The Reserve Bank of Australia (RBA) is scheduled to announce its next monetary policy decision during the upcoming Asia-Pacific session (Tuesday, 3:30 am GMT). Bank has kept interest rates unchanged at the four previous meetings but market consensus now expects a hike!

What to know before the RBA rate decision?

- Main interest rate: 4.10%

- Rates last changed in June 2023 (+25 bp)

- 400 basis points of tightening delivered since April 2022

- RBA expects inflation to drop below 3% in Q4 2025

- Q3 CPI at 5.4% YoY (exp. 5.3% YoY, prev. 6.0% YoY) and 1.2% QoQ (exp. 1.1% QoQ, prev. 0.8% QoQ)

- Q3 PPI at 3.8% YoY (prev. 3.9% YoY) and 1.8% QoQ (prev. 0.5% QoQ)

- Employment change in September: +6.7k (exp. +20k, prev. +63.3k)

- Unemployment rate in September: 3.6%, down from 3.7% in August

- Retail sales for September: 0.9% MoM (exp. 0.3% MoM, prev. 0.3% MoM)

- Services and manufacturing PMIs for September below 50 points

- New home sales for September: -4.6% MoM (exp. 1.1% MoM, prev. 8.1% MoM)

RBA expected to deliver 25 bp rate hike

Median consensus among economists and financial institutions is for the Reserve Bank of Australia to deliver a 25 basis point rate hike after staying on hold for almost half a year. Recent inflation data for Q3 2023 came in above expectations with price growth accelerating compared to Q2 on quarter-over-quarter basis. Labor market remains tight and retail sales data hints that consumer spending is still robust. Reasons for a hike are there and recent hawkish comments from RBA members are a strong hint that one may be coming.

However, this would likely be the final one. In spite of a rather solid picture of the Australian economy, money markets price in just a slightly above-50% chance of a 25 basis point rate hike and no more hikes afterwards. First rate cuts are priced in for the second half of 2024.

Money markets price in 56% chance of RBA delivering a 25 basis point rate hike tomorrow. Source: Bloomberg Finance LP

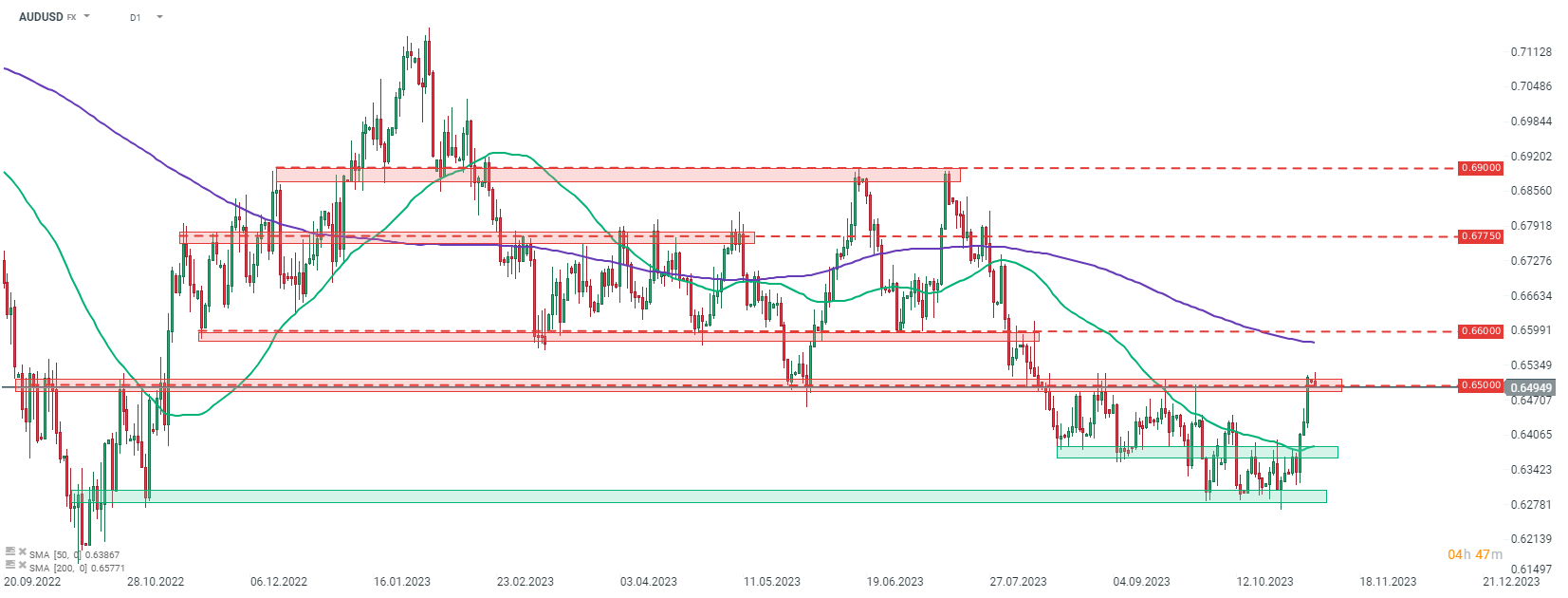

A look at AUDUSD

AUDUSD has been trading higher recently, partially on USD weakening and partially on better performance of Antipodean currencies. Pair bounced off 1-year lows and is now testing resistance zone ranging around 0.6500 mark - the highest level since the turn of August and September 2023. While a 25 bp rate hike is expected by economists, a sub-60% pricing on the money markets shows that there is a room for surprise. Hike not being fully priced in also means that AUD could gain if expectations are met. In case we see a break above the 0.6500 resistance zone, the next level to watch can be found in the 0.6600 area.

Source: xStation5

Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS