What happened?

Technology stocks that are so popular this year have been in a correction for two weeks but other key equity indices remained resilient and weak dollar suggested that investors were confident in a rally. Suddenly all this collapsed yesterday with European indices plunging and US dollar gaining sharply causing price declines on commodities from Gold to OIL.

What are the reasons?

There is no single crystal-clear catalyst behind the move but these reasons have been key:

- Tech stocks are immensely expensive – many ratios are close to peak from 2000 dot-com bubble

- Tesla offering new shares was a signal that these tech stocks could be overvalued

- European covid statistics deteriorate – new restrictions are being introduced

- Leaked reports showed big banks around the globe contributed to money laundering

- USD was extremely oversold by speculators (as shown in the CFTC reports) and negative news caused unwinding of some of these positions, triggering a sell-off on Gold and Silver

What’s next?

This has been the sharpest correction since at least June and in some markets since March. At this point it could be treated just as a reduction of excessive optimism but a deeper pullback could not be ruled out, as will be shown for US500.

US500

This has been the largest correction so far measuring in point but percentage-wise it was just above 10%. This is an interesting level because for many investors 10% correction is considered to be a good entry point. However, the first two correction after the GFC were 17.6 and 22.3% - much deeper than the present one. That would imply levels of 2955 and 2787 respectively. Of course, one should not expect such correction to repeat so precisely but the history shows that a deeper correction is certainly possible after a strong rally.

This has been the largest correction so far measuring in point but percentage-wise it was just above 10%. This is an interesting level because for many investors 10% correction is considered to be a good entry point. However, the first two correction after the GFC were 17.6 and 22.3% - much deeper than the present one. That would imply levels of 2955 and 2787 respectively. Of course, one should not expect such correction to repeat so precisely but the history shows that a deeper correction is certainly possible after a strong rally.

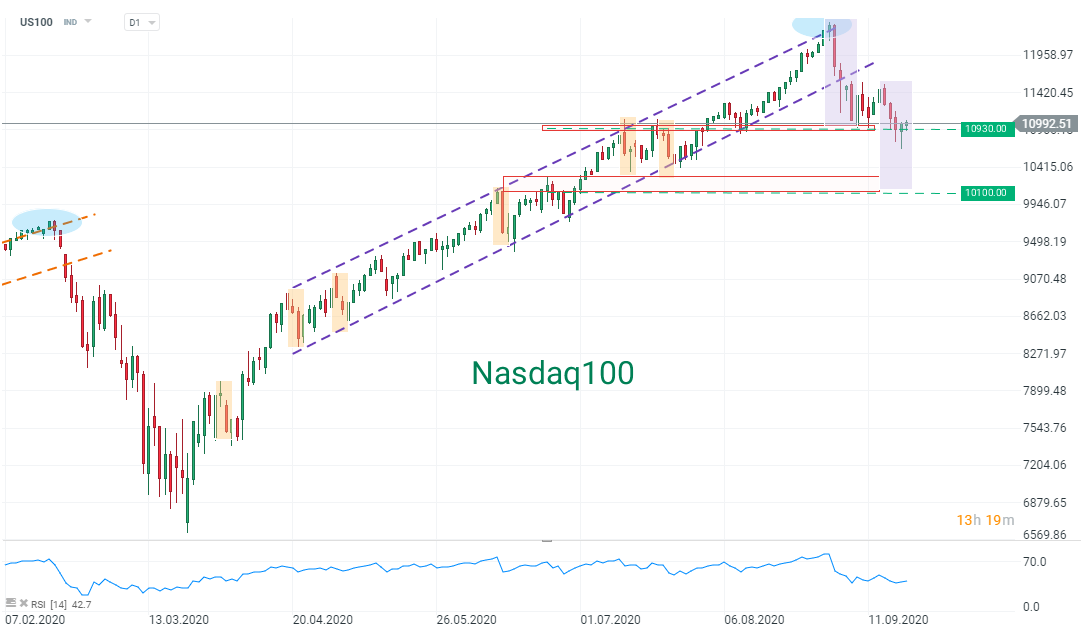

US100

US100 broke the key 10930 support last Friday, opening the possibility of a slide towards 10100 points. Interestingly, tech stocks recovered even as other indices plunged yesterday as investors thought that return of restrictions can actually benefit some of them.

US100 broke the key 10930 support last Friday, opening the possibility of a slide towards 10100 points. Interestingly, tech stocks recovered even as other indices plunged yesterday as investors thought that return of restrictions can actually benefit some of them.

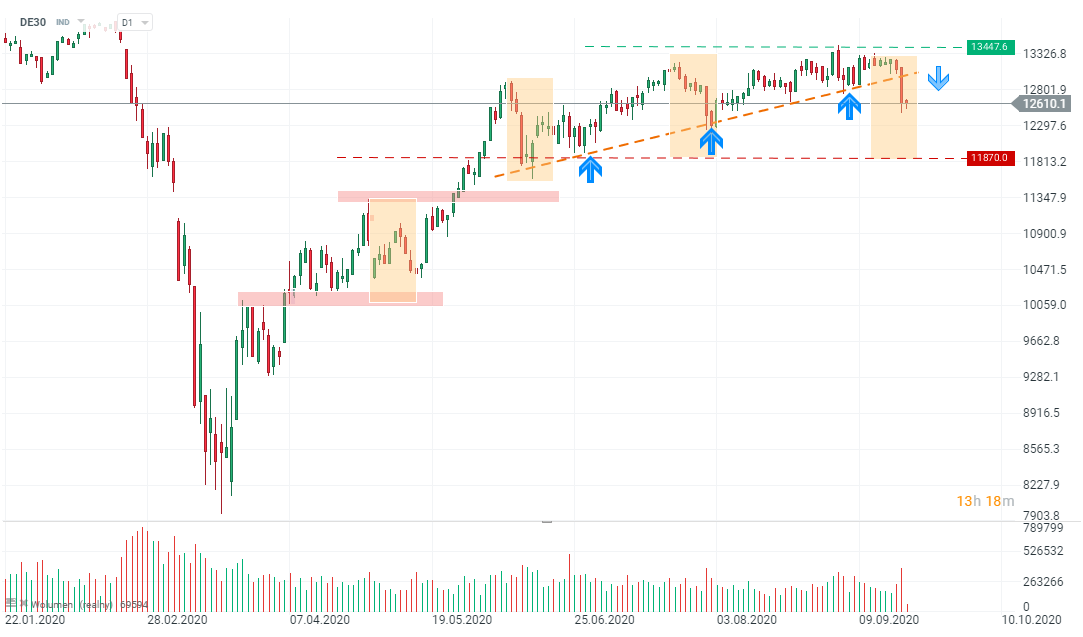

DE30

The German DE30 broke out of the triangle formation, paving the way for a deeper correction. Looking at moves from May and June one can paint a support line at 11870 points.

The German DE30 broke out of the triangle formation, paving the way for a deeper correction. Looking at moves from May and June one can paint a support line at 11870 points.

GOLD

Gold prices broke the key 75-day moving average that used to support the upwards trend. The support point is not so obvious now. The most likely point is the intraday low from 12 August at $1865, just above the 150-day moving average.

Gold prices broke the key 75-day moving average that used to support the upwards trend. The support point is not so obvious now. The most likely point is the intraday low from 12 August at $1865, just above the 150-day moving average.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report