Shares of Advanced Micro Devices (AMD.US) are gaining 0.70% in pre-market trading ahead of the publication of their first-quarter results, which are expected to be released after the close of the Wall Street session.

Market consensus for AMD's results

Financial data for the first quarter:

- Adjusted EPS: 61 cents, compared to Bloomberg's consensus estimate of 62 cents.

- Revenue: $5.45 billion, compared to $5.6 billion in the previous quarter.

- Data center revenue: $2.31 billion, accounting for a significant portion of overall revenue.

- Gaming revenue: $965.5 million, which marks a decline compared to the previous quarter and year-on-year.

- Client revenue: $1.29 billion.

- Other revenue: $922.6 million.

- Adjusted gross margin: 52%.

- Adjusted operating profit: $1.11 billion.

- Adjusted operating margin: 20.8%.

- Free cash flow: $2.22 billion.

- Capital expenditures: $118.4 million.

- R&D expenditures: $1.5 billion.

Expectations for the second quarter:

- Revenue: $5.72 billion.

- Adjusted gross margin: 53%.

Annual expectations:

- Revenue: $25.88 billion.

- Adjusted gross margin: 53.5%.

Analysts predict a report consistent with expectations, with potential growth in the MI300 sector. The new type of MI300 chip, which aims to compete with Nvidia's offering, is projected to bring the company a total annual revenue of around $4 billion in a year, indicating growth potential for the AI portfolio. AMD is also expected to see growth in the overall AI segment and promising prospects for the upcoming quarters, including the aforementioned MI300 chip.

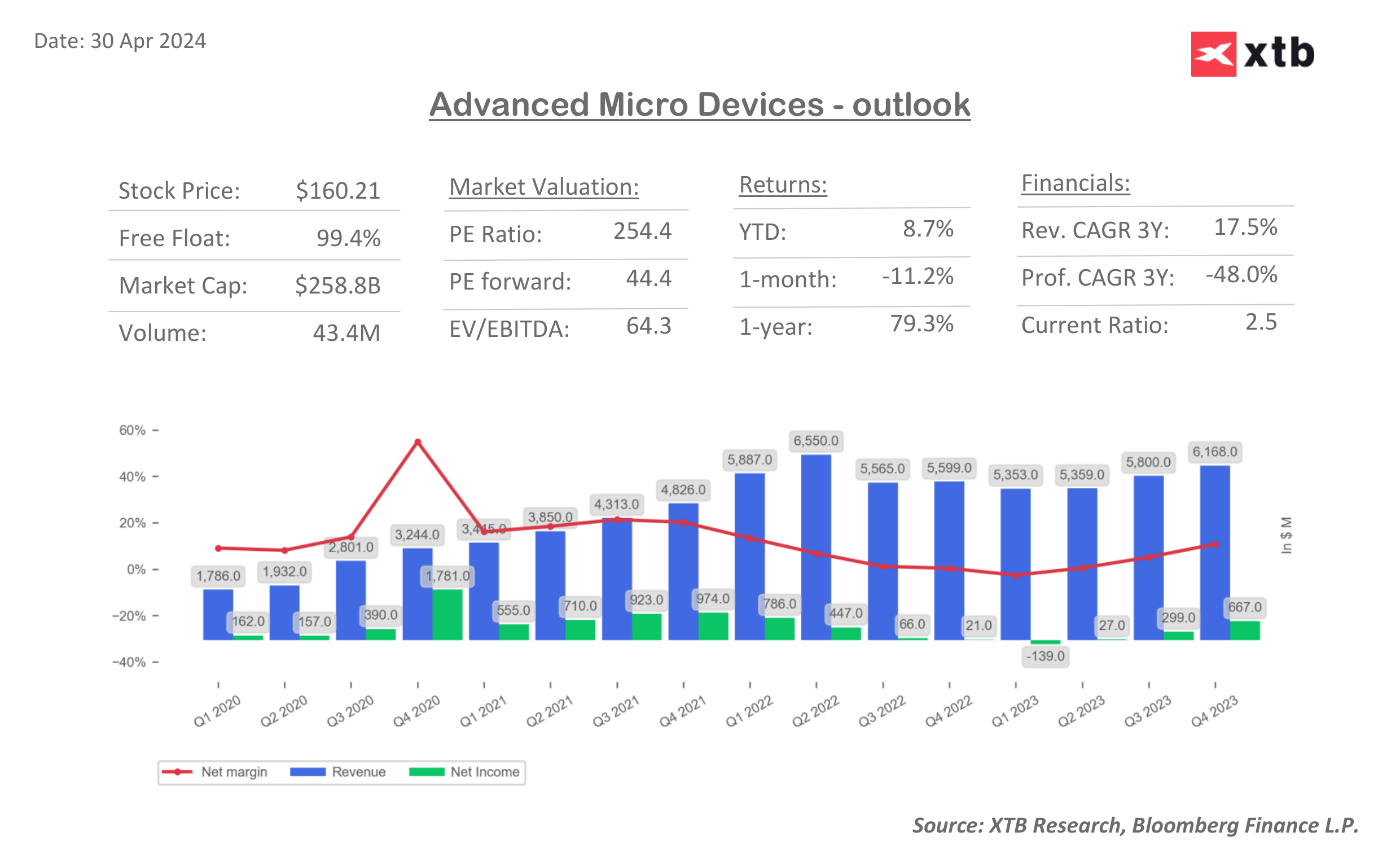

AMD's financial dashboard for the recent quarters.

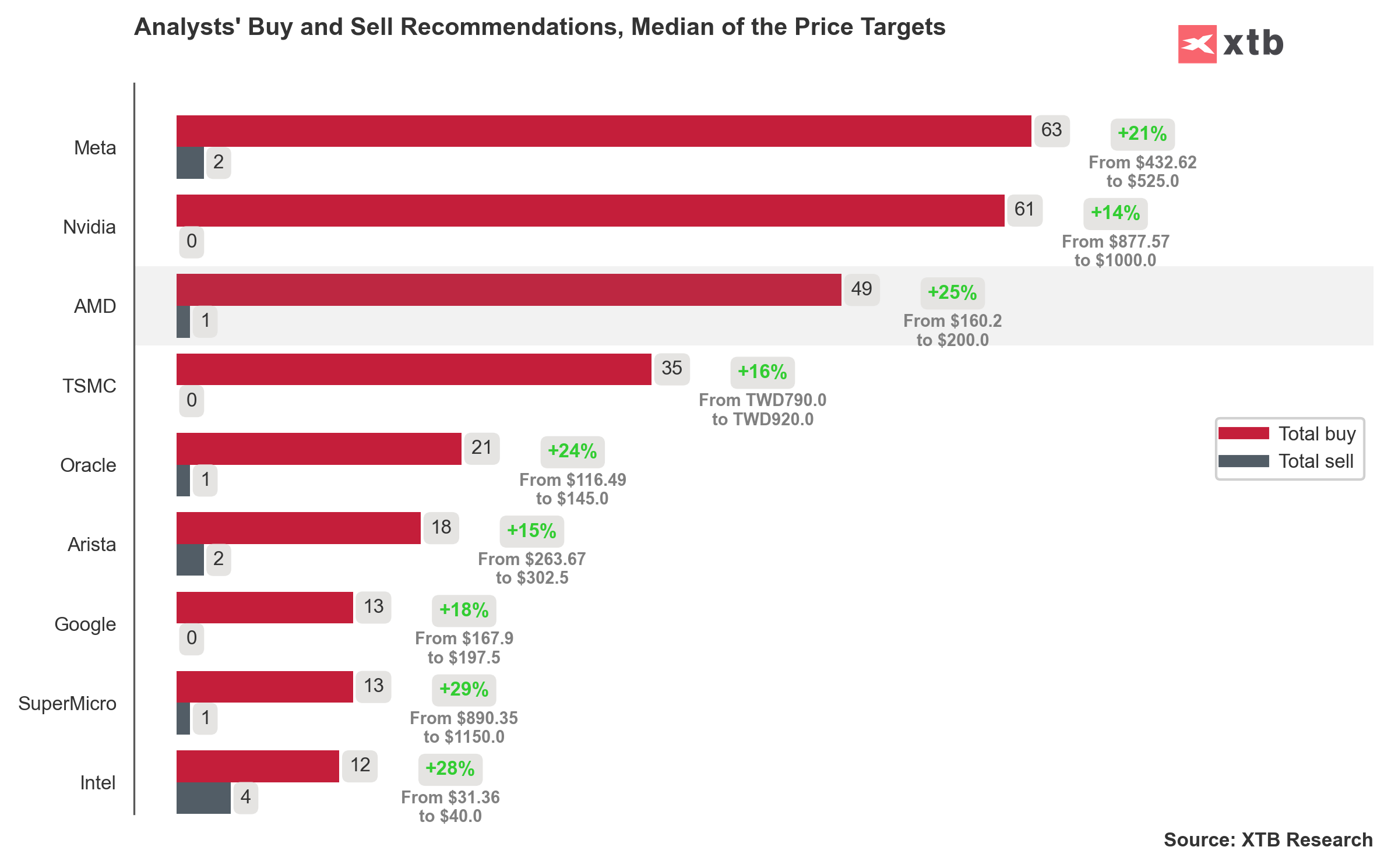

Analysts' recommendations for AMD remain relatively positive compared to other companies in the sector. The median recommendation indicates a potential 25% increase in stock value to around $200.

AMD's shares are also performing well compared to the competition. Since the introduction of ChatGPT, the shares have gained nearly 161%. The chart excludes shares of Super Micro Devices and Nvidia due to their high returns.

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment