations for BoE cuts as it showed bigger-than-expected slowdown in headline and core CPI. However, headline CPI at 3.4% YoY and core CPI at 4.5% YoY remain one of the highest among major Western economies and Bank of England wants to have confidence that it is heading back towards the target. Also, while headline and core inflation slowed more than expected, services inflation, measure closely watched by Bank of England, slowed from 6.5% to 6.1% - in-line with central banks forecasts.

Having said that, rate move seems unlikely as inflation still is double the target and full impact of rate hikes is yet to be felt. The key question now is whether Bank of England begins cutting rates at June meeting or waits until August to deliver the first cut.

Source: Bloomberg Finance LP, XTB Research

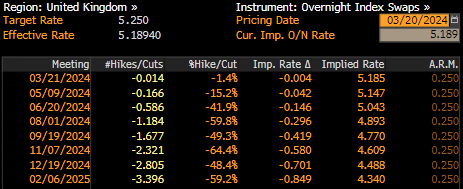

Markets expect BoE to stay put tomorrow

Economists surveyed by Bloomberg and Reuters are expecting rates to be kept unchanged at 5.25%. The decision is expected to be almost unanimous, with a 7-2 vote, with one policymaker calling for a hike and one for a cut. That would mark a change from the previous meeting when rates were left unchanged in a 6-3 vote, with two policymakers calling for a hike and one for a cut.

Money markets are also seeing no chance for a move. The first rate cut is fully priced in for August meeting currently. However, market prices in an almost 60% of a rate cut at June meeting.

Source: Bloomberg Finance LP, XTB Research

Guidance will be crucial

As there is virtually no chance for a rate surprise from Bank of England tomorrow, all attention will be on the guidance. Current downward inflation trends are expected to continue. Headline inflation is expected to drop below BoE target in Q2 this year, while core inflation is seen dropping to 3% by this time. If Bank of England alters the statement and hints that a rate cut in June is a possibility, it may trigger a dovish reaction on the markets with GBP weakening. On the other hand, keeping statement unchanged or retaining 6-3 vote split could be seen as somewhat hawkish and sees market pricing for June cut to drop.

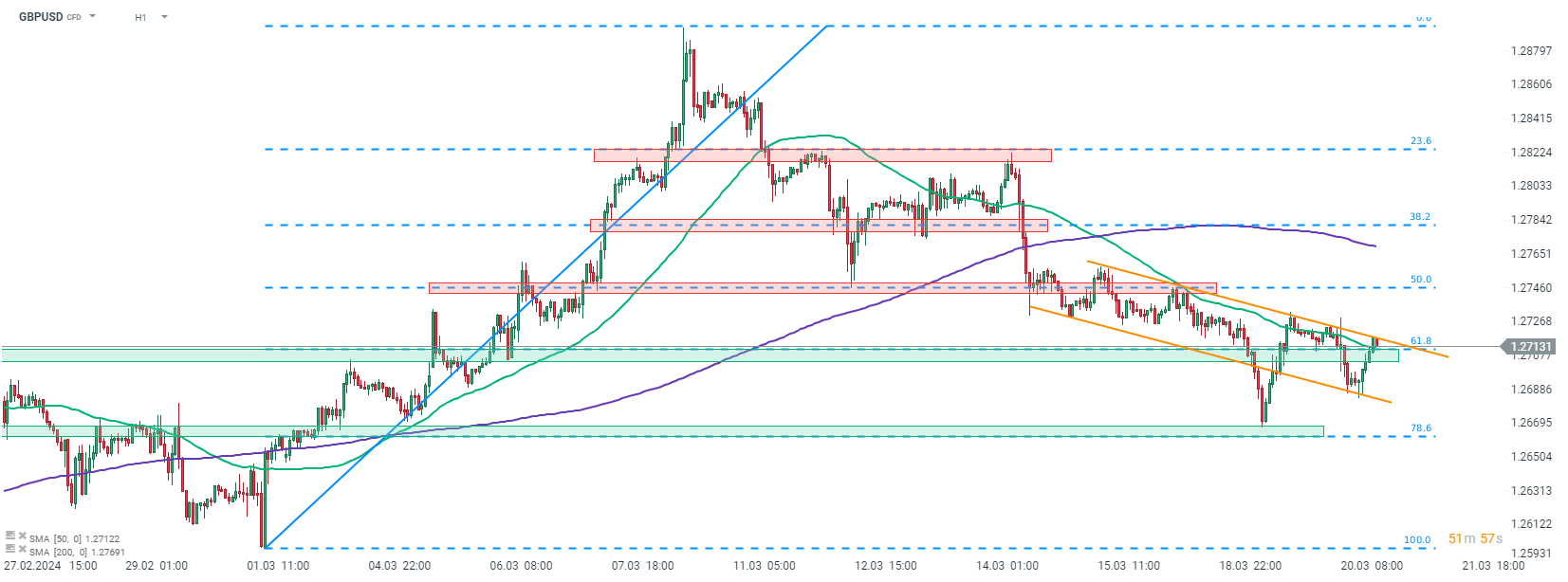

A look at GBPUSD

GBP has been strengthening recently. However, GBPUSD dropped as USD outperformed British currency. Taking a look at GBPUSD chart at H1 interval, we can see that the pair is trading in a short-term bearish price channel. Pair managed to climbed back above the 61.8% retracement today, but bulls failed to break above the upper limit, and a pullback can be observed at press time. Should the pair break back below 50-hour moving average (green line), the chance of returning to the lower limit of the channel and retesting recent lows will increase.

Lack of dovish message from Bank of England tomorrow may support GBP and push the pair above the channel. However, a break above the upper limit of market geometry near 50% retracement would be needed to invalidate a short-term downtrend.

Source: xStation5

Source: xStation5

Economic Calendar: U.S. Unemployment Claims in spotlight (12.03.2025)

BREAKING: EURUSD muted after stable US CPI report 🇺🇸 📌

Market Wrap: Market awaits Middle East resolution and US CPI🕞

Economic calendar: US CPI inflation the key release 🔎