Albemarle (ALB.US) is the largest global producer of lithium used in electric cars. The company also provides services in the chemical industry (including bromine, chemical catalysis, oil refining, food safety and other niche services). The latest commentary from Bank of America (BofA) analysts shows that the bank expects lithium prices, which have been falling for many months, to stabilize. This could indicate the better sentiment around the shares of the lithium producers. In recent days, Tesla (TSLA.US), one of the company's largest customers (EV battery packs) reported that it was building a massive lithium plant in Texas. However, it indicated that it does not intend to abandon Albemarle's services.

- On May 4, Albemarle reported Q1 results - lower-than-expected revenue ($2.58 billion vs. $2.74 billion forecast) but sharply higher-than-expected earnings per share of $10.93 vs. $6.94 estimates and $2.38 in Q1 2022 (nearly 400% increase).

- The sharply higher-than-expected net profit may indicate that the company has 'ample room' to raise prices for its customers and possibly cut costs. Net margin in Q1 was over 41%, and return on assets (ROE) was over 49% - all this despite massive declines in spot lithium prices.

The biggest threat appears to be a possible recession but, surrounded by a rebound in lithium prices in the markets, some analysts have recently raised recommendations:

- Bank of America raised its recommendation on Albemarle to 'neutral' with a target price of $200

- Scotiabank raised its recommendation on Albemarle to 'outperform' with a target price of $250

- KeyBanc raised its recommendation on Albemarle to 'outperform' with a target price of $270

The index of lithium producers and miners has had a great start to May. Source: Bloomberg

Prices for a ton of lithium, denominated in Chinese yuan (CNY), have risen nearly 20% since April 25. Source: TradingEconomics

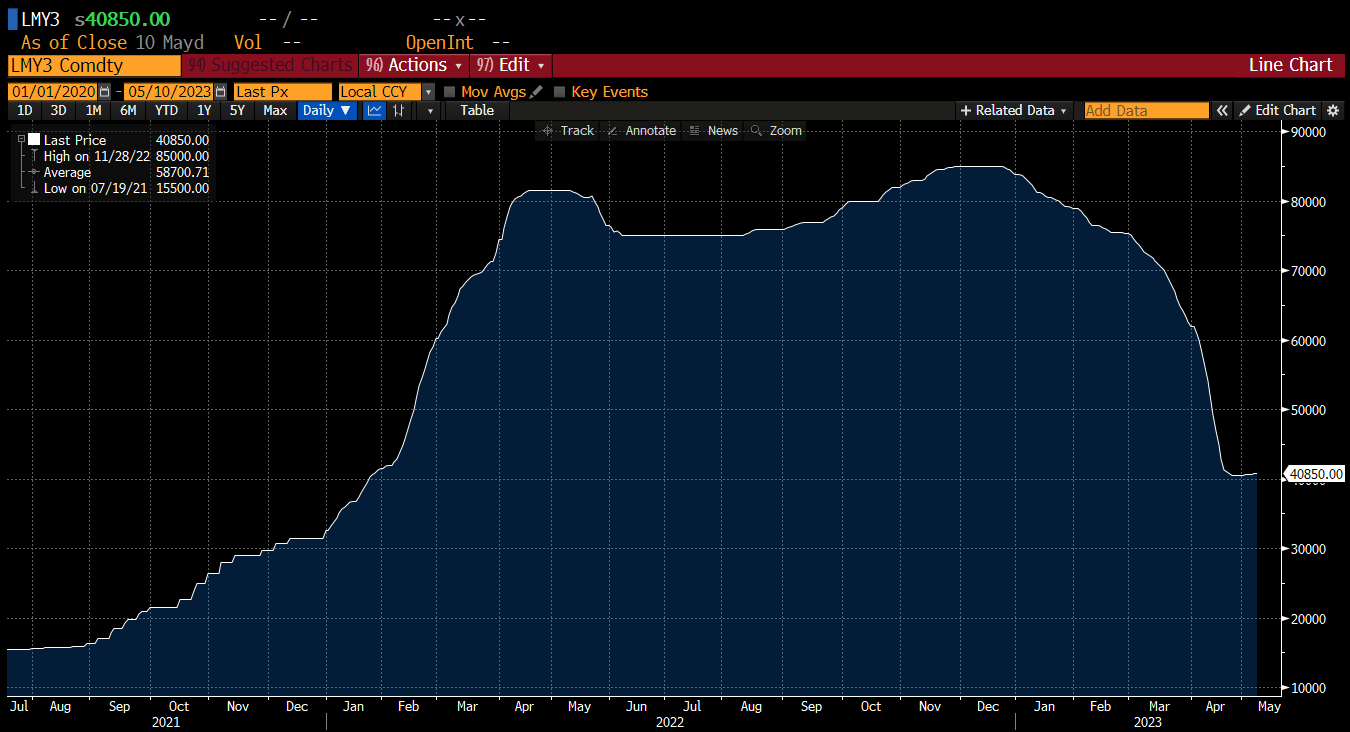

July lithium contracts are still showing the expected slight improvement. This shows that, if the rise continues, room for upside could become much more plentiful. On the other hand, the main threat to a further rebound is, of course, a recession and lower demand on EV market. Source: Bloomberg

Albemarle (ALB.US) shares, D1 interval. The sell-off stopped at the level set by significant previous price reactions, among others, local minima from the fall of 2022. If the positive momentum for lithium lasts longer, a possible would be rise towards $225 per share, where we see the 38.2 Fibonacci retracement of the March 2020 upward wave. On the other hand significant fall below SMA200 is worry for bulls. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment